- Hong Kong

- /

- Entertainment

- /

- SEHK:9999

NetEase (SEHK:9999): Is There More Value After a 71% Year-to-Date Rally?

Reviewed by Kshitija Bhandaru

NetEase (SEHK:9999) shares have caught fresh attention in recent trading sessions, as investors consider recent price movements along with underlying business momentum. The company’s stock has delivered strong returns over the past year, which has sparked renewed discussion about its future direction.

See our latest analysis for NetEase.

Momentum has been building for NetEase, with a remarkable 71% year-to-date share price return. This reflects growing optimism around its market position and fundamentals. The company’s strong 82% total shareholder return over the past year signals that enthusiasm among investors remains resilient, despite minor short-term price fluctuations.

If rapid growth stories like this have you watching the digital sector more closely, consider broadening your search and discover fast growing stocks with high insider ownership

With NetEase’s impressive rise and resilient investor sentiment, the question now is whether its shares offer further upside or if the current price already fully reflects expectations for future growth and profitability.

Most Popular Narrative: 2.7% Undervalued

NetEase’s last close of HK$235 is just below the fair value estimated by the most widely followed narrative, suggesting moderate upside potential if the projected fundamentals play out. The market currently weighs the company’s momentum against a detailed outlook for growth, margins, and future profit multiples.

NetEase is accelerating global expansion with self-developed and licensed games that have performed strongly in overseas markets (e.g., Marvel Mystic Mayhem, FragPunk, Once Human, Eggy Party). This is increasing the company's addressable market and diversifying revenue streams beyond China, supporting higher long-term revenue growth and earnings stability.

Ready for the full story? This narrative values NetEase using forecasts for both profit margins and future earnings multiples. Want to know what level of growth, and just how ambitious a profit target, underpins that valuation? Only the narrative reveals the key drivers that could justify this premium.

Result: Fair Value of $241.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. NetEase’s heavy reliance on China and rising development costs could pressure earnings if overseas expansion or new releases underperform.

Find out about the key risks to this NetEase narrative.

Another View: Testing the Numbers with a Different Lens

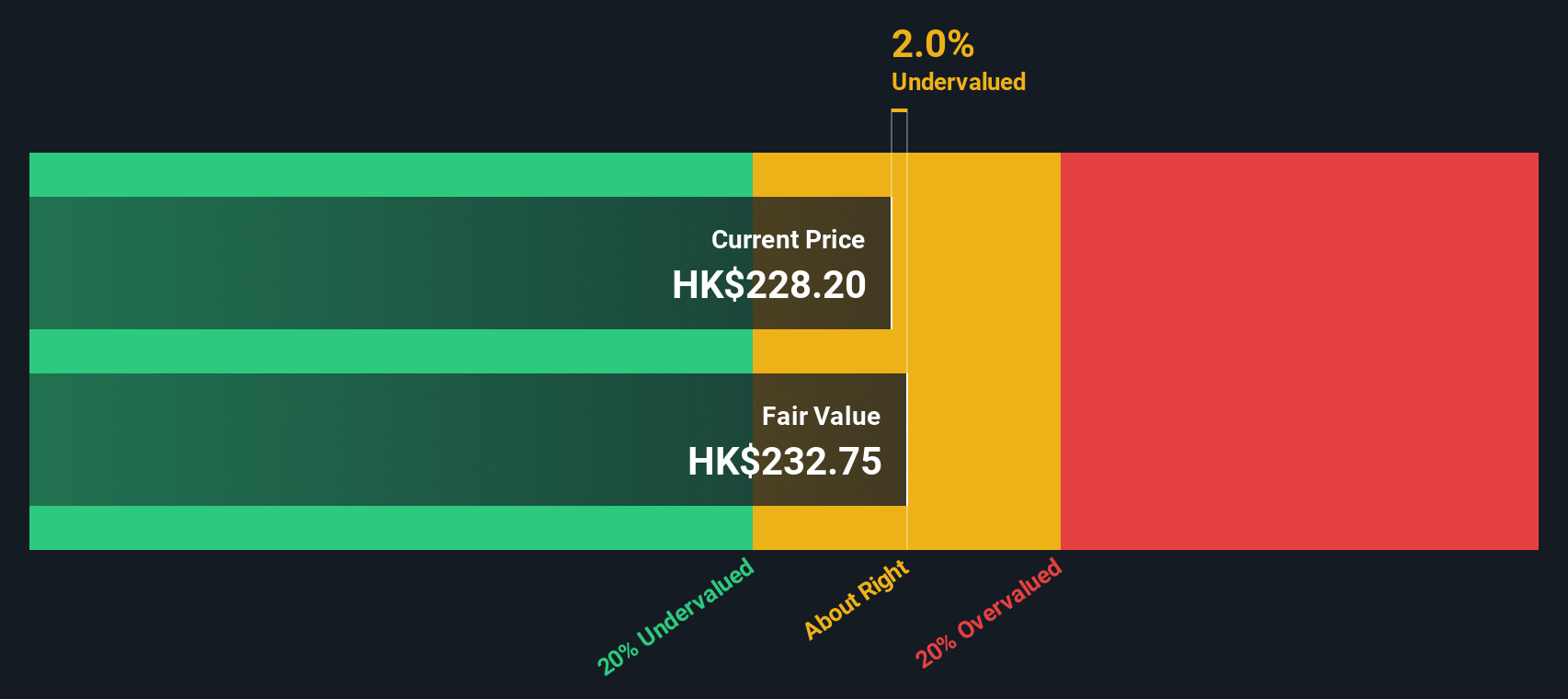

Looking at NetEase through our DCF model, the fair value estimate is HK$232.83, just below the current share price. This method suggests the stock is slightly overvalued, which contrasts with the narrative’s undervalued view. Could deeper risks or lower long-term growth be holding back the DCF estimate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NetEase for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NetEase Narrative

If you see things differently or want to dig deeper into NetEase’s performance, you can craft your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NetEase.

Looking for more investment ideas?

Don’t wait for the next big trend to pass you by. Uncover fresh opportunities today with investing strategies that match your goals and interests.

- Boost your portfolio’s resilience by tapping into stable income streams with these 18 dividend stocks with yields > 3%, which consistently yield above-average returns.

- Unlock the future of healthcare by tracking rapid advancements and promising breakthroughs with these 33 healthcare AI stocks, showing real progress in medical technology.

- Accelerate your search for undervalued gems and maximize growth potential with these 893 undervalued stocks based on cash flows, which could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9999

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives