- Hong Kong

- /

- Entertainment

- /

- SEHK:777

Analysts Just Slashed Their NetDragon Websoft Holdings Limited (HKG:777) EPS Numbers

Today is shaping up negative for NetDragon Websoft Holdings Limited ( HKG:777 ) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. At HK$15.22, shares are up 8.1% in the past 7 days. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

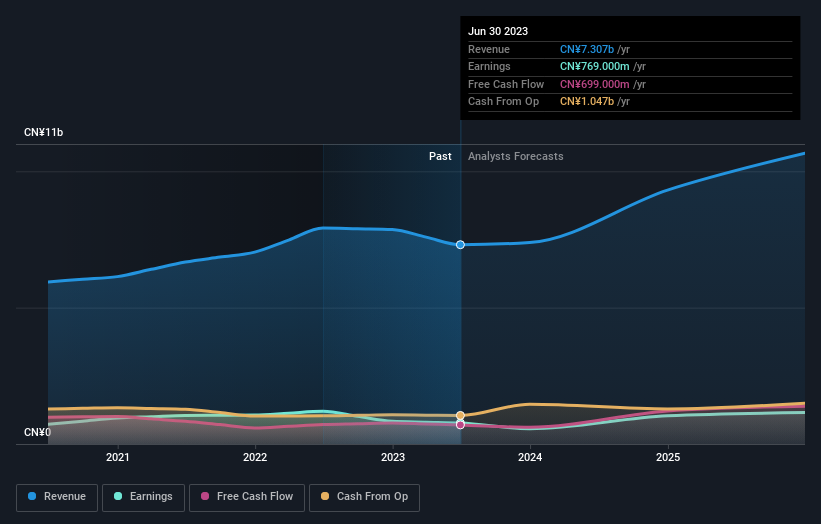

Following this downgrade, NetDragon Websoft Holdings' two analysts are forecasting 2023 revenues to be CN¥7.4b, approximately in line with the last 12 months. Statutory earnings per share are supposed to plummet 29% to CN¥1.04 in the same period. Previously, the analysts had been modelling revenues of CN¥8.4b and earnings per share (EPS) of CN¥1.64 in 2023. Indeed, we can see that the analysts are a lot more bearish about NetDragon Websoft Holdings' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for NetDragon Websoft Holdings

What's most unexpected is that the consensus price target rose 6.5% to CN¥20.00, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on NetDragon Websoft Holdings, with the most bullish analyst valuing it at CN¥20.73 and the most bearish at CN¥19.26 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that NetDragon Websoft Holdings' revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 2.2% growth on an annualised basis. This is compared to a historical growth rate of 11% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 21% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than NetDragon Websoft Holdings.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for NetDragon Websoft Holdings. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that NetDragon Websoft Holdings' revenues are expected to grow slower than the wider market. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for NetDragon Websoft Holdings going out as far as 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying .

Valuation is complex, but we're here to simplify it.

Discover if NetDragon Websoft Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:777

NetDragon Websoft Holdings

Provides online and mobile games the People’s Republic of China, the United States, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion