Benign Growth For CStone Pharmaceuticals (HKG:2616) Underpins Stock's 25% Plummet

CStone Pharmaceuticals (HKG:2616) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

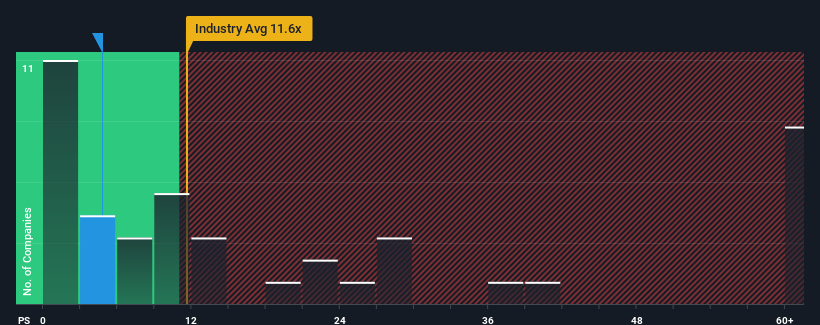

Following the heavy fall in price, CStone Pharmaceuticals may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.8x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 11.6x and even P/S higher than 29x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CStone Pharmaceuticals

What Does CStone Pharmaceuticals' Recent Performance Look Like?

CStone Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think CStone Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is CStone Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, CStone Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 61% over the next year. With the industry predicted to deliver 78% growth, the company is positioned for a weaker revenue result.

With this information, we can see why CStone Pharmaceuticals is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Having almost fallen off a cliff, CStone Pharmaceuticals' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of CStone Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for CStone Pharmaceuticals that you should be aware of.

If these risks are making you reconsider your opinion on CStone Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives