Benign Growth For Innovent Biologics, Inc. (HKG:1801) Underpins Its Share Price

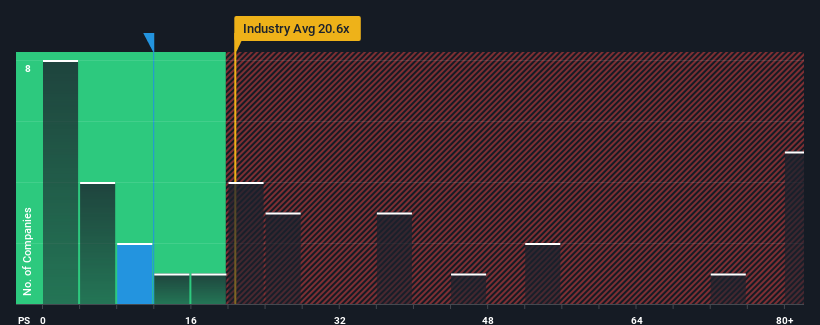

Innovent Biologics, Inc.'s (HKG:1801) price-to-sales (or "P/S") ratio of 11.9x might make it look like a buy right now compared to the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 20.6x and even P/S above 42x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Innovent Biologics

What Does Innovent Biologics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Innovent Biologics has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Innovent Biologics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Innovent Biologics' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 6.7% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 29% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 107% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Innovent Biologics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Innovent Biologics' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Innovent Biologics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Innovent Biologics you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Innovent Biologics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, develops and commercializes monoclonal antibodies and other drug assets in the fields of oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in the People’s Republic of China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives