China Resources Pharmaceutical Group Limited's (HKG:3320) Shares May Have Run Too Fast Too Soon

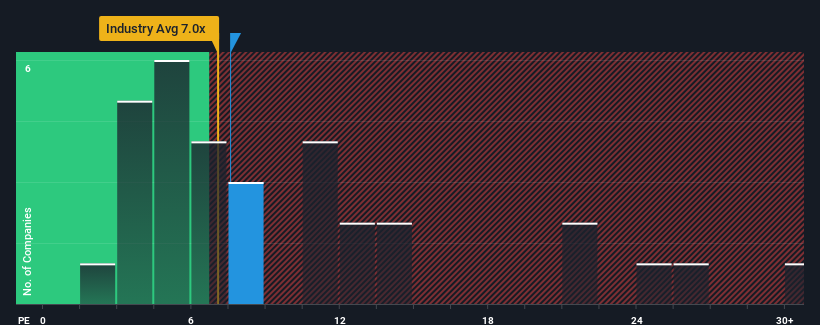

There wouldn't be many who think China Resources Pharmaceutical Group Limited's (HKG:3320) price-to-earnings (or "P/E") ratio of 7.6x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

There hasn't been much to differentiate China Resources Pharmaceutical Group's and the market's retreating earnings lately. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

See our latest analysis for China Resources Pharmaceutical Group

How Is China Resources Pharmaceutical Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like China Resources Pharmaceutical Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.5%. Even so, admirably EPS has lifted 47% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 11% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 15% per annum, which is noticeably more attractive.

With this information, we find it interesting that China Resources Pharmaceutical Group is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Resources Pharmaceutical Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for China Resources Pharmaceutical Group you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3320

China Resources Pharmaceutical Group

An investment holding company, engages in the manufacture, distribution, and retail of pharmaceutical and other healthcare products in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives