- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:6100

Did You Miss Tongdao Liepin Group's (HKG:6100) 15% Share Price Gain?

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if when you choose to buy stocks, some of them will be below average performers. For example, the Tongdao Liepin Group (HKG:6100), share price is up over the last year, but its gain of 15% trails the market return. Tongdao Liepin Group hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Tongdao Liepin Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

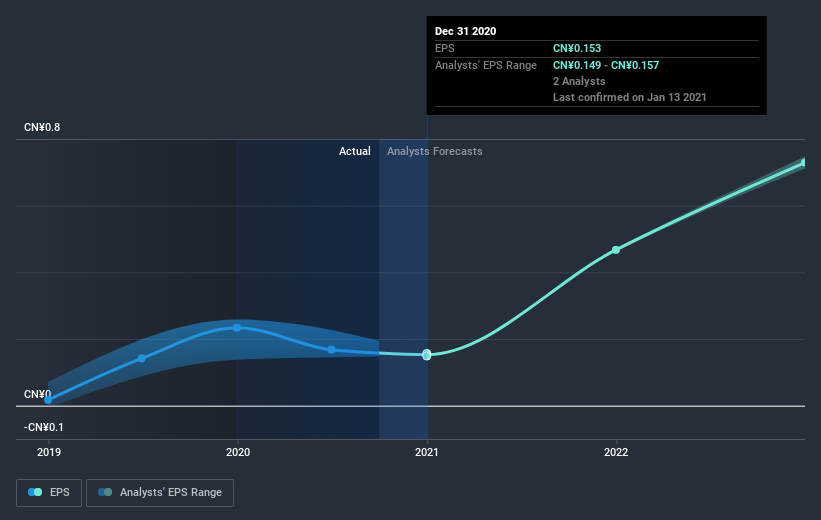

During the last year Tongdao Liepin Group grew its earnings per share (EPS) by 18%. It's fair to say that the share price gain of 15% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Tongdao Liepin Group as it was before. This could be an opportunity. Of course, with a P/E ratio of 99.21, the market remains optimistic.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Tongdao Liepin Group's earnings, revenue and cash flow.

A Different Perspective

Tongdao Liepin Group shareholders have gained 15% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 28%. The last three months haven't been so kind to Tongdao Liepin Group, with the share price gaining just 2.9%. It's not uncommon to see a company's share price between updates to shareholders. Is Tongdao Liepin Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Tongdao Liepin Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tongdao Liepin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6100

Tongdao Liepin Group

An investment holding company, provides talent acquisition services in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.