- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

XD Inc. Reported A Surprise Loss, And Analysts Have Updated Their Forecasts

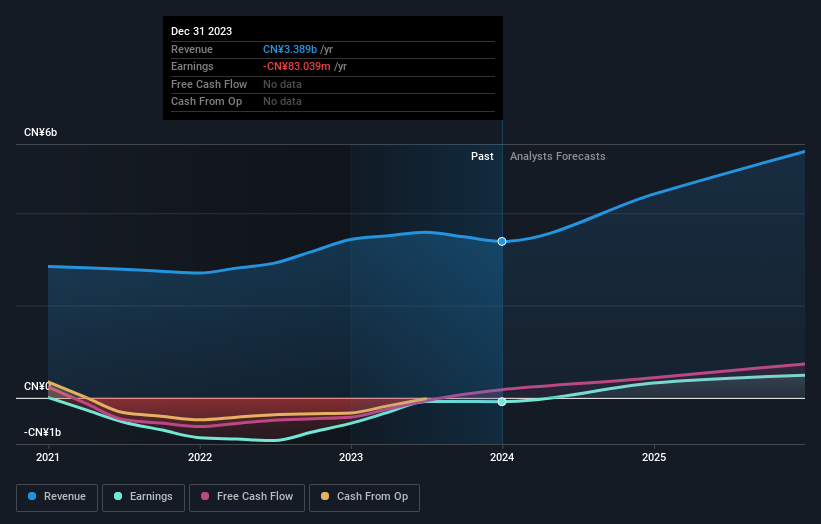

XD Inc. (HKG:2400) shareholders are probably feeling a little disappointed, since its shares fell 5.5% to HK$15.90 in the week after its latest annual results. It looks like a pretty bad result, given that revenues fell 11% short of analyst estimates at CN¥3.4b, and the company reported a statutory loss of CN¥0.18 per share instead of the profit that the analysts had been forecasting. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for XD

After the latest results, the ten analysts covering XD are now predicting revenues of CN¥4.41b in 2024. If met, this would reflect a major 30% improvement in revenue compared to the last 12 months. Earnings are expected to improve, with XD forecast to report a statutory profit of CN¥0.71 per share. Before this earnings report, the analysts had been forecasting revenues of CN¥4.70b and earnings per share (EPS) of CN¥0.84 in 2024. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a real cut to earnings per share estimates.

It'll come as no surprise then, to learn that the analysts have cut their price target 7.1% to HK$19.77. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values XD at HK$34.68 per share, while the most bearish prices it at HK$11.53. With such a wide range in price targets, analysts are almost certainly betting on widely divergent outcomes in the underlying business. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the XD's past performance and to peers in the same industry. The analysts are definitely expecting XD's growth to accelerate, with the forecast 30% annualised growth to the end of 2024 ranking favourably alongside historical growth of 7.9% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 15% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that XD is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for XD. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of XD's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on XD. Long-term earnings power is much more important than next year's profits. We have forecasts for XD going out to 2025, and you can see them free on our platform here.

It is also worth noting that we have found 1 warning sign for XD that you need to take into consideration.

If you're looking to trade XD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives