The CEO of SK Target Group Limited (HKG:8427) is Swee Loh, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for SK Target Group

How Does Total Compensation For Swee Loh Compare With Other Companies In The Industry?

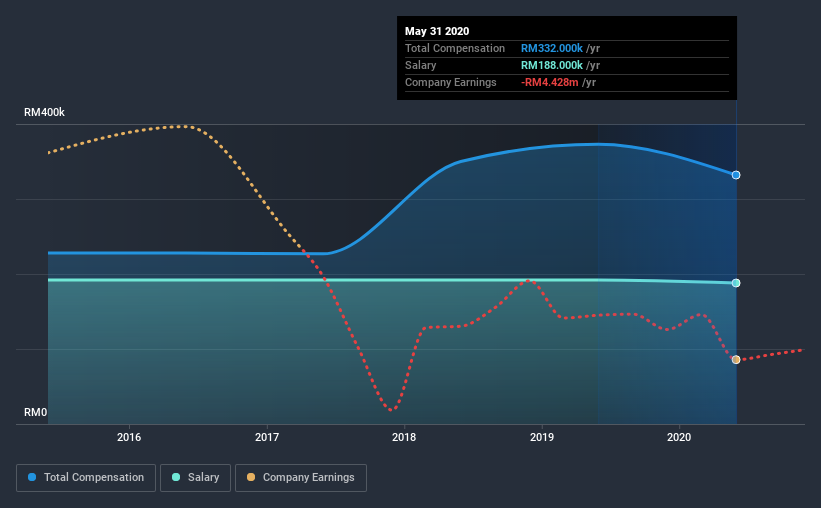

At the time of writing, our data shows that SK Target Group Limited has a market capitalization of HK$44m, and reported total annual CEO compensation of RM332k for the year to May 2020. That's a notable decrease of 11% on last year. In particular, the salary of RM188.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was RM418k. So it looks like SK Target Group compensates Swee Loh in line with the median for the industry. Furthermore, Swee Loh directly owns HK$19m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM188k | RM192k | 57% |

| Other | RM144k | RM181k | 43% |

| Total Compensation | RM332k | RM373k | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. SK Target Group pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at SK Target Group Limited's Growth Numbers

SK Target Group Limited's earnings per share (EPS) grew 9.2% per year over the last three years. Its revenue is down 28% over the previous year.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has SK Target Group Limited Been A Good Investment?

Given the total shareholder loss of 72% over three years, many shareholders in SK Target Group Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As previously discussed, Swee is compensated close to the median for companies of its size, and which belong to the same industry. But with negative shareholder returns and unimpressive EPS growth, shareholders will surely be disturbed. We'd stop short of saying CEO compensation is inappropriate, but without an improvement in performance, it's sure to draw criticism. Shareholders will also not want to see performance improving before agreeing to any raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for SK Target Group you should be aware of, and 2 of them can't be ignored.

Switching gears from SK Target Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade SK Target Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WS-SK Target Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8427

WS-SK Target Group

An investment holding company, manufactures and trades in precast concrete junction boxes in Malaysia, China, and Hong Kong.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)