Stella International Holdings And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong bank earnings driving U.S. stocks higher, investors are closely watching the performance of value stocks, which have recently outperformed growth shares. In this dynamic environment, dividend stocks offer a compelling opportunity for those seeking steady income streams; Stella International Holdings and two other reliable dividend-paying companies stand out as potential considerations for investors looking to navigate these market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

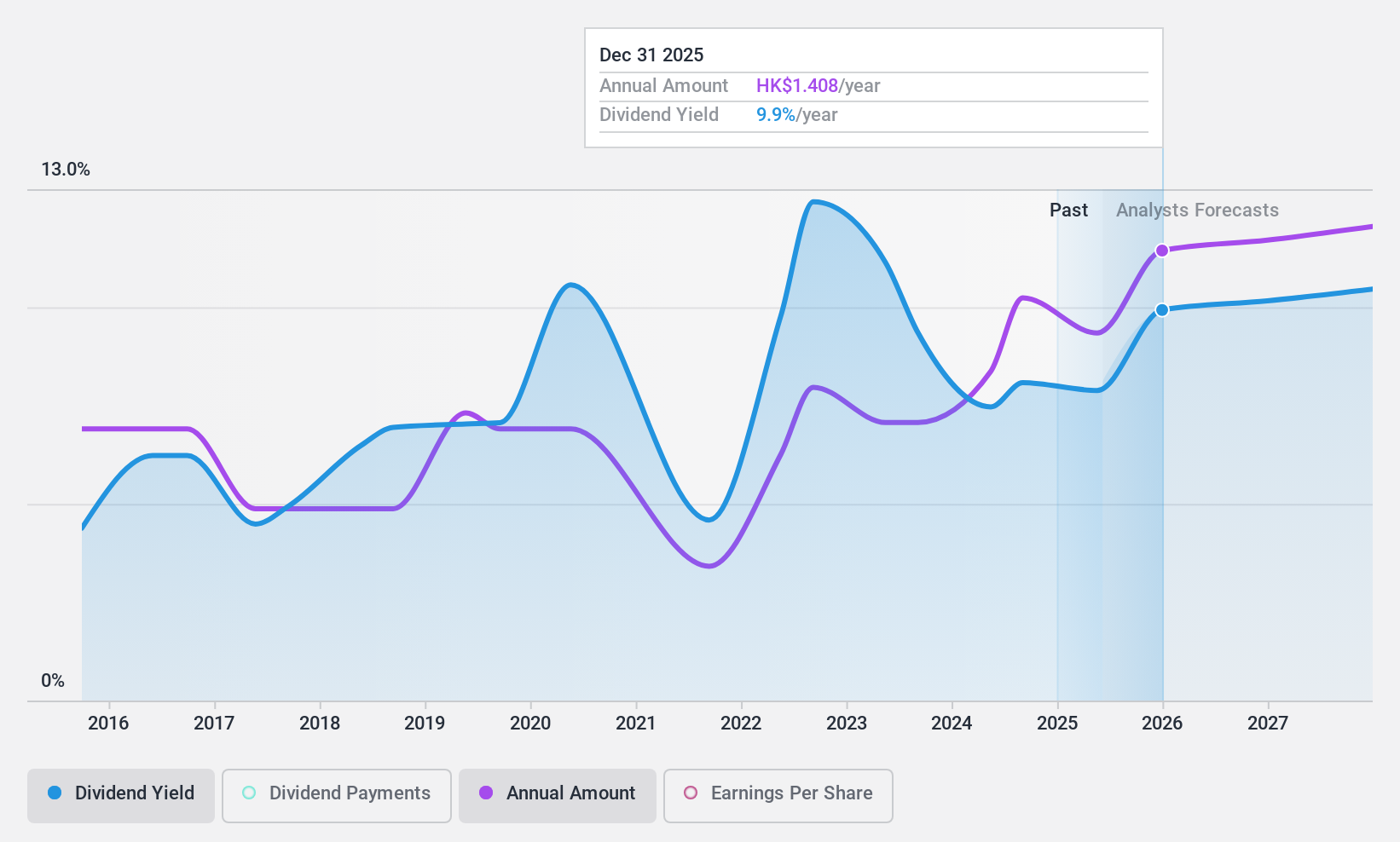

Stella International Holdings (SEHK:1836)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella International Holdings Limited is an investment holding company involved in the development, manufacture, and sale of footwear products and leather goods across North America, China, Europe, Asia, and other international markets with a market cap of HK$14.63 billion.

Operations: Stella International Holdings Limited generates its revenue primarily from Manufacturing, which accounts for $1.55 billion, and Retailing and Wholesaling, contributing $2.84 million.

Dividend Yield: 7.0%

Stella International Holdings exhibits a mixed dividend profile. Despite a volatile dividend history, the company maintains a reasonable payout ratio of 72.6% and covers dividends with cash flows at 54.4%. Recent earnings growth of 56.6% suggests potential support for future payouts, although the current yield is below top-tier levels in Hong Kong. Revenue increased to US$1.55 billion in 2024, indicating some stability amidst executive changes and market challenges.

- Click here to discover the nuances of Stella International Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Stella International Holdings implies its share price may be too high.

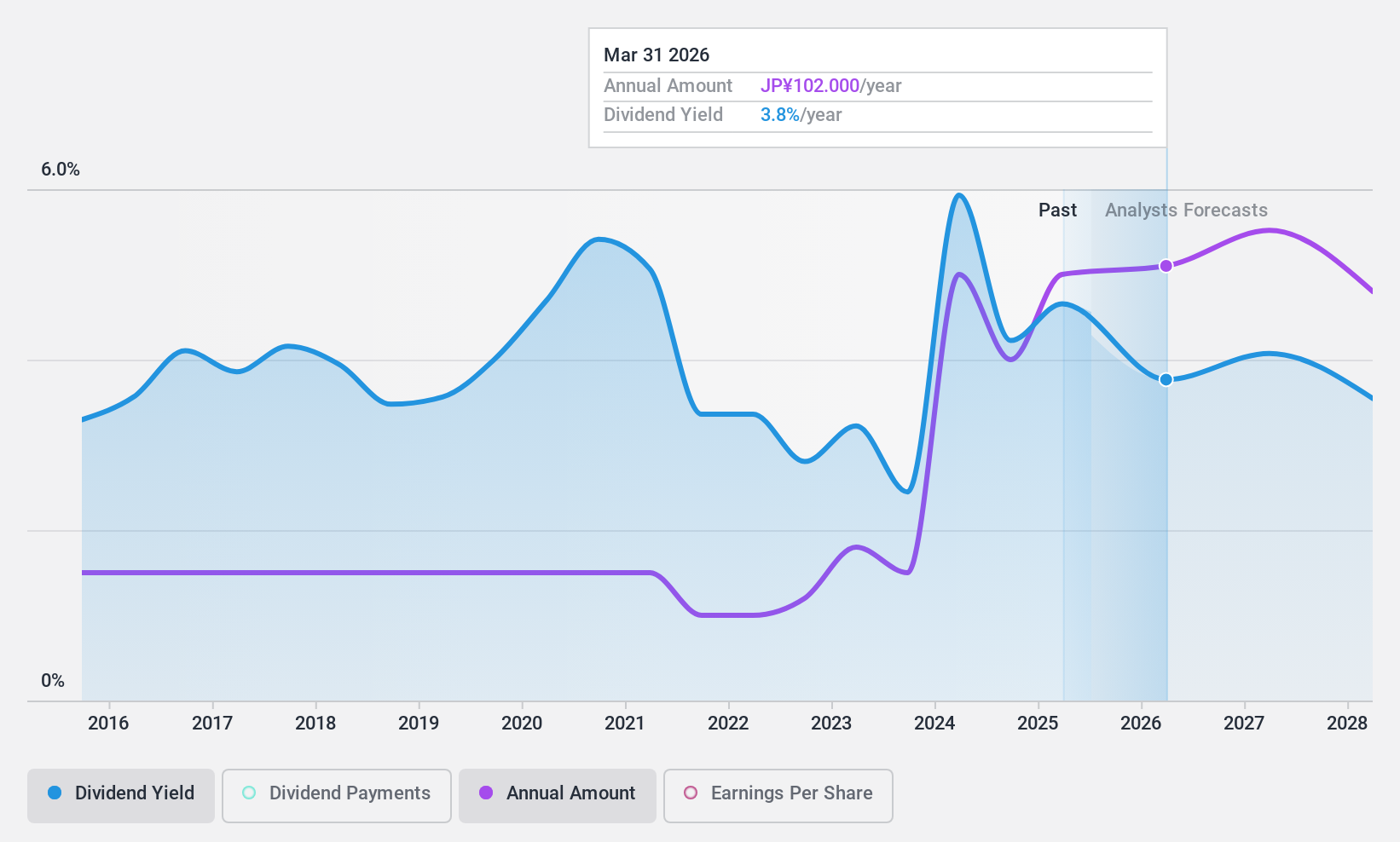

Sankyo (TSE:6417)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sankyo Co., Ltd. manufactures and sells game machines and ball bearing supply systems in Japan, with a market cap of ¥461.29 billion.

Operations: Sankyo Co., Ltd. generates revenue primarily from its Pachinko-Related Segment at ¥102.92 billion, followed by the Pachislo-Related Segment at ¥49.66 billion and the Supplementary Equipment-Related Business at ¥20.57 billion.

Dividend Yield: 3.8%

Sankyo's dividend sustainability is supported by a low payout ratio of 43.6% and a cash payout ratio of 34%, indicating coverage by both earnings and cash flows. However, the company's dividends have been volatile over the past decade, with an unstable track record despite recent increases to JPY 40 per share. Trading at nearly 60% below estimated fair value, it offers good relative value but yields slightly below top-tier levels in Japan.

- Dive into the specifics of Sankyo here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sankyo is priced lower than what may be justified by its financials.

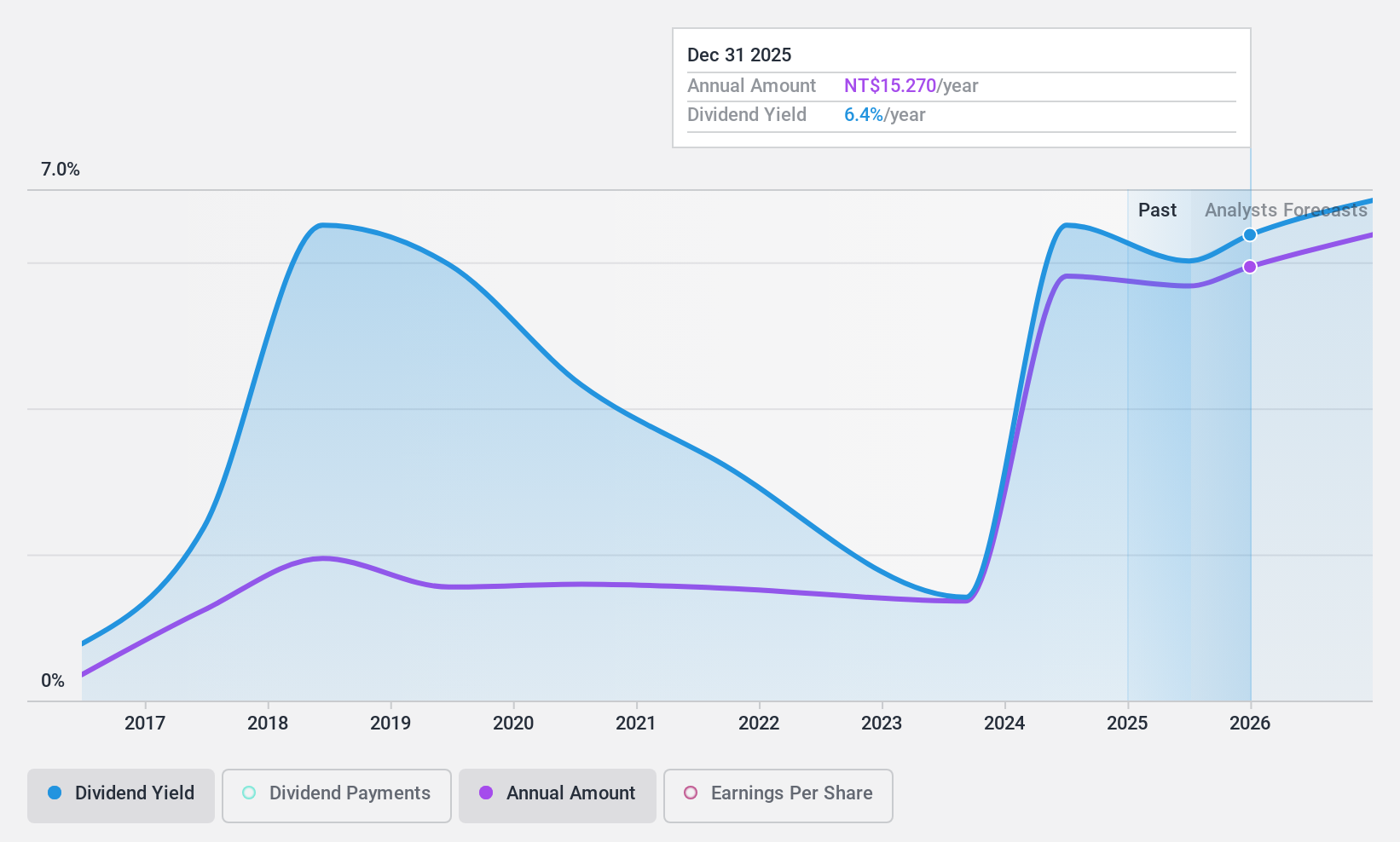

Wowprime (TWSE:2727)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wowprime Corp. operates restaurants and coffee/tea shops in Taiwan and Mainland China, with a market cap of NT$18.35 billion.

Operations: Wowprime Corp.'s revenue is comprised of NT$17.90 billion from its operations in Taiwan and NT$4.36 billion from its activities in Mainland China.

Dividend Yield: 6.7%

Wowprime's dividend yield of 6.71% is among the top 25% in Taiwan, but its sustainability is questionable due to a high payout ratio of 95.4%, though cash flow coverage at 47.6% is adequate. Despite trading at a significant discount to fair value, dividends have been volatile and unreliable over the past decade, with inconsistent growth patterns. Recent earnings show slight declines in sales and net income compared to last year, reflecting potential challenges in maintaining dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Wowprime.

- The valuation report we've compiled suggests that Wowprime's current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1983 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1836

Stella International Holdings

An investment holding company, engages in development, manufacture, and sale of footwear products and leather goods in North America, the People’s Republic of China, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives