- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

Revenues Not Telling The Story For XD Inc. (HKG:2400) After Shares Rise 80%

Those holding XD Inc. (HKG:2400) shares would be relieved that the share price has rebounded 80% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

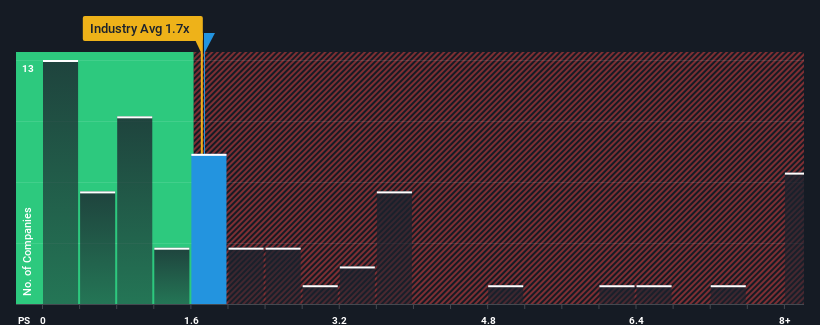

Although its price has surged higher, it's still not a stretch to say that XD's price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for XD

What Does XD's P/S Mean For Shareholders?

Recent times haven't been great for XD as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think XD's future stacks up against the industry? In that case, our free report is a great place to start.How Is XD's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like XD's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. As a result, it also grew revenue by 21% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 17% over the next year. With the industry predicted to deliver 46% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that XD's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On XD's P/S

XD's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that XD's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 1 warning sign for XD that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade XD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives