- Hong Kong

- /

- Metals and Mining

- /

- SEHK:661

Can China Daye Non-Ferrous Metals Mining (HKG:661) Continue To Grow Its Returns On Capital?

What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Speaking of which, we noticed some great changes in China Daye Non-Ferrous Metals Mining's (HKG:661) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

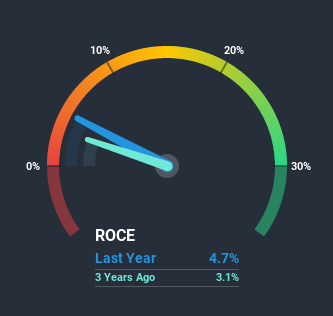

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for China Daye Non-Ferrous Metals Mining, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.047 = CN¥400m ÷ (CN¥17b - CN¥8.2b) (Based on the trailing twelve months to June 2020).

So, China Daye Non-Ferrous Metals Mining has an ROCE of 4.7%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 7.5%.

Check out our latest analysis for China Daye Non-Ferrous Metals Mining

Historical performance is a great place to start when researching a stock so above you can see the gauge for China Daye Non-Ferrous Metals Mining's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of China Daye Non-Ferrous Metals Mining, check out these free graphs here.

What Does the ROCE Trend For China Daye Non-Ferrous Metals Mining Tell Us?

Even though ROCE is still low in absolute terms, it's good to see it's heading in the right direction. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 243% in that same time. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

On a separate but related note, it's important to know that China Daye Non-Ferrous Metals Mining has a current liabilities to total assets ratio of 49%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.What We Can Learn From China Daye Non-Ferrous Metals Mining's ROCE

To bring it all together, China Daye Non-Ferrous Metals Mining has done well to increase the returns it's generating from its capital employed. Astute investors may have an opportunity here because the stock has declined 41% in the last five years. With that in mind, we believe the promising trends warrant this stock for further investigation.

On a final note, we found 3 warning signs for China Daye Non-Ferrous Metals Mining (1 is potentially serious) you should be aware of.

While China Daye Non-Ferrous Metals Mining may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade China Daye Non-Ferrous Metals Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:661

China Daye Non-Ferrous Metals Mining

An investment holding company, engages in the mining and processing of mineral ores in China, Hong Kong, Kyrgyzstan, and the Republic of Mongolia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.