There's Reason For Concern Over CSPC Pharmaceutical Group Limited's (HKG:1093) Price

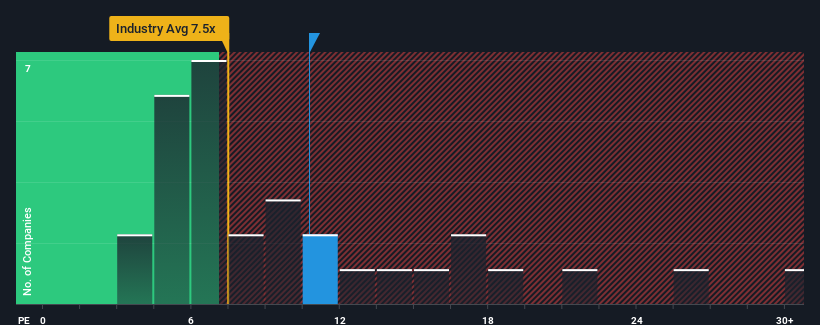

With a median price-to-earnings (or "P/E") ratio of close to 9x in Hong Kong, you could be forgiven for feeling indifferent about CSPC Pharmaceutical Group Limited's (HKG:1093) P/E ratio of 10.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

CSPC Pharmaceutical Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for CSPC Pharmaceutical Group

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, CSPC Pharmaceutical Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 3.2% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 9.6% per annum as estimated by the analysts watching the company. That's shaping up to be materially lower than the 15% per year growth forecast for the broader market.

With this information, we find it interesting that CSPC Pharmaceutical Group is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CSPC Pharmaceutical Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for CSPC Pharmaceutical Group that you should be aware of.

If you're unsure about the strength of CSPC Pharmaceutical Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical products in the People’s Republic of China, other Asian regions, North America, Europe, and internationally.

Excellent balance sheet and good value.