- Hong Kong

- /

- Entertainment

- /

- SEHK:8368

Why Creative China Holdings' (HKG:8368) Shaky Earnings Are Just The Beginning Of Its Problems

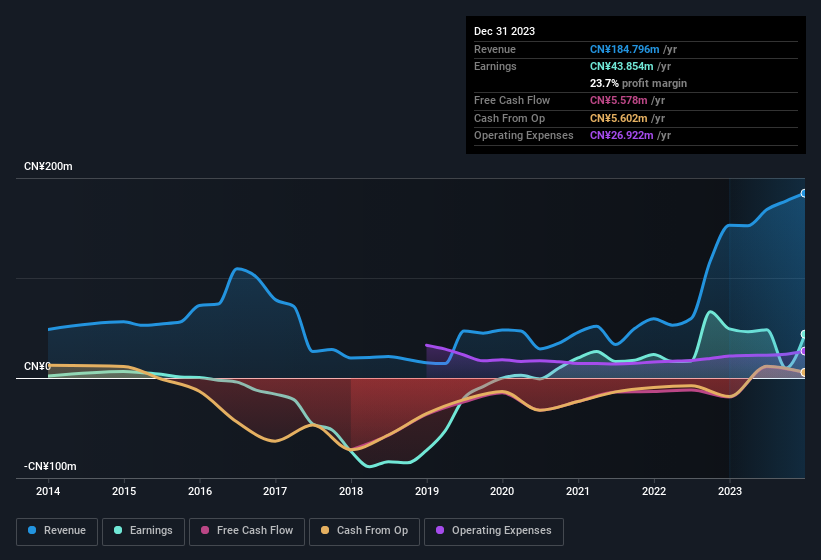

A lackluster earnings announcement from Creative China Holdings Limited (HKG:8368) last week didn't sink the stock price. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Creative China Holdings

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Creative China Holdings increased the number of shares on issue by 55% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Creative China Holdings' EPS by clicking here.

How Is Dilution Impacting Creative China Holdings' Earnings Per Share (EPS)?

As you can see above, Creative China Holdings has been growing its net income over the last few years, with an annualized gain of 119% over three years. In comparison, earnings per share only gained 33% over the same period. Net profit actually dropped by 11% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 20%. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Creative China Holdings' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Creative China Holdings.

Our Take On Creative China Holdings' Profit Performance

Creative China Holdings issued shares during the year, and that means its EPS performance lags its net income growth. For this reason, we think that Creative China Holdings' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Nonetheless, it's still worth noting that its earnings per share have grown at 33% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 3 warning signs we've spotted with Creative China Holdings (including 1 which shouldn't be ignored).

Today we've zoomed in on a single data point to better understand the nature of Creative China Holdings' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Creative China Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8368

Creative China Holdings

An investment holding company, primarily provides film and television program original script creation, adaptation, production and licensing, and related services in the People’s Republic of China, Hong Kong, and Southeast Asia.

Excellent balance sheet low.

Market Insights

Community Narratives