Improved Revenues Required Before CStone Pharmaceuticals (HKG:2616) Stock's 27% Jump Looks Justified

Those holding CStone Pharmaceuticals (HKG:2616) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 64% share price decline over the last year.

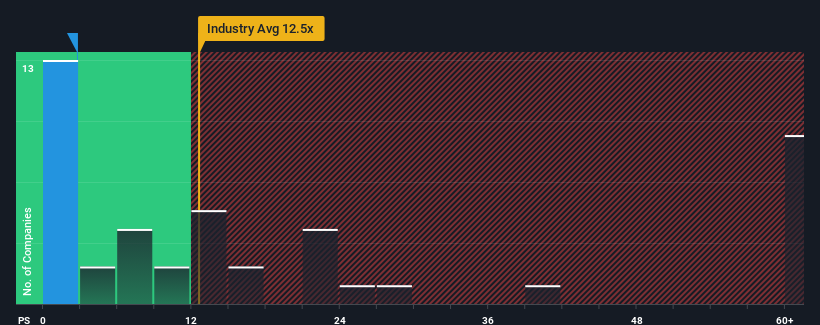

Even after such a large jump in price, CStone Pharmaceuticals may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.7x, considering almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 12.5x and even P/S higher than 30x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CStone Pharmaceuticals

What Does CStone Pharmaceuticals' Recent Performance Look Like?

CStone Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think CStone Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is CStone Pharmaceuticals' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as CStone Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.6%. As a result, revenue from three years ago have also fallen 55% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 37% per year as estimated by the two analysts watching the company. With the industry predicted to deliver 56% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why CStone Pharmaceuticals' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does CStone Pharmaceuticals' P/S Mean For Investors?

Even after such a strong price move, CStone Pharmaceuticals' P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of CStone Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for CStone Pharmaceuticals that you should be aware of.

If these risks are making you reconsider your opinion on CStone Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives