Can Henlius Keep Its Momentum After Announcing New FDA Approval in 2025?

Reviewed by Simply Wall St

Thinking about investing in Shanghai Henlius Biotech? You are not alone. With the company’s stock surging an incredible 238.3% since the start of the year and a jaw-dropping 243.4% rise over the past twelve months, investors are understandably curious about where it might go next. While the past week and month have seen modest pullbacks of -2.9% and -4.9%, these minor dips barely register against the backdrop of tremendous three- and five-year returns, at 456.7% and 58.8% respectively. Long-term shareholders are clearly sitting on major gains, but recent volatility suggests that opinions and risk appetites might be shifting as the company attracts broader attention.

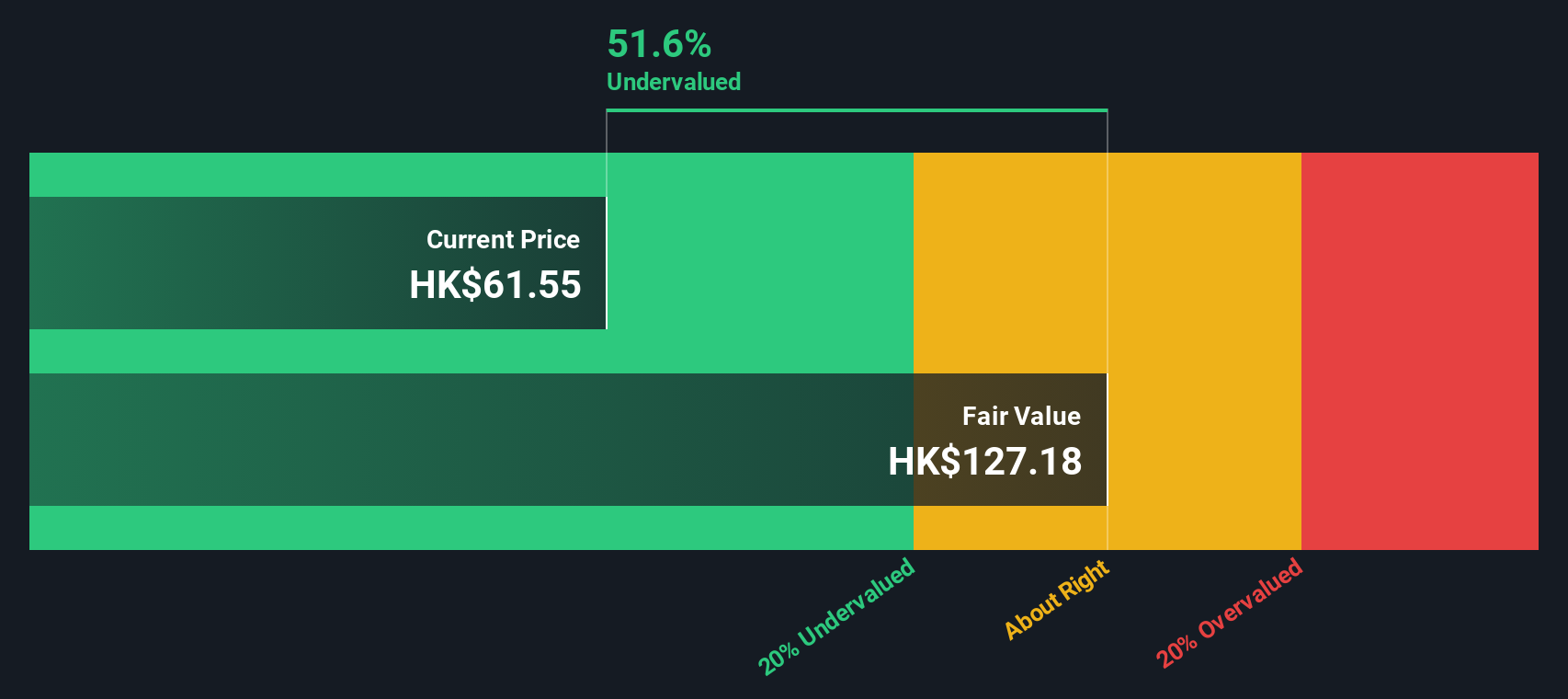

Part of the renewed focus on Shanghai Henlius centers around macro market developments, as investors seek growth stories in the healthcare and biotech space. These trends are giving the stock more visibility and driving both optimism and cautiousness about just how much upside remains. For those wondering whether the company is still attractively priced after such strong runs, our quantitative value assessment gives Henlius a value score of 3 out of 6, meaning the stock is undervalued in half of the six major valuation checks we use. That leaves open some major questions about whether there is more room for appreciation, or if risk and price are finally catching up.

Let us break down those different valuation approaches in detail, and then explore a perspective on valuation that goes even deeper than the usual checklist. This could give you an edge in navigating the next moves for Shanghai Henlius Biotech.

Shanghai Henlius Biotech delivered 243.4% returns over the last year. See how this stacks up to the rest of the Biotechs industry.Approach 1: Shanghai Henlius Biotech Discounted Cash Flow (DCF) Analysis

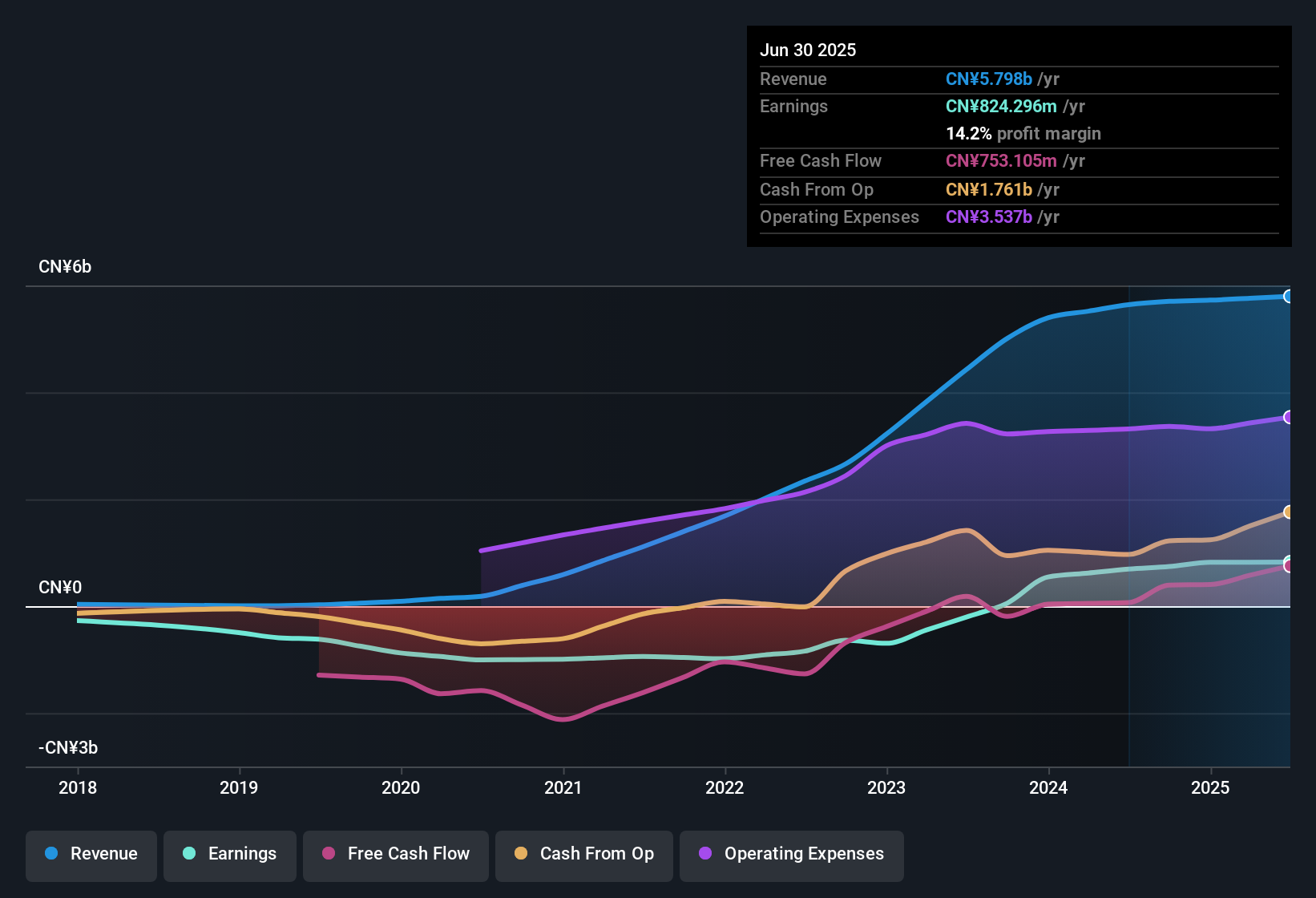

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates a company's intrinsic worth by projecting its future free cash flows and discounting them back to today's value. In the case of Shanghai Henlius Biotech, this means taking projected Free Cash Flow (FCF) in coming years, expressed in Chinese Yuan (CN¥), and adjusting for the time value of money using a two-stage model.

Currently, Henlius generates around CN¥82.2 Million in Free Cash Flow. According to analyst estimates and further extrapolation, FCF is projected to grow dramatically, reaching as much as CN¥4.07 Billion by 2035, with estimates of CN¥2.12 Billion by 2029. The early years of growth are based on consensus forecasts, while Simply Wall St provides longer-term projections. This aggressive expansion in cash generation reflects both investor optimism and expectations for the company’s scale-up in the biotech industry.

The DCF analysis computes an estimated intrinsic value for Shanghai Henlius Biotech at CN¥134.46 per share. This suggests the stock is currently trading at a 40.9% discount compared to its underlying cash flow value.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Shanghai Henlius Biotech.

Approach 2: Shanghai Henlius Biotech Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used and effective valuation tool for profitable biotech companies. It offers a straightforward way to gauge how much investors are willing to pay per dollar of earnings, making it a good measure for companies like Shanghai Henlius that are generating consistent profits.

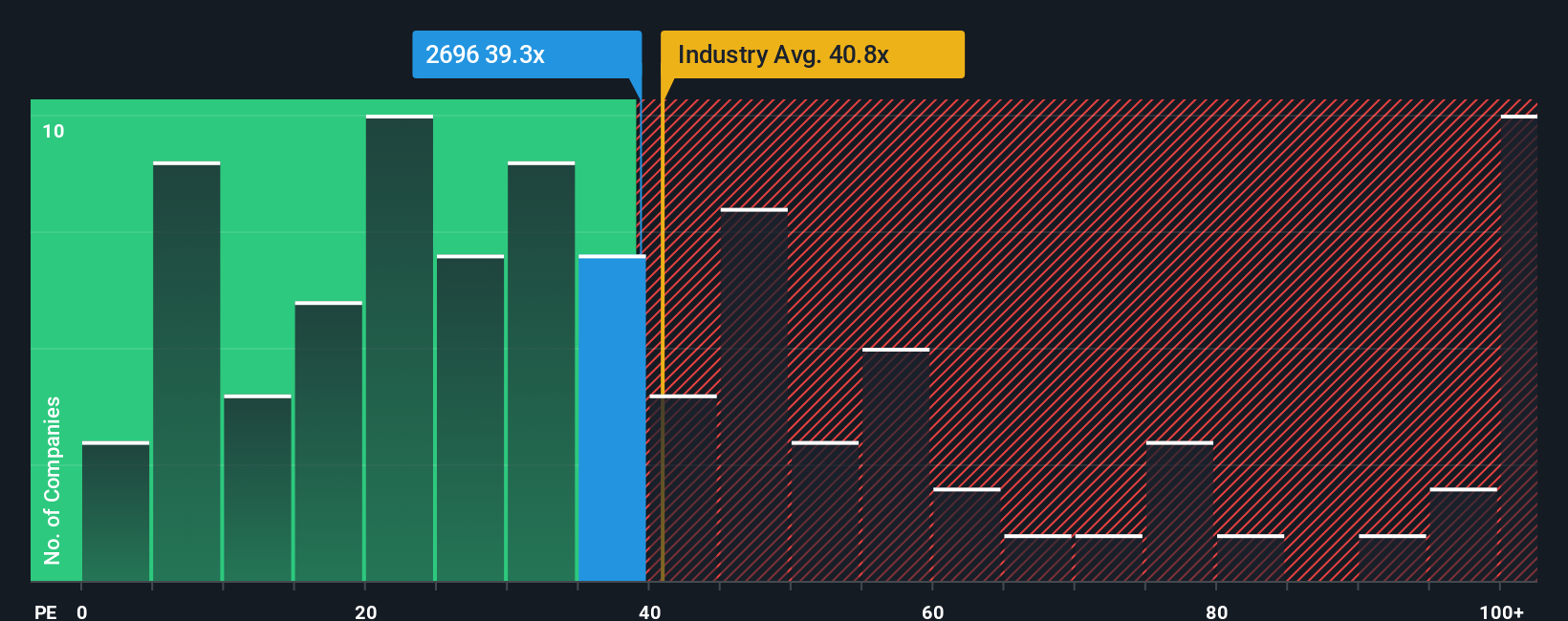

However, there is no one-size-fits-all when it comes to what a "normal" or "fair" PE ratio should be. High-growth firms, or those with lower risk profiles, often command higher PE ratios, while cyclical or riskier companies tend to trade at lower multiples. The industry backdrop also sets context. For example, the average PE ratio for biotechs stands at 29.65x, and Shanghai Henlius’s close peer group averages 51.21x.

At the moment, Shanghai Henlius Biotech trades at 48.00x earnings. This is above the broader biotech industry average, but quite close to its peer group. To get a more tailored sense of a fair multiple, Simply Wall St calculates a “Fair Ratio” for each company, factoring in its specific growth prospects, profit margins, risks, industry dynamics, and market cap. This approach helps avoid the pitfalls of blind peer or industry comparison and offers a more precise evaluation.

Shanghai Henlius’s Fair Ratio is 22.47x, which is substantially below both its current PE and the average peer multiple. Given that the company’s actual multiple is well above this fair benchmark, it appears the stock is trading above its justified valuation based on fundamentals and outlook.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Shanghai Henlius Biotech Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful approach that allows you to tie your story about a company directly to the numbers, combining your outlook for future revenue, earnings, and margins with an estimated fair value. Narratives help you connect Shanghai Henlius Biotech’s unique journey to a financial forecast, creating a fair value that reflects how you see its future playing out.

This tool is both easy to use and accessible on Simply Wall St’s Community page, which is used by millions of investors. With Narratives, you can quickly see whether a stock looks attractive by comparing your Fair Value estimate to the current market price, helping you make more informed buy or sell decisions. Even better, Narratives update automatically when new information, like earnings or breaking news, becomes available, so your outlook always stays current.

For Shanghai Henlius Biotech, some investors might see a bright future and assign a high fair value, while others, more cautious, may expect slower growth and a lower estimate, all within the same platform. This dynamic approach brings clarity and context to investing, allowing you to make decisions that truly fit your perspective.

Do you think there's more to the story for Shanghai Henlius Biotech? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2696

Shanghai Henlius Biotech

Engages in the research and development of biologic medicines with a focus on oncology, autoimmune diseases, and ophthalmic diseases.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)