- Hong Kong

- /

- Entertainment

- /

- SEHK:1981

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets react to U.S. inflation data and the Nasdaq Composite leads gains, growth stocks are outperforming value shares while small-cap stocks lag behind major indices like the S&P 500. In this environment of climbing stock indexes and economic uncertainty, investors might consider focusing on high-growth tech companies that demonstrate strong innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1206 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cathay Group Holdings (SEHK:1981)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cathay Group Holdings Inc. is an investment holding company involved in entertainment production and higher education sectors in China and internationally, with a market cap of HK$2.73 billion.

Operations: Cathay Group Holdings Inc. generates revenue primarily from its higher and vocational education segment, which accounts for CN¥606.66 million, and its entertainment and livestreaming e-commerce segment, contributing CN¥162.17 million.

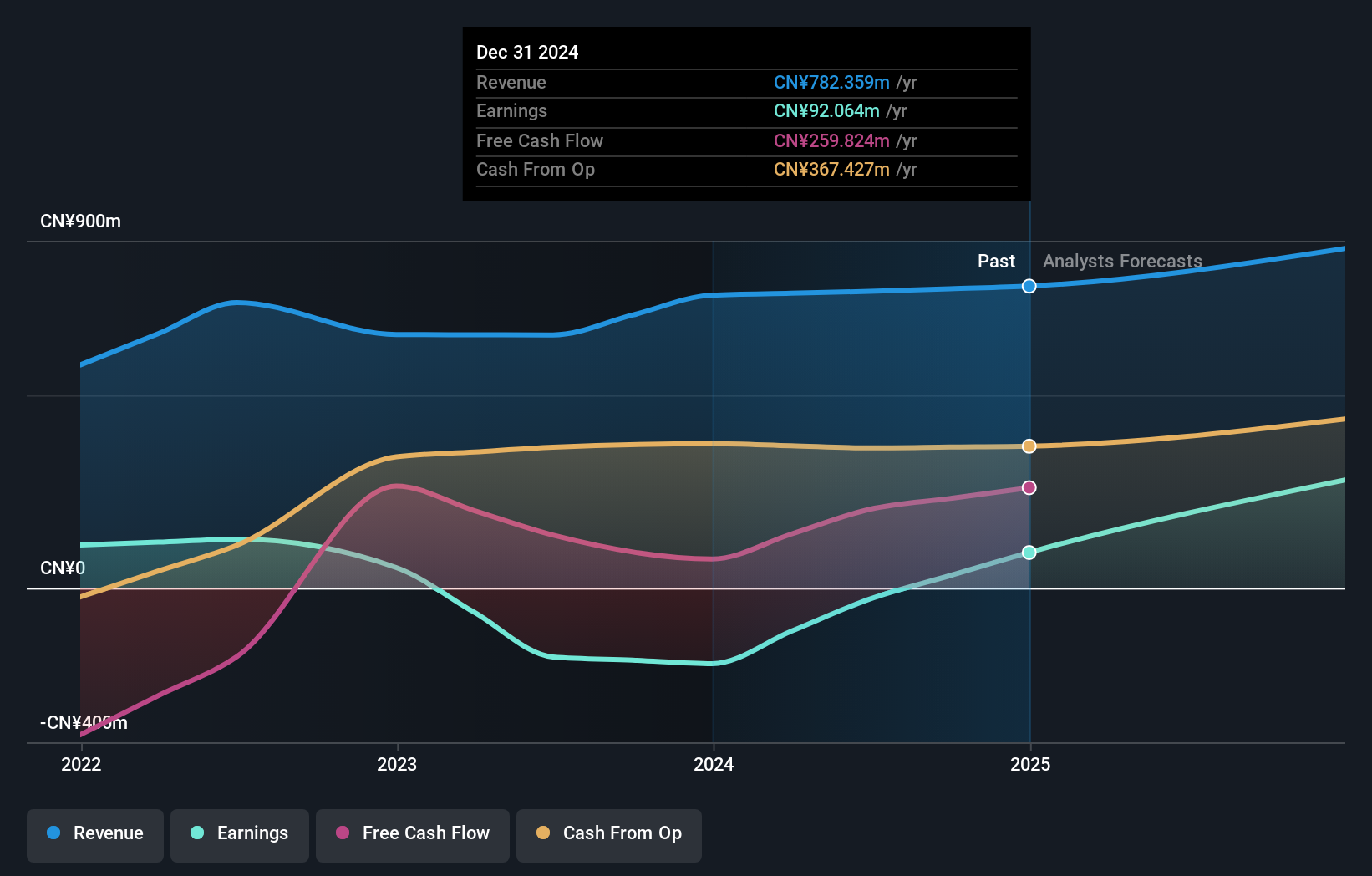

Cathay Group Holdings, amid a volatile market, showcases robust future growth potential with an expected revenue increase of 8.7% per year, outpacing the Hong Kong market's 7.8%. This tech firm is poised to transition from unprofitability to profitability within three years, reflecting an impressive forecasted annual earnings growth of 98.76%. Despite current challenges, the strategic shift in its principal business location to a key commercial hub in Causeway Bay as of January 2025 underscores a tactical move to bolster operations and client engagement. This relocation aligns with industry trends where prime positioning can significantly enhance corporate visibility and customer access in the competitive tech landscape.

- Take a closer look at Cathay Group Holdings' potential here in our health report.

Assess Cathay Group Holdings' past performance with our detailed historical performance reports.

Beijing LongRuan Technologies (SHSE:688078)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing LongRuan Technologies Inc. specializes in offering GIS-based software solutions and IT services tailored for the coal industry, with a market capitalization of CN¥2.95 billion.

Operations: The company generates revenue through its GIS-based software solutions and IT services specifically designed for the coal industry.

Beijing LongRuan Technologies, with a forecasted annual revenue growth of 24.6%, outstrips the Chinese market's average of 13.3%. This software company is also set to see its earnings surge by 34.2% annually, significantly higher than the broader market's 25.2%. Despite a challenging past year with earnings contraction, the firm's robust commitment to R&D—evidenced by substantial investment relative to revenue—positions it well for innovative breakthroughs and sustained competitive advantage in the fast-evolving tech landscape.

- Click here to discover the nuances of Beijing LongRuan Technologies with our detailed analytical health report.

Understand Beijing LongRuan Technologies' track record by examining our Past report.

dely (TSE:299A)

Simply Wall St Growth Rating: ★★★★★★

Overview: dely inc. is engaged in the planning, development, management, and operation of various smartphone applications and web media with a market capitalization of ¥46.60 billion.

Operations: The company's primary revenue stream is its Platform Business, generating ¥9.90 billion. With a focus on smartphone apps and web media, dely inc. leverages its expertise in digital platforms to drive growth within this segment.

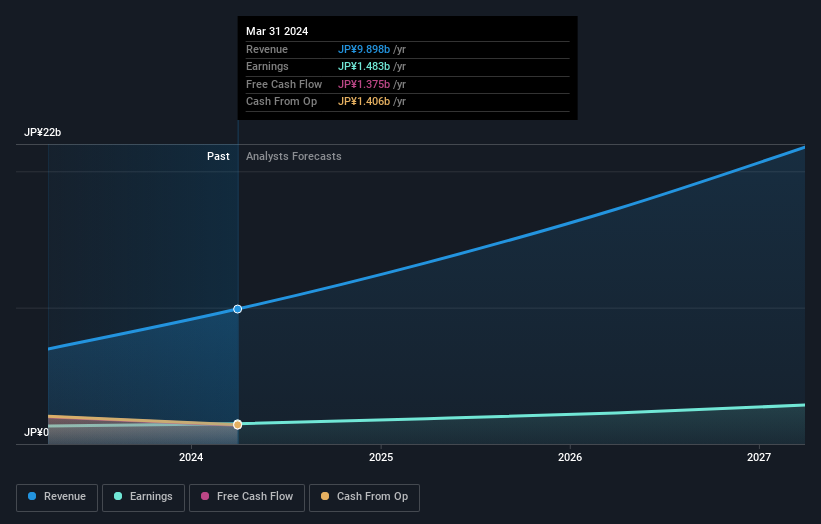

Dely Inc., following its recent IPO, has demonstrated robust financial dynamics, with a notable annual revenue growth forecast at 25.3% and earnings expected to surge by 21.3% per year. This performance is substantially above the Japanese market averages of 4.2% and 8%, respectively. The firm's aggressive investment in R&D, which stands at {rd_expense_string}, not only underscores its commitment to innovation but also aligns with industry shifts towards more sustainable and advanced tech solutions. These strategic moves could potentially enhance Dely's market position in a highly competitive sector, leveraging cutting-edge technology to meet evolving consumer demands.

- Get an in-depth perspective on dely's performance by reading our health report here.

Gain insights into dely's past trends and performance with our Past report.

Taking Advantage

- Access the full spectrum of 1206 High Growth Tech and AI Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1981

Cathay Group Holdings

An investment holding company, provides higher and vocational education services in Mainland China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026