- Japan

- /

- Tech Hardware

- /

- TSE:6736

Undiscovered Gems With Strong Fundamentals To Explore January 2025

Reviewed by Simply Wall St

As global markets reach new highs, buoyed by optimism surrounding potential trade deals and the burgeoning AI sector, small-cap stocks have lagged behind their larger counterparts. Despite this disparity, the current economic landscape presents unique opportunities for investors to explore stocks with robust fundamentals that may not yet be widely recognized. Identifying these undiscovered gems requires a focus on strong financial health and growth potential amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 0.96% | -9.28% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.85% | 71.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.30% | 18.80% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Center International GroupLtd | 27.06% | 1.89% | -39.77% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| Zhejiang E-P Equipment | 15.30% | 21.69% | 32.47% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Mobvista (SEHK:1860)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services essential for developing the mobile internet ecosystem globally, with a market cap of HK$11.35 billion.

Operations: Mobvista generates revenue primarily through its advertising and marketing technology services, focusing on the mobile internet ecosystem. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management.

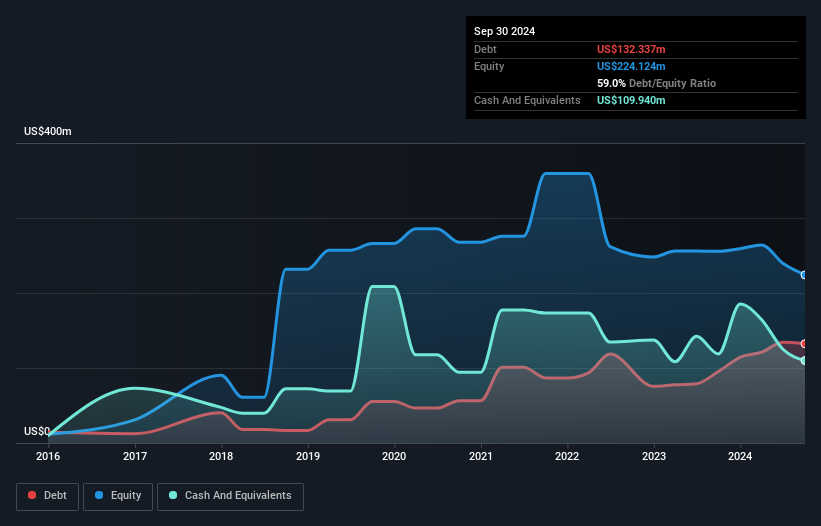

Mobvista's recent performance highlights its potential as an emerging player in the tech landscape. The company reported third-quarter sales of US$416 million, up from US$269 million the previous year, and net income rose to US$9.9 million from US$3.78 million. Basic earnings per share increased to US$0.0065 compared to US$0.0025 a year ago, reflecting strong operational growth despite a volatile share price over the past three months. Mobvista's debt-to-equity ratio has climbed from 20% to 59% over five years, suggesting increased leverage but with interest payments well covered by EBIT at 6.2 times coverage.

- Unlock comprehensive insights into our analysis of Mobvista stock in this health report.

Review our historical performance report to gain insights into Mobvista's's past performance.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Value Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market capitalization of approximately CN¥4.84 billion.

Operations: V V Food & Beverage Co., Ltd generates revenue primarily from the sale of food and beverage products in both domestic and international markets. The company has a market capitalization of approximately CN¥4.84 billion.

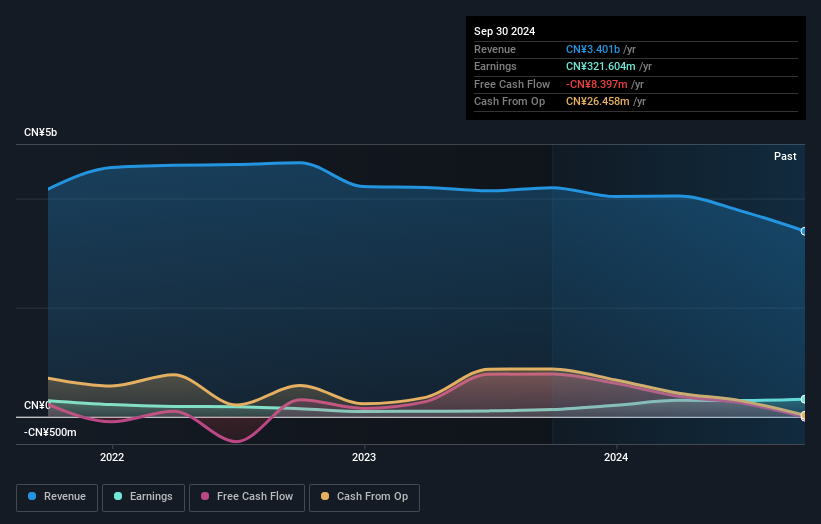

Earnings for V V Food & Beverage Ltd. surged by 146% over the past year, significantly outpacing the food industry's -6.3%. This growth is supported by a debt-to-equity ratio that has impressively decreased from 131.4% to 10.5% over five years, indicating stronger financial health. The company also benefits from having more cash than total debt, which suggests robust liquidity management. However, a notable one-off gain of CN¥149M impacted recent results, hinting at potential volatility in earnings quality. With a price-to-earnings ratio of 16x below the market average of 35x, it seems attractively valued within its sector context.

- Delve into the full analysis health report here for a deeper understanding of V V Food & BeverageLtd.

Assess V V Food & BeverageLtd's past performance with our detailed historical performance reports.

Sun (TSE:6736)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun Corporation operates in mobile data solutions, entertainment, and information technology sectors within Japan and has a market capitalization of ¥204.38 billion.

Operations: Sun Corporation's revenue primarily stems from its Entertainment Related Business, generating ¥6.94 billion, followed by the New IT Related Business at ¥3.27 billion. The Global Data Intelligence Business contributes ¥1.09 billion to the total revenue stream.

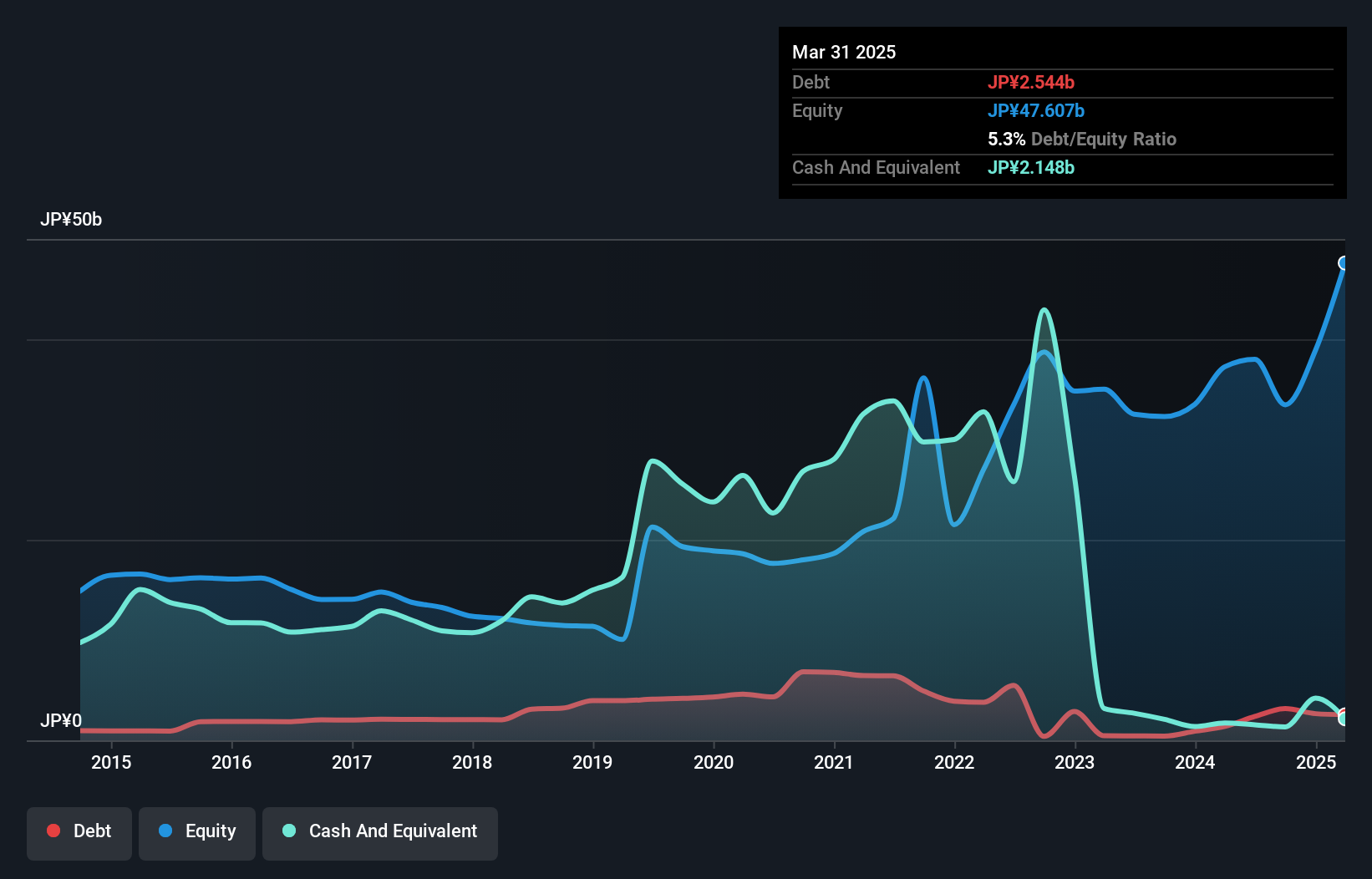

Sun Corporation, a tech player with a modest market cap, has recently turned profitable, marking a significant milestone. The company boasts high-quality earnings and its debt to equity ratio has impressively decreased from 21.6% to 9.5% over the past five years. Despite the lack of free cash flow positivity, Sun seems well-positioned financially with satisfactory net debt levels at 5.5%. Recent executive changes may influence strategic direction, while dividends remain steady at JPY 50 per share for Q2 FY2025. However, investors should be cautious of its volatile share price in recent months.

Key Takeaways

- Investigate our full lineup of 4668 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6736

Sun

Engages in the mobile data solutions, entertainment, information technology, and other businesses in Japan.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives