- Hong Kong

- /

- Entertainment

- /

- SEHK:8280

China Digital Video Holdings Limited (HKG:8280) Stock Catapults 78% Though Its Price And Business Still Lag The Industry

China Digital Video Holdings Limited (HKG:8280) shareholders would be excited to see that the share price has had a great month, posting a 78% gain and recovering from prior weakness. The annual gain comes to 129% following the latest surge, making investors sit up and take notice.

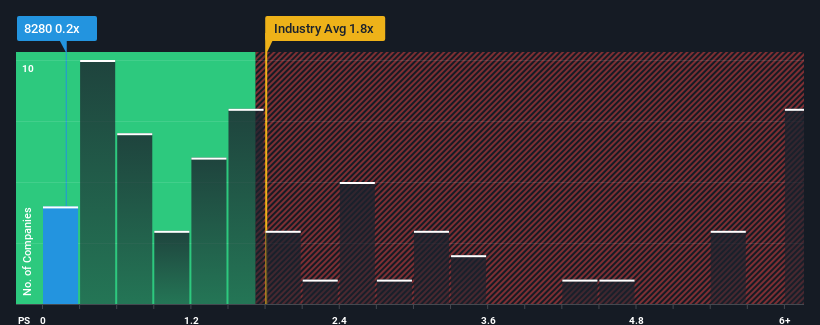

In spite of the firm bounce in price, China Digital Video Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.8x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Digital Video Holdings

How China Digital Video Holdings Has Been Performing

For instance, China Digital Video Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Digital Video Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as China Digital Video Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 56% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 35% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that China Digital Video Holdings is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On China Digital Video Holdings' P/S

The latest share price surge wasn't enough to lift China Digital Video Holdings' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Digital Video Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for China Digital Video Holdings that you should be aware of.

If you're unsure about the strength of China Digital Video Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8280

China Digital Video Holdings

An investment holding company, engages in the research, development, and sale of video-related and broadcasting equipment and software to TV broadcasters, new media operators, and other digital video content providers in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives