- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

3 SEHK Stocks Estimated To Be Trading Up To 44.1% Below Intrinsic Value

Reviewed by Simply Wall St

The Hong Kong stock market has recently experienced a downturn, with the Hang Seng Index falling by 6.53% amid waning optimism about Beijing's stimulus measures. This decline presents potential opportunities for investors seeking undervalued stocks that may be trading below their intrinsic value. In such volatile conditions, identifying stocks with strong fundamentals and growth potential can be key to finding hidden value in the market.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$32.25 | HK$63.32 | 49.1% |

| Giant Biogene Holding (SEHK:2367) | HK$51.10 | HK$97.66 | 47.7% |

| Laopu Gold (SEHK:6181) | HK$157.20 | HK$308.63 | 49.1% |

| Yadea Group Holdings (SEHK:1585) | HK$12.02 | HK$23.15 | 48.1% |

| Kuaishou Technology (SEHK:1024) | HK$46.35 | HK$88.45 | 47.6% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.15 | HK$55.93 | 49.7% |

| CSC Financial (SEHK:6066) | HK$8.99 | HK$17.29 | 48% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.24 | HK$19.54 | 47.6% |

| Innovent Biologics (SEHK:1801) | HK$43.85 | HK$80.39 | 45.5% |

| AK Medical Holdings (SEHK:1789) | HK$4.29 | HK$8.33 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Swire Properties (SEHK:1972)

Overview: Swire Properties Limited, with a market cap of HK$95.25 billion, develops, owns, and operates mixed-use commercial properties in Hong Kong, Mainland China, the United States, and internationally.

Operations: The company's revenue segments consist of HK$14.39 billion from Property Investment, HK$945 million from Hotels, and HK$119 million from Property Trading.

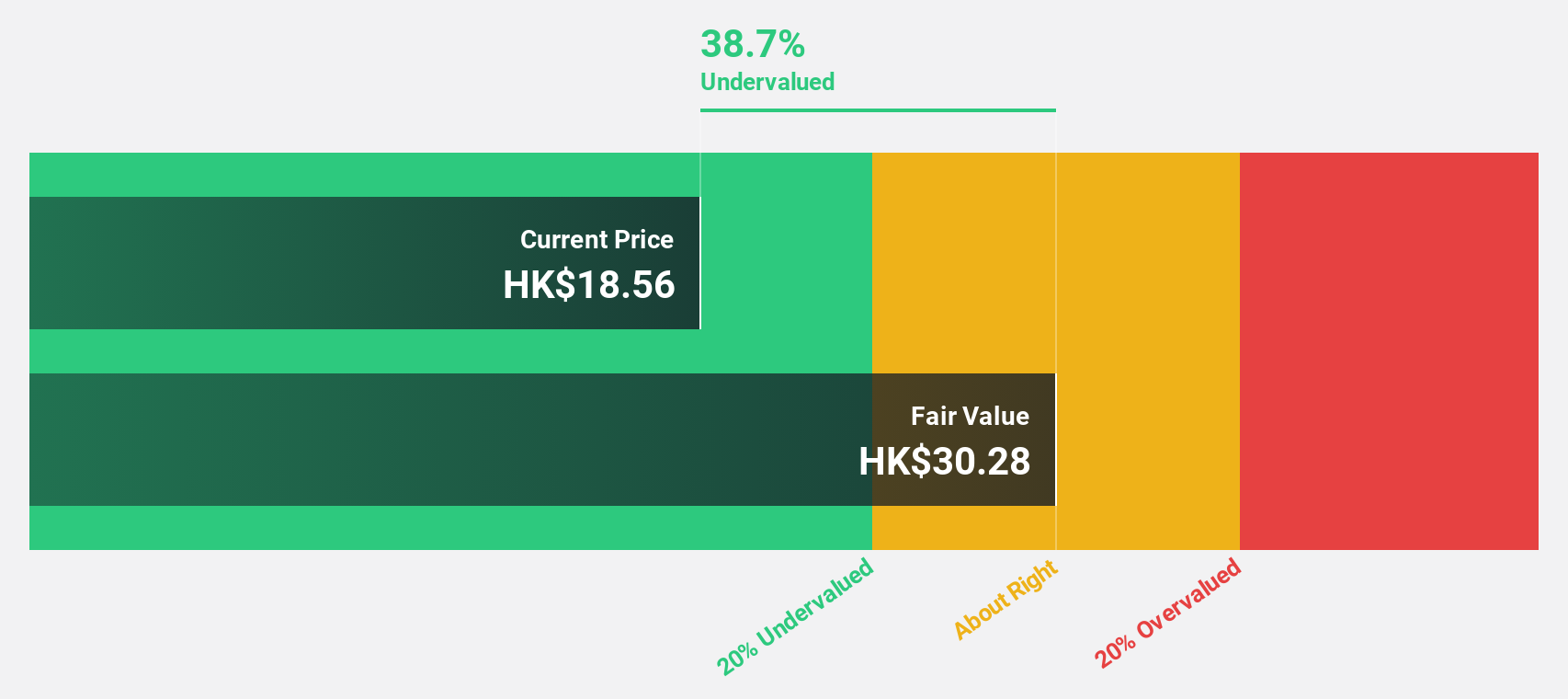

Estimated Discount To Fair Value: 14.0%

Swire Properties is trading at HK$16.32, below its estimated fair value of HK$18.98, with earnings projected to grow 25.5% annually—outpacing the Hong Kong market's 12%. Despite a recent decline in net income to HK$1.80 billion for H1 2024 and lower profit margins, the company’s share repurchase program could enhance shareholder value. However, insider selling and a dividend yield not fully covered by earnings suggest caution is warranted despite its undervaluation based on cash flows.

- Insights from our recent growth report point to a promising forecast for Swire Properties' business outlook.

- Dive into the specifics of Swire Properties here with our thorough financial health report.

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization with operations in China, North America, Europe, and internationally, and has a market cap of HK$27.32 billion.

Operations: The company's revenue from pharmaceuticals amounts to CN¥2.80 billion.

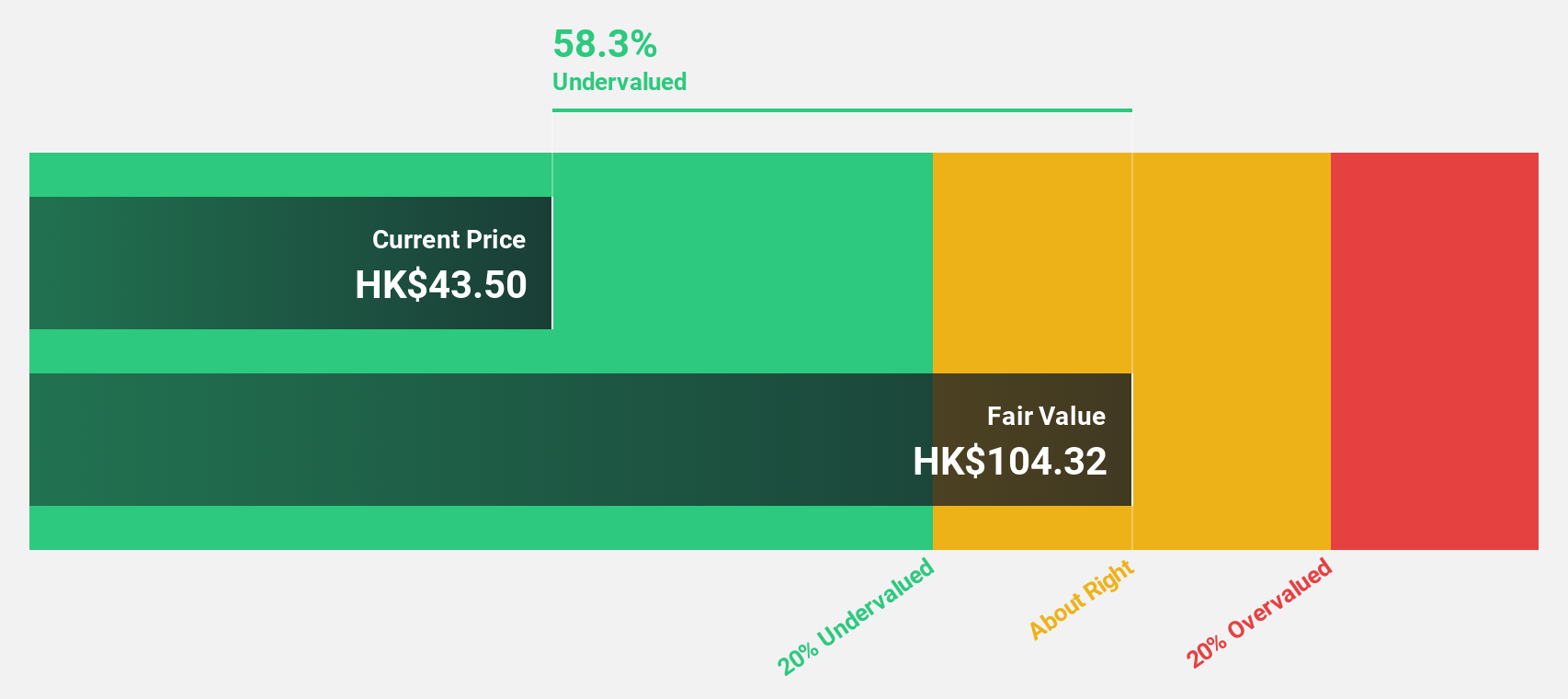

Estimated Discount To Fair Value: 44.1%

WuXi XDC Cayman is trading at HK$21.85, significantly below its estimated fair value of HK$39.12, indicating undervaluation based on cash flows. The company reported a substantial rise in net income to CNY 488.23 million for H1 2024, reflecting strong earnings growth of over 150% year-on-year. With projected annual earnings and revenue growth rates of 26.9% and 25.6%, respectively, WuXi XDC outpaces the broader Hong Kong market's performance expectations despite a forecasted low return on equity.

- Our growth report here indicates WuXi XDC Cayman may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of WuXi XDC Cayman.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel industry in the People’s Republic of China, with a market cap of HK$52.21 billion.

Operations: The company's revenue is primarily derived from Down Apparels (CN¥19.54 billion), Ladieswear Apparels (CN¥819.80 million), and Original Equipment Manufacturing (OEM) Management (CN¥2.70 billion), along with a smaller contribution from Diversified Apparels (CN¥235.33 million).

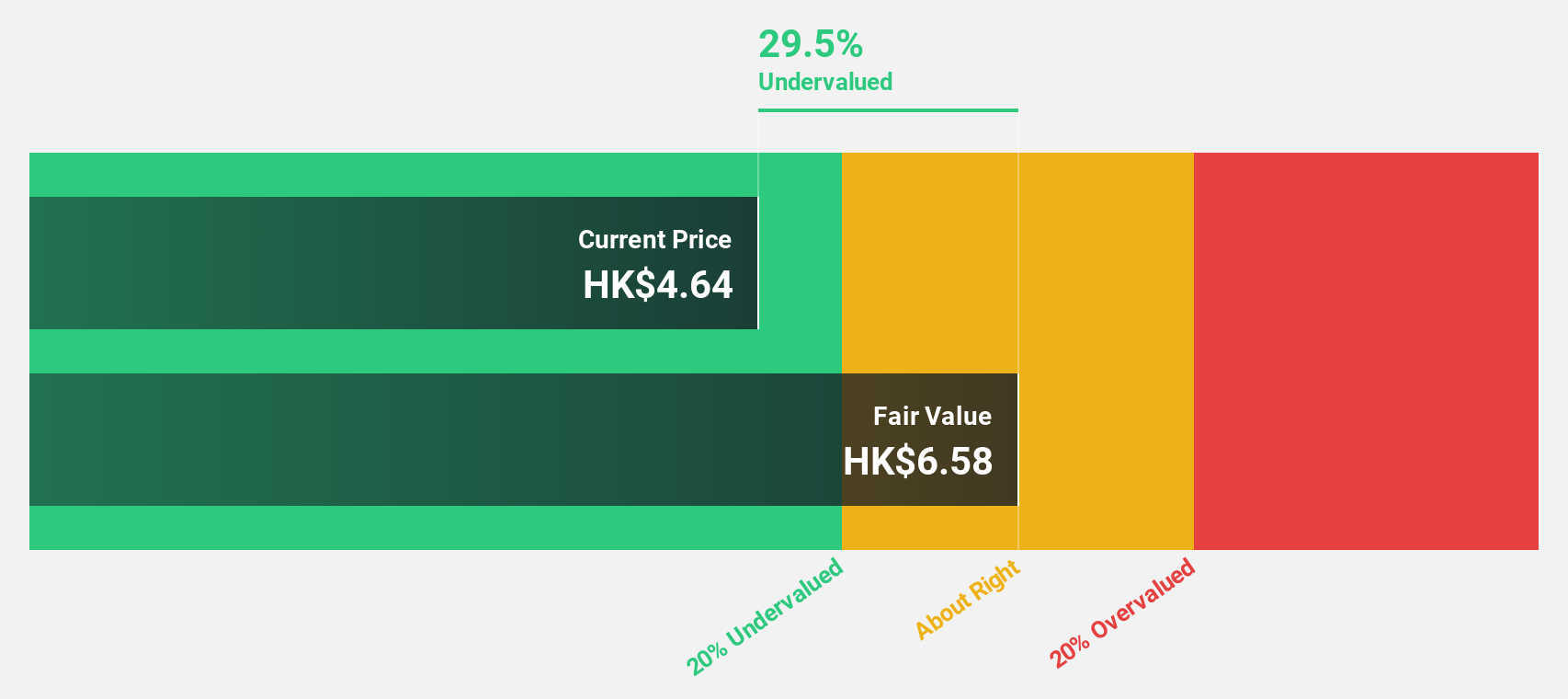

Estimated Discount To Fair Value: 29.3%

Bosideng International Holdings is trading at HK$4.75, well below its estimated fair value of HK$6.72, highlighting its undervaluation based on cash flows. The company's earnings grew by 43.7% over the past year and are projected to increase by 12.52% annually, surpassing the Hong Kong market's average growth rate. Despite an unstable dividend history, Bosideng's strategic partnership with Moose Knuckles supports its international expansion ambitions and potential revenue growth of 10.9% per year.

- Upon reviewing our latest growth report, Bosideng International Holdings' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Bosideng International Holdings with our detailed financial health report.

Taking Advantage

- Dive into all 37 of the Undervalued SEHK Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, and the United States.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026