Is CSPC Pharmaceutical Group Still an Opportunity After Recent 4% Weekly Rally?

Reviewed by Bailey Pemberton

Are you looking at CSPC Pharmaceutical Group and wondering whether it is the right time to jump in, hold, or even cash out? You are definitely not alone. With shares recently closing at 9.7 and a trail of headline-grabbing performances, the stock has caught the attention of investors wanting both growth and value.

Let’s talk about those movements. In just the past week, CSPC’s share price rose 4.1%, bouncing back from a rougher patch last month, when the stock dropped 13.3%. Step back, though, and the bigger picture gets interesting. Year to date, the stock is up a huge 109.5%, and over the past year, it returned 41.7%. Looking back even further, there’s a steady gain of 41.2% over three years, and 13.0% over five. Much of this momentum connects with growing optimism about pharmaceutical innovation, with new product launches and strong demand lifting the sector as a whole, and a shift in risk appetite among investors eyeing long-term growth.

But numbers like these beg the classic investor question: is CSPC still undervalued after such a strong run, or has its rapid growth outpaced its fundamentals? According to the valuation scorecard, CSPC Pharmaceutical Group ticks 4 out of 6 boxes for being undervalued. Not bad, but not a slam dunk either. So, what are these checks and what do they say about the potential upside left in CSPC? Let’s unpack each valuation approach, and if you stick with me to the end, you’ll see why there may be an even better way to size up the stock.

Why CSPC Pharmaceutical Group is lagging behind its peers

Approach 1: CSPC Pharmaceutical Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future free cash flows and then discounting those amounts back to today. The core idea is simple: a business is worth the cash it will generate in the future, adjusted for risk and the time value of money.

For CSPC Pharmaceutical Group, the latest reported Free Cash Flow is approximately CN¥4.07 billion. Analysts forecast this number to grow steadily, with projections (including both analyst estimates and further extrapolations) reaching around CN¥9.40 billion by 2035. Notably, estimates from analysts cover the first five years. After that period, projections are extended by Simply Wall St using reasonable growth rates.

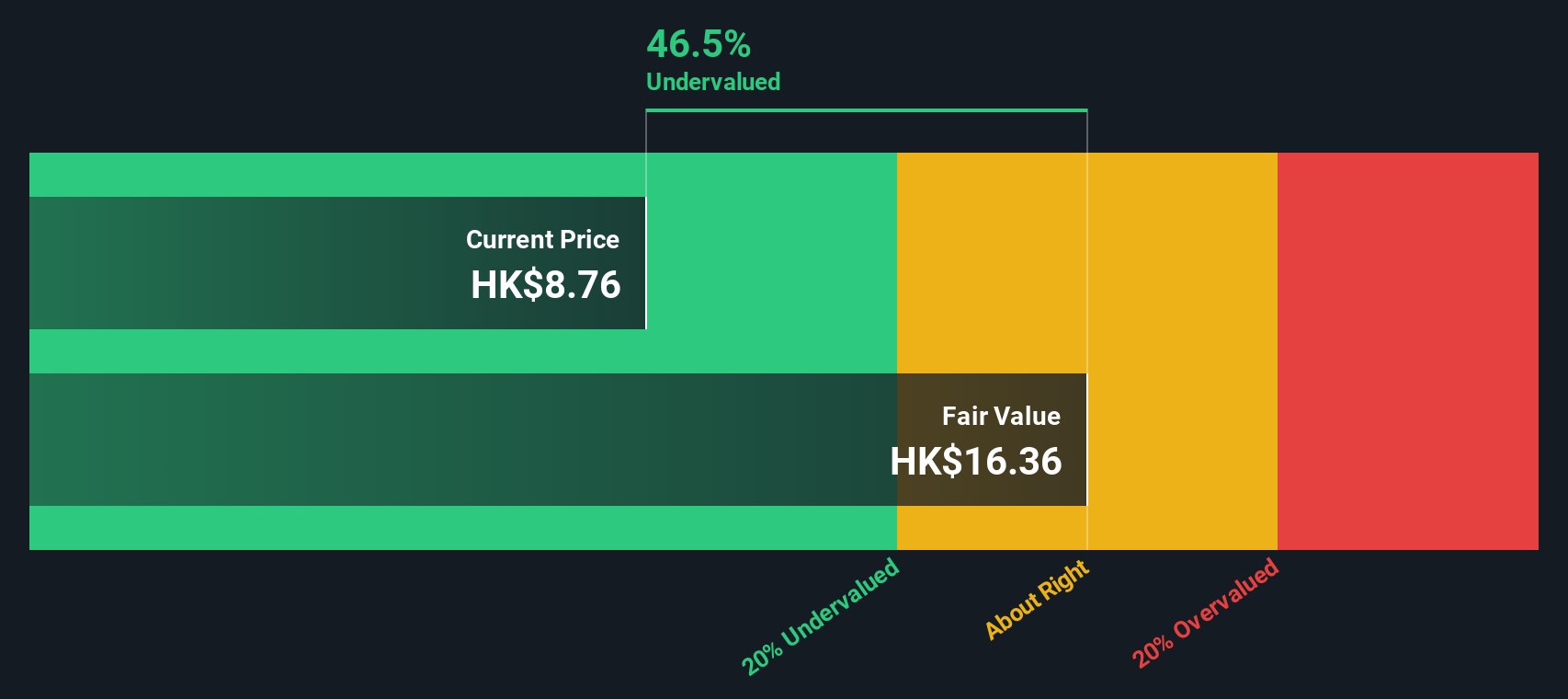

When these future cash flows are all added up and discounted back to the present, the model calculates an intrinsic value for the stock of HK$16.41 per share. This is significantly higher than the recent share price of HK$9.70. This implies that CSPC is currently trading at a 40.9% discount to its fair value based on the DCF approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CSPC Pharmaceutical Group is undervalued by 40.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CSPC Pharmaceutical Group Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is the go-to metric for valuing profitable businesses because it lets investors quickly compare how much the market is willing to pay for each dollar of a company’s earnings. For companies like CSPC Pharmaceutical Group, with a positive and stable earnings record, the PE ratio cuts through short-term noise and highlights how optimistic or cautious investors are about future prospects.

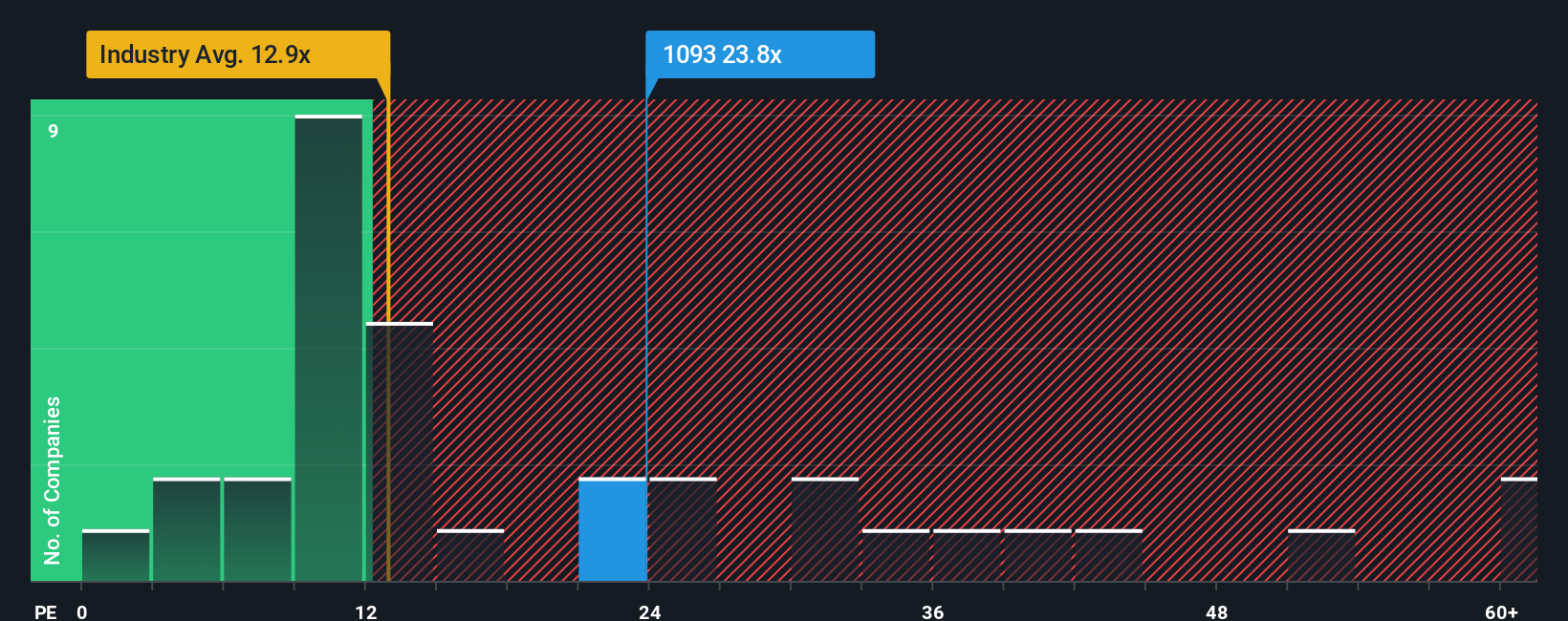

Growth expectations and risk play a big role in what makes a “normal” PE ratio. Fast-growing, low-risk companies often deserve higher multiples, while slower or riskier ones trade at a discount. CSPC currently trades on a PE of 26.3x, which is nearly double the Pharmaceuticals industry average of 13.6x, but is lower than the average of its direct peers at 33.4x. At first glance, this suggests the stock commands a premium thanks to perceived growth or stability, yet isn’t as aggressively valued as some competitors.

This is where the Simply Wall St "Fair Ratio" comes in. Unlike a straightforward peer comparison, the Fair Ratio of 27.4x is data-driven. It factors in not just current earnings but also CSPC’s growth outlook, profit margins, industry characteristics, and overall risk and market cap. This results in a benchmark that is far more tailored than a simple average and sets realistic expectations for a company’s valuation in today’s market conditions. With CSPC’s actual PE (26.3x) sitting just below its Fair Ratio (27.4x), the shares look to be fairly priced.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

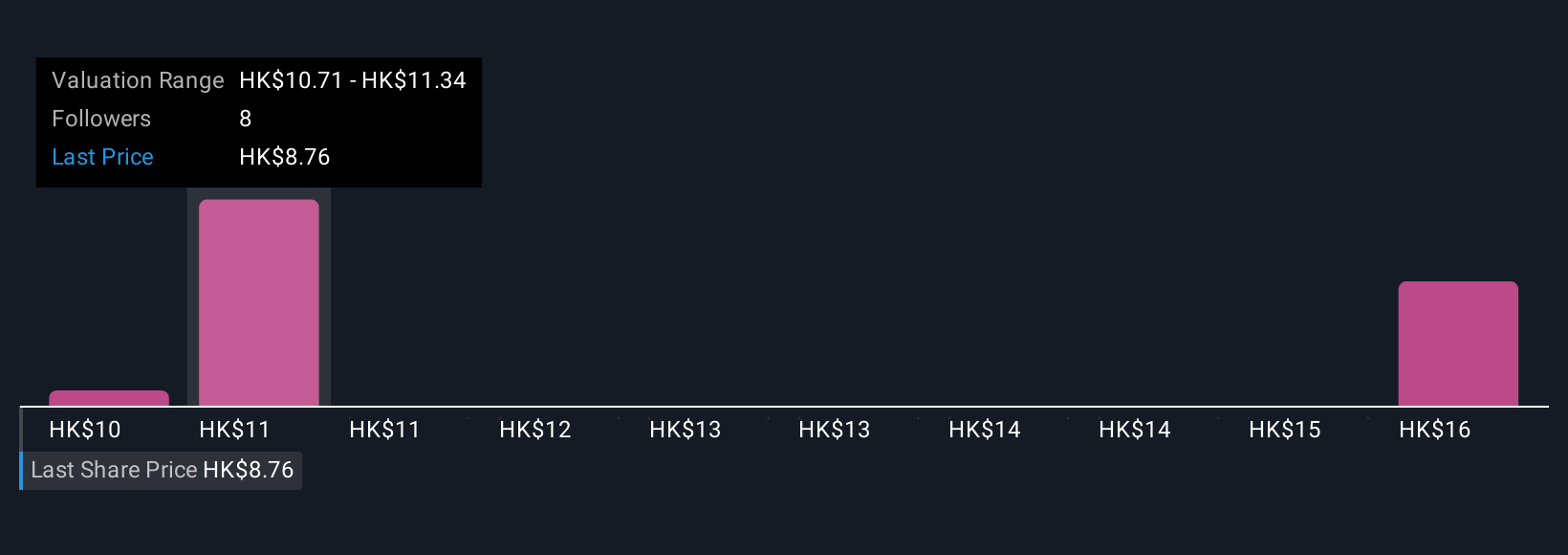

Upgrade Your Decision Making: Choose your CSPC Pharmaceutical Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story behind CSPC Pharmaceutical Group’s numbers; it connects what you think about the company’s prospects to real financial forecasts, like its future revenue, profit margins, and ultimately, fair value. Instead of relying on just one rigid estimate, Narratives help you create your own view or explore what others in the Community on Simply Wall St (used by millions of investors) believe, all in one easy-to-access place.

This approach makes deciding when to buy, hold or sell more transparent, since you can compare your (or the community’s) Fair Value to the current Price. Plus, whenever fresh news or earnings come out, Narratives update automatically, ensuring your perspectives always reflect the latest information. For example, some CSPC investors may see rapid drug approvals justifying a much higher fair value, while others, cautious about future competition, might set a lower figure. Narratives empower you to make smarter, more personalized investment decisions by linking the company’s evolving story directly to its numbers.

Do you think there's more to the story for CSPC Pharmaceutical Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives