China Resources Pharmaceutical Group (HKG:3320) Is Increasing Its Dividend To CN¥0.1697

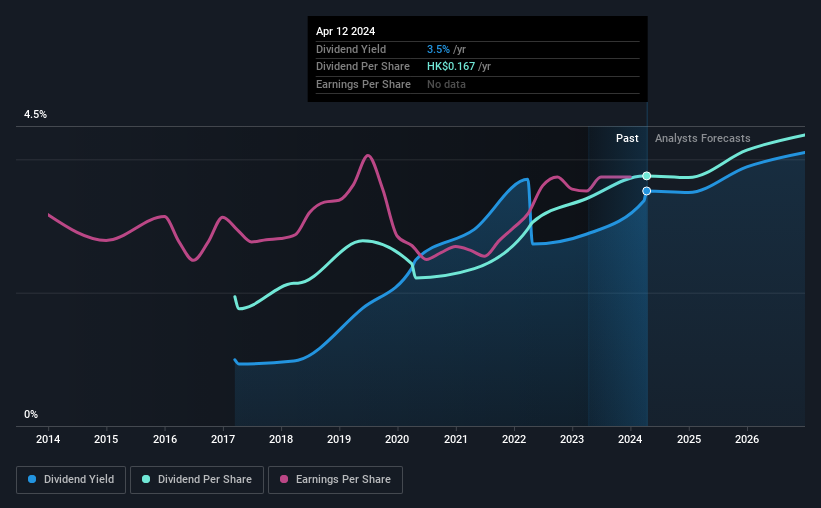

China Resources Pharmaceutical Group Limited's (HKG:3320) dividend will be increasing from last year's payment of the same period to CN¥0.1697 on 19th of July. This takes the annual payment to 3.5% of the current stock price, which is about average for the industry.

View our latest analysis for China Resources Pharmaceutical Group

China Resources Pharmaceutical Group's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, China Resources Pharmaceutical Group was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Looking forward, earnings per share is forecast to rise by 26.2% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 24%, which is in the range that makes us comfortable with the sustainability of the dividend.

China Resources Pharmaceutical Group Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 7 years of history we want to see a few more years of history before making any solid conclusions. Since 2017, the annual payment back then was CN¥0.0796, compared to the most recent full-year payment of CN¥0.154. This implies that the company grew its distributions at a yearly rate of about 9.9% over that duration. China Resources Pharmaceutical Group has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

China Resources Pharmaceutical Group May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately, China Resources Pharmaceutical Group's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. While EPS growth is quite low, China Resources Pharmaceutical Group has the option to increase the payout ratio to return more cash to shareholders.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for China Resources Pharmaceutical Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3320

China Resources Pharmaceutical Group

An investment holding company, engages in the manufacture, distribution, and retail of pharmaceutical and other healthcare products in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives