- Hong Kong

- /

- Entertainment

- /

- SEHK:136

Why Investors Shouldn't Be Surprised By China Ruyi Holdings Limited's (HKG:136) P/S

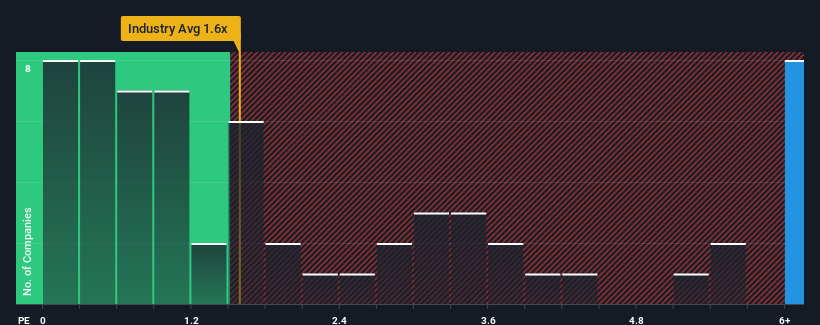

When you see that almost half of the companies in the Entertainment industry in Hong Kong have price-to-sales ratios (or "P/S") below 1.6x, China Ruyi Holdings Limited (HKG:136) looks to be giving off strong sell signals with its 11.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for China Ruyi Holdings

How Has China Ruyi Holdings Performed Recently?

China Ruyi Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Ruyi Holdings.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, China Ruyi Holdings would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.5%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 152% as estimated by the two analysts watching the company. With the industry only predicted to deliver 47%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why China Ruyi Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From China Ruyi Holdings' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into China Ruyi Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for China Ruyi Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Solid track record and good value.

Market Insights

Community Narratives