Revenues Not Telling The Story For Shanghai Junshi Biosciences Co., Ltd. (HKG:1877)

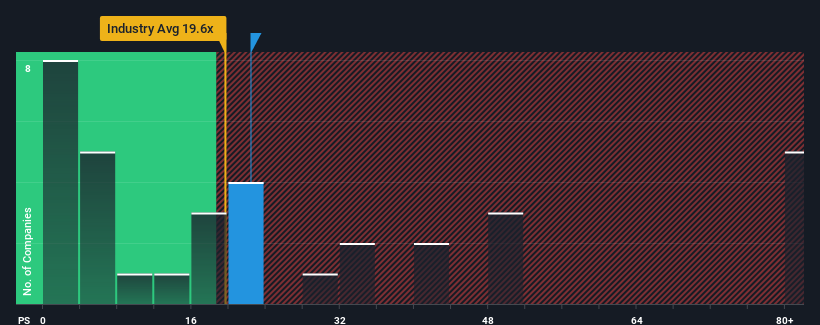

It's not a stretch to say that Shanghai Junshi Biosciences Co., Ltd.'s (HKG:1877) price-to-sales (or "P/S") ratio of 22.4x right now seems quite "middle-of-the-road" for companies in the Biotechs industry in Hong Kong, where the median P/S ratio is around 19.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Shanghai Junshi Biosciences

How Has Shanghai Junshi Biosciences Performed Recently?

Shanghai Junshi Biosciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Junshi Biosciences.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Shanghai Junshi Biosciences' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 64%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 61% per annum as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 107% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Shanghai Junshi Biosciences' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of Shanghai Junshi Biosciences' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shanghai Junshi Biosciences, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives