- Hong Kong

- /

- Entertainment

- /

- SEHK:2309

There's Reason For Concern Over ZO Future Group's (HKG:2309) Massive 32% Price Jump

ZO Future Group (HKG:2309) shares have continued their recent momentum with a 32% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

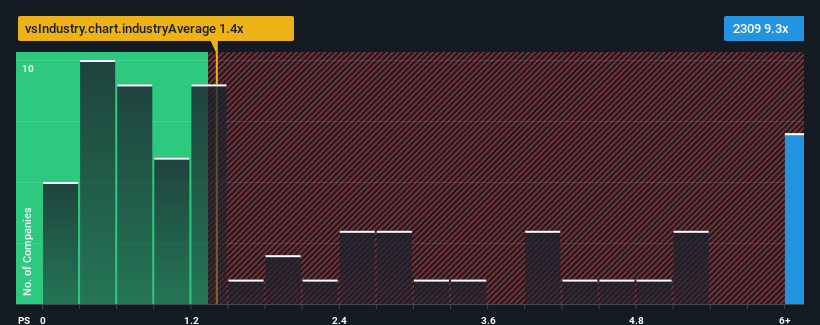

After such a large jump in price, when almost half of the companies in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider ZO Future Group as a stock not worth researching with its 9.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for ZO Future Group in our free report.See our latest analysis for ZO Future Group

What Does ZO Future Group's P/S Mean For Shareholders?

Revenue has risen firmly for ZO Future Group recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ZO Future Group's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For ZO Future Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ZO Future Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 49% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it interesting that ZO Future Group is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Bottom Line On ZO Future Group's P/S

ZO Future Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of ZO Future Group revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for ZO Future Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZO Future Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2309

ZO Future Group

An investment holding company, operates a professional football club in Hong Kong, the United Kingdom, the People's Republic of China, Cambodia, and Japan.

Low risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)