As global markets continue to surge, with U.S. stocks reaching record highs amid optimism over trade policies and AI developments, investors are keenly observing the shifting economic landscape. In this context, penny stocks—often associated with smaller or emerging companies—remain a compelling area of interest for those seeking growth opportunities. Despite being an older term, penny stocks can still offer significant potential when backed by strong financial health and strategic prospects. Here, we explore three such stocks that stand out for their robust balance sheets and promising potential in today's market climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.65B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

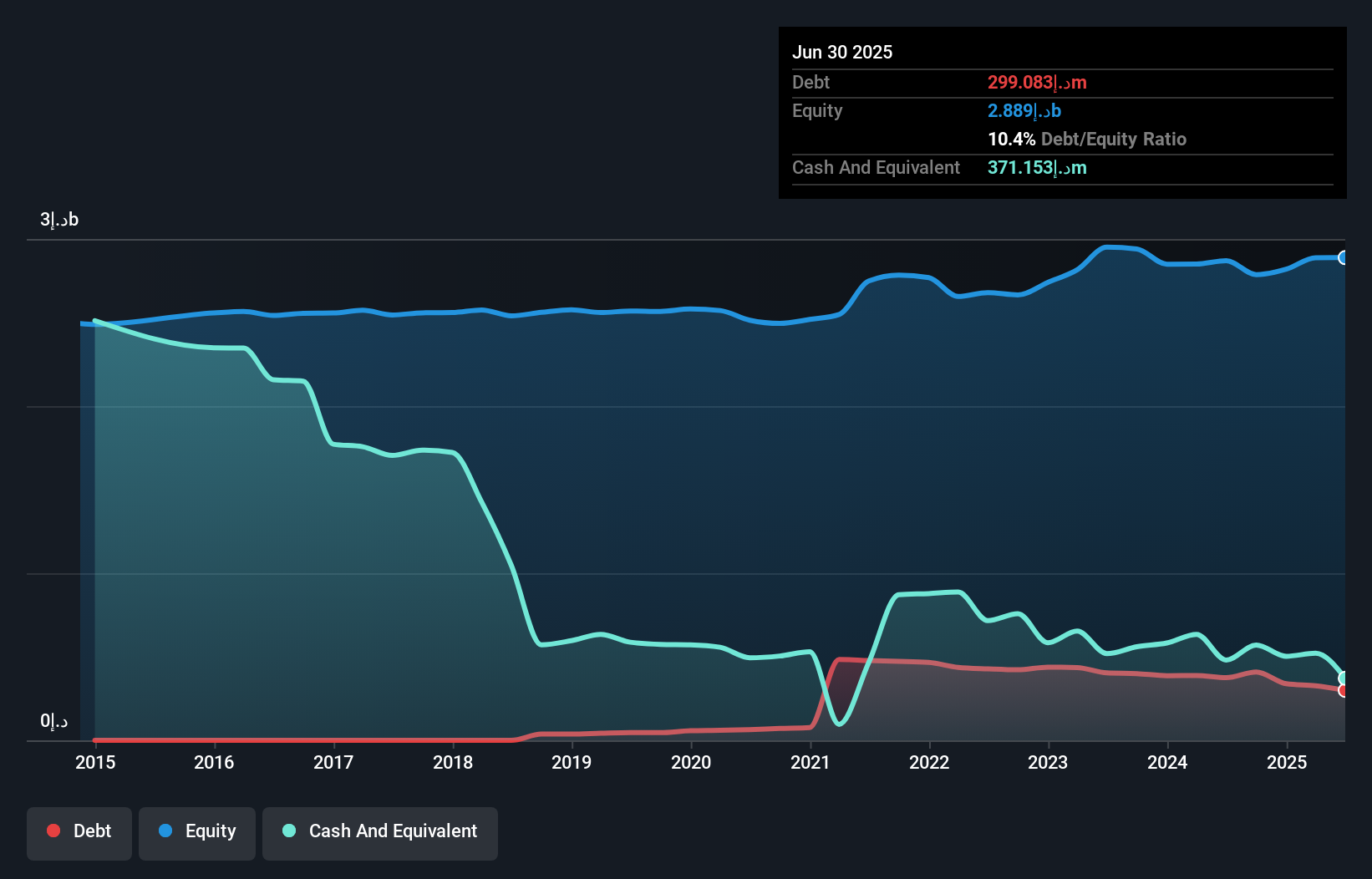

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, with a market cap of AED2.68 billion, invests in companies within the education and healthcare sectors through its subsidiaries.

Operations: The company generates revenue from two primary segments: Education, contributing AED395.21 million, and Healthcare, contributing AED394.11 million.

Market Cap: AED2.68B

Amanat Holdings PJSC, with a market cap of AED2.68 billion, remains unprofitable despite generating substantial revenue from its education and healthcare segments. The company's short-term assets exceed both its long-term and short-term liabilities, indicating a strong liquidity position. However, Amanat's negative return on equity and increasing losses over the past five years highlight ongoing profitability challenges. Recent earnings reports show increased sales but also a widening net loss for the third quarter of 2024 compared to the previous year. Despite these financial hurdles, debt is well-covered by operating cash flow, providing some financial stability amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Amanat Holdings PJSC.

- Understand Amanat Holdings PJSC's track record by examining our performance history report.

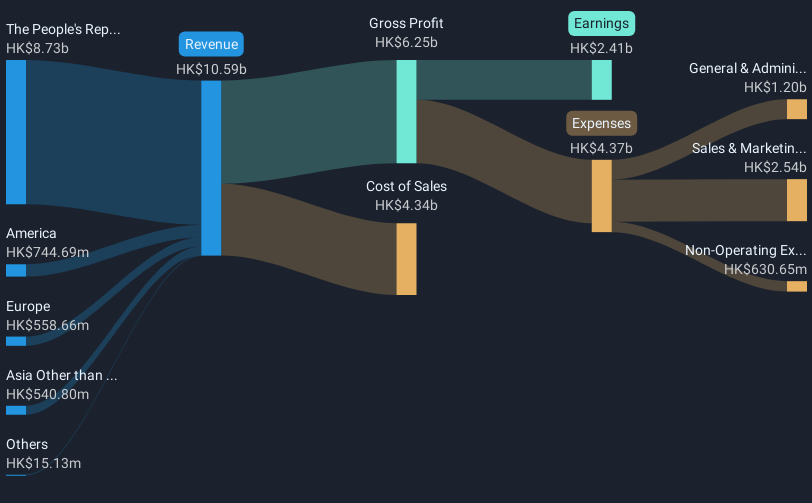

Grand Pharmaceutical Group (SEHK:512)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grand Pharmaceutical Group Limited is an investment holding company involved in the research and development, manufacture, and sale of pharmaceutical preparations, medical devices, biotechnology and healthcare products, and pharmaceutical raw materials with a market cap of HK$15.37 billion.

Operations: The company generates revenue of HK$10.59 billion from its Pharmaceuticals segment.

Market Cap: HK$15.37B

Grand Pharmaceutical Group, with a market cap of HK$15.37 billion, shows strong financial stability and innovative potential in the pharmaceutical sector. The company's debt is well-covered by operating cash flow, and its short-term assets exceed liabilities, indicating solid liquidity. Recent developments include the submission of a New Drug Application for an ophthalmic product targeting Demodex blepharitis in China and the approval of an intravascular imaging system. These advancements highlight Grand's strategic focus on expanding its innovative product pipeline in ophthalmology and medical devices, potentially enhancing its competitive position while addressing unmet clinical needs domestically and internationally.

- Jump into the full analysis health report here for a deeper understanding of Grand Pharmaceutical Group.

- Examine Grand Pharmaceutical Group's earnings growth report to understand how analysts expect it to perform.

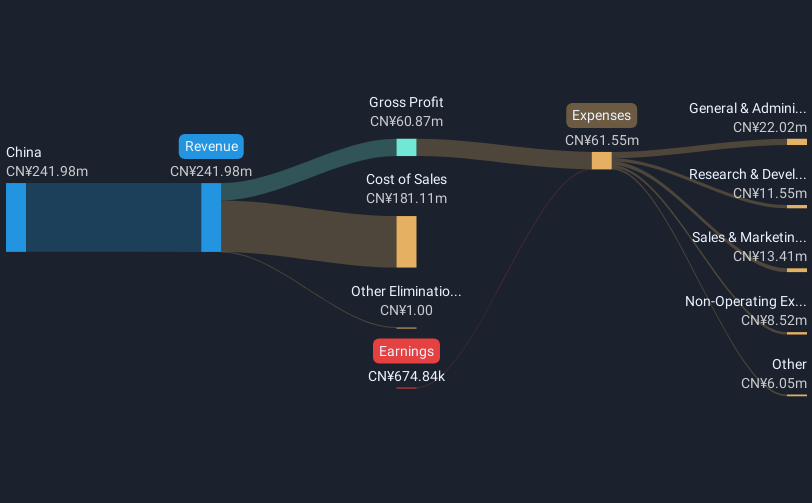

Guangdong Jialong Food (SZSE:002495)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Jialong Food Co., Ltd. engages in the research, development, production, and sale of food products in China with a market cap of CN¥2.25 billion.

Operations: The company generates revenue of CN¥241.98 million from its operations in China.

Market Cap: CN¥2.25B

Guangdong Jialong Food, with a market cap of CN¥2.25 billion, operates in the food sector but remains unprofitable, with losses increasing by 55.5% annually over five years. Despite stable weekly volatility and no shareholder dilution recently, the company's share price has been highly volatile over the past three months. It is debt-free with short-term assets of CN¥393.2 million comfortably covering liabilities totaling CN¥61.9 million, indicating solid liquidity management. The experienced board averages 14.4 years in tenure, providing seasoned oversight amidst financial challenges and ongoing efforts to stabilize operations without leveraging debt obligations.

- Unlock comprehensive insights into our analysis of Guangdong Jialong Food stock in this financial health report.

- Explore historical data to track Guangdong Jialong Food's performance over time in our past results report.

Summing It All Up

- Gain an insight into the universe of 5,722 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002495

Guangdong Jialong Food

Researches, develops, produces, and sells food products in China.

Flawless balance sheet very low.

Market Insights

Community Narratives