- Hong Kong

- /

- Entertainment

- /

- SEHK:9999

Did Earnings Strength and Cloud Music’s Global Data Push Just Shift NetEase’s (SEHK:9999) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, NetEase reported higher sales and net income year over year, affirmed a US$0.114 per-share dividend, completed a US$2.00 billion buyback program, and saw its NetEase Cloud Music charts integrated into Chartmetric’s platform for global industry access.

- The Chartmetric integration gives international labels and artists direct visibility into youth-driven listening trends on NetEase Cloud Music, potentially increasing the platform’s influence in global music discovery and data-driven marketing.

- We’ll now examine how NetEase’s stronger quarterly earnings and expanded Cloud Music data reach may reshape its longer-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

NetEase Investment Narrative Recap

To own NetEase, you need to believe its core gaming and digital content platforms can keep converting large user bases into sustained earnings, while managing heavy R&D spending and regulatory uncertainty. The latest earnings beat reinforces profitability as a key short term catalyst, but the Chartmetric integration is more incremental at this stage and does not materially change the biggest risk, which is still NetEase’s high exposure to China relative to overseas markets.

Among the recent announcements, the stronger third quarter of 2025, with higher sales and net income year over year, looks most relevant. It underpins the idea that NetEase can keep funding initiatives like Cloud Music’s expanded data reach without visibly compromising margins yet, which matters if investors see continued content investment and international expansion as the core drivers for the story.

Yet, for all the encouraging numbers, investors should still be aware of how concentrated NetEase’s revenue is in China and what that means if ...

Read the full narrative on NetEase (it's free!)

NetEase's narrative projects CN¥140.2 billion revenue and CN¥43.2 billion earnings by 2028. This requires 8.5% yearly revenue growth and about CN¥9 billion earnings increase from CN¥34.2 billion today.

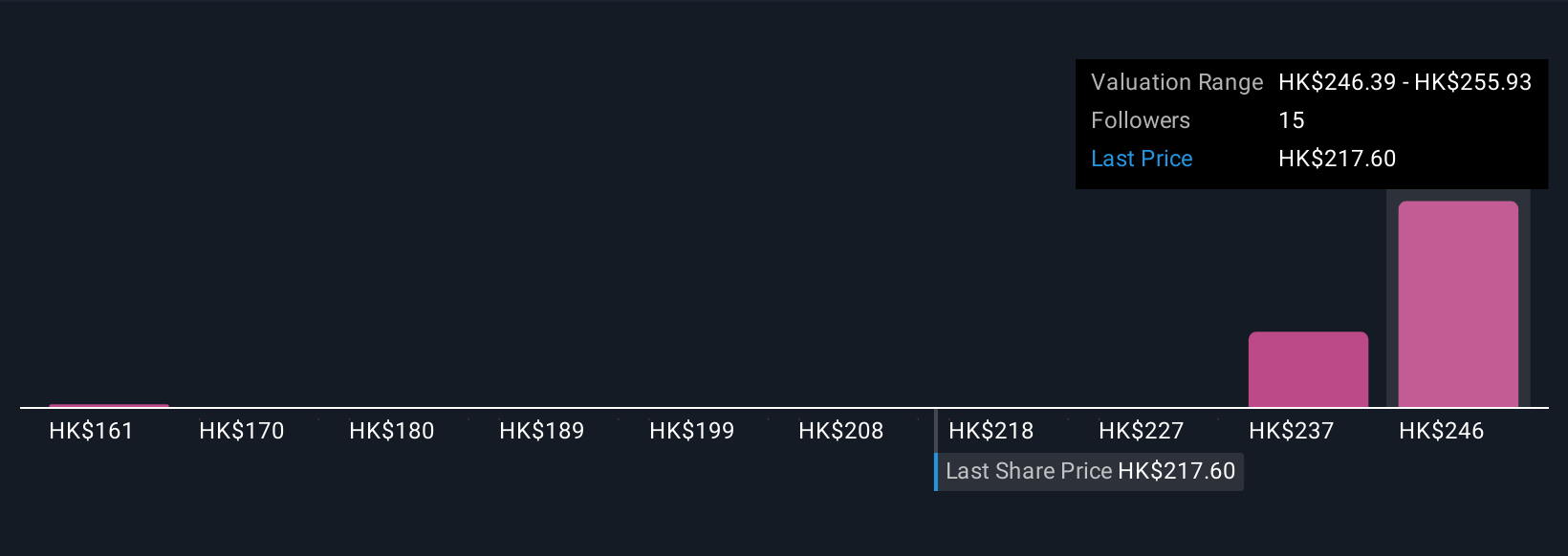

Uncover how NetEase's forecasts yield a HK$255.93 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly HK$160.54 to HK$255.93, underscoring how far apart individual views can be. As you weigh those opinions, it is worth setting them against NetEase’s reliance on the slower growth Chinese market and considering what that concentration could mean for future performance.

Explore 3 other fair value estimates on NetEase - why the stock might be worth 26% less than the current price!

Build Your Own NetEase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetEase research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NetEase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetEase's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9999

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026