As global markets grapple with economic uncertainty and inflation concerns, investors are increasingly looking towards Asia for opportunities, particularly in the realm of dividend stocks. In this environment, a strong dividend yield can provide a buffer against market volatility and offer a steady income stream, making it an attractive feature for those seeking stability amidst fluctuating indices.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 4.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.94% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.29% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

Click here to see the full list of 1173 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

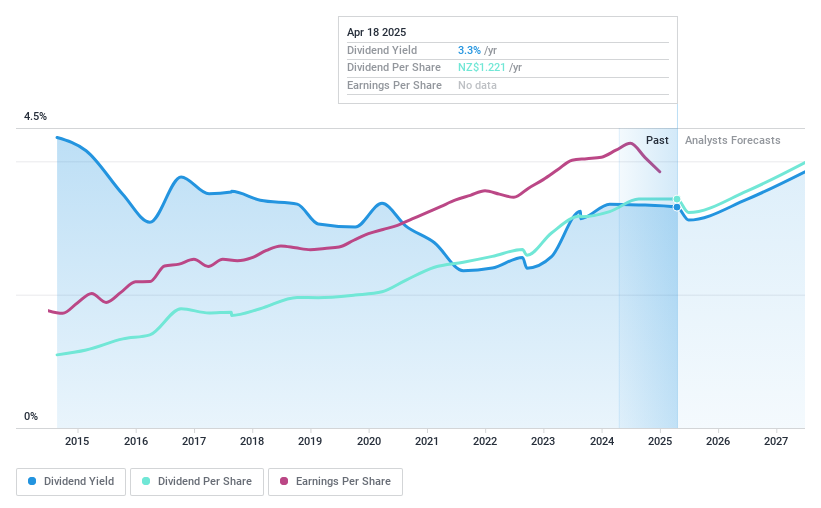

EBOS Group (NZSE:EBO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EBOS Group Limited operates in the marketing, wholesale, and distribution of healthcare, medical, pharmaceutical, and animal care products across Australia, Southeast Asia, and New Zealand with a market cap of NZ$7.59 billion.

Operations: EBOS Group's revenue segments include A$12.00 billion from Healthcare and A$597.08 million from Animal Care.

Dividend Yield: 3.2%

EBOS Group has maintained stable and reliable dividend payments over the past decade, with recent announcements affirming a fully franked interim dividend of NZ$0.57 per share. Despite a decrease in sales and net income for the half-year ending December 2024, dividends remain covered by earnings (85.2% payout ratio) and cash flows (70% cash payout ratio). The dividend yield is relatively low at 3.18%, but the company offers a Dividend Reinvestment Plan with shares available at a discount to VWAP.

- Get an in-depth perspective on EBOS Group's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, EBOS Group's share price might be too optimistic.

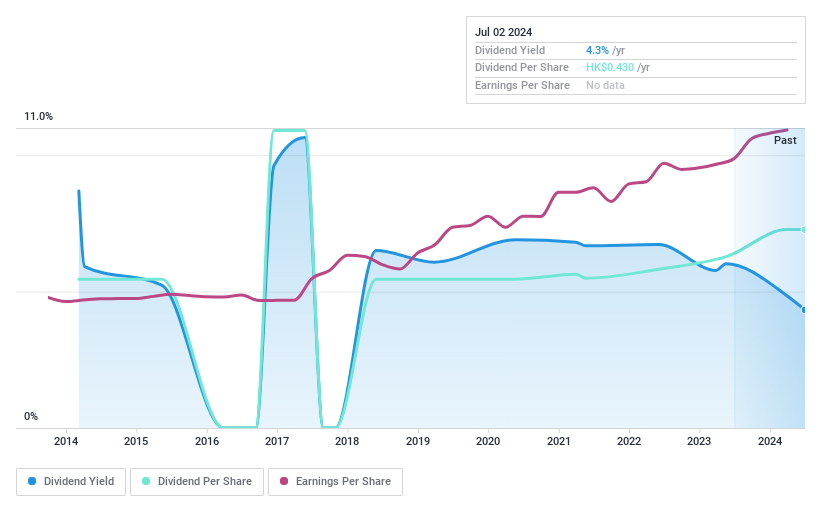

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in the publishing and media industry, with a market cap of approximately HK$17.97 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates revenue primarily from its operations in the publishing and media sector.

Dividend Yield: 3.7%

Xinhua Winshare Publishing and Media Co., Ltd. reported stable sales growth, with revenues reaching CNY 12.33 billion for 2024, though net income slightly declined. The company proposed a final dividend of RMB 0.41 per share, supported by a low payout ratio of 47.6%, indicating sustainability despite past volatility in dividend payments. Trading at a significant discount to its estimated fair value, the stock presents good relative value compared to peers in the Hong Kong market where its yield is below top-tier levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Xinhua Winshare Publishing and Media.

- In light of our recent valuation report, it seems possible that Xinhua Winshare Publishing and Media is trading behind its estimated value.

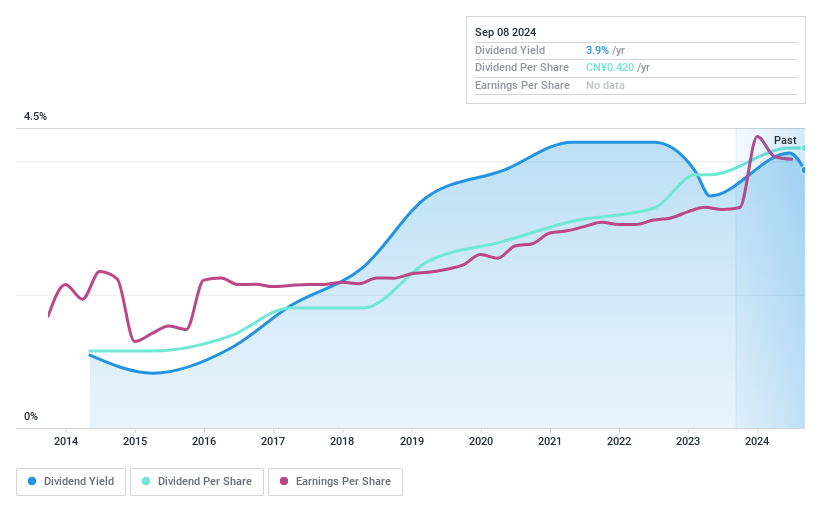

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central China Land Media CO., LTD, along with its subsidiaries, is involved in the editing, production, and marketing of publications in China and has a market cap of CN¥12.01 billion.

Operations: Central China Land Media CO., LTD generates revenue through its operations in the editing, production, and marketing of publications within China.

Dividend Yield: 3.6%

Central China Land Media Ltd. offers a dividend yield of 3.58%, ranking in the top 25% within the CN market, yet its high payout ratio of 422.7% suggests dividends are not covered by earnings but well supported by cash flows with a low cash payout ratio of 21.6%. Despite stable dividends over the past decade, recent earnings showed a decline, with net income at CNY 1.05 billion for 2024, reflecting potential challenges in sustaining future payouts.

- Dive into the specifics of Central China Land MediaLTD here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Central China Land MediaLTD shares in the market.

Where To Now?

- Navigate through the entire inventory of 1173 Top Asian Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000719

Central China Land MediaLTD

Engages in the editing, production, and marketing of publications in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives