- Hong Kong

- /

- Entertainment

- /

- SEHK:8368

Creative China Holdings Limited (HKG:8368) Stock's 35% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Creative China Holdings Limited (HKG:8368) share price has dived 35% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 154%.

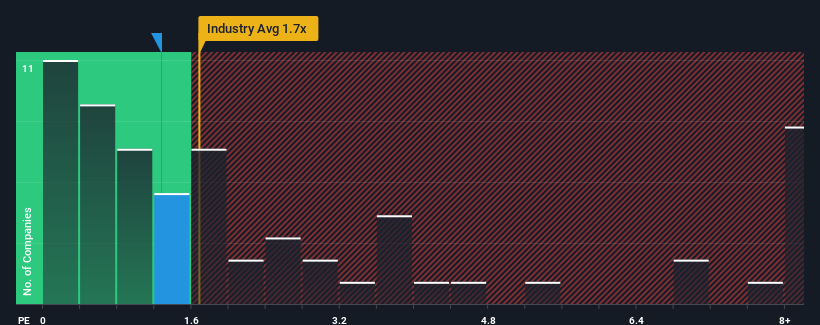

Even after such a large drop in price, there still wouldn't be many who think Creative China Holdings' price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in Hong Kong's Entertainment industry is similar at about 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Creative China Holdings

How Has Creative China Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Creative China Holdings has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Creative China Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Creative China Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 51% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 45%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Creative China Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Creative China Holdings' P/S?

Following Creative China Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Creative China Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Creative China Holdings has 6 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8368

Creative China Holdings

An investment holding company, primarily provides film and television program original script creation, adaptation, production and licensing, and related services in the People’s Republic of China, Hong Kong, and Southeast Asia.

Excellent balance sheet low.

Market Insights

Community Narratives