The United Laboratories International Holdings Limited (HKG:3933) Is Yielding 1.3% - But Is It A Buy?

Could The United Laboratories International Holdings Limited (HKG:3933) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

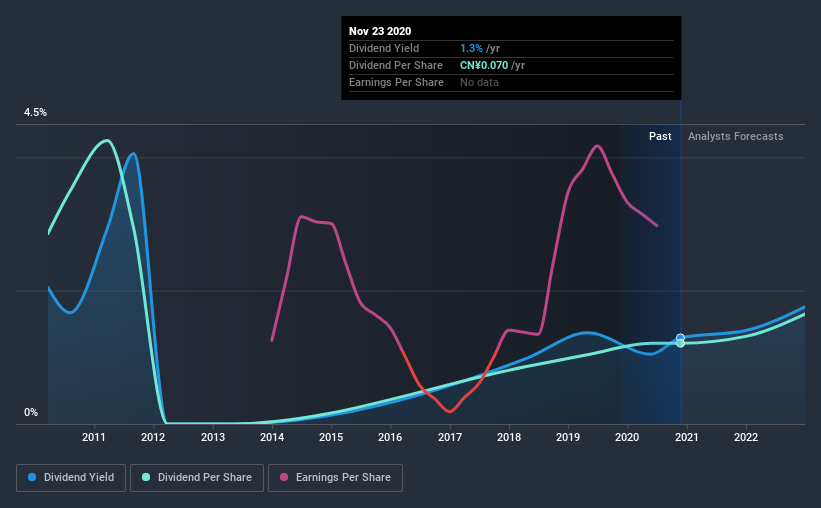

A slim 1.3% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, United Laboratories International Holdings could have potential. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 21% of United Laboratories International Holdings' profits were paid out as dividends in the last 12 months. We'd say its dividends are thoroughly covered by earnings.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. United Laboratories International Holdings' cash payout ratio last year was 8.0%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that United Laboratories International Holdings' dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

We update our data on United Laboratories International Holdings every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of United Laboratories International Holdings' dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was CN¥0.2 in 2010, compared to CN¥0.07 last year. The dividend has shrunk at around 8.2% a year during that period. United Laboratories International Holdings' dividend hasn't shrunk linearly at 8.2% per annum, but the CAGR is a useful estimate of the historical rate of change.

A shrinking dividend over a 10-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. United Laboratories International Holdings' earnings per share have been essentially flat over the past five years. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that United Laboratories International Holdings has low and conservative payout ratios. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. Ultimately, United Laboratories International Holdings comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 5 warning signs for United Laboratories International Holdings that investors should know about before committing capital to this stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade United Laboratories International Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade United Laboratories International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3933

United Laboratories International Holdings

An investment holding company, engages in the research and development, manufacture, distribution, and sale of pharmaceutical products.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives