Here's Why We Think Fufeng Group (HKG:546) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Fufeng Group (HKG:546). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fufeng Group with the means to add long-term value to shareholders.

See our latest analysis for Fufeng Group

Fufeng Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Fufeng Group has grown EPS by 8.4% per year. That's a good rate of growth, if it can be sustained.

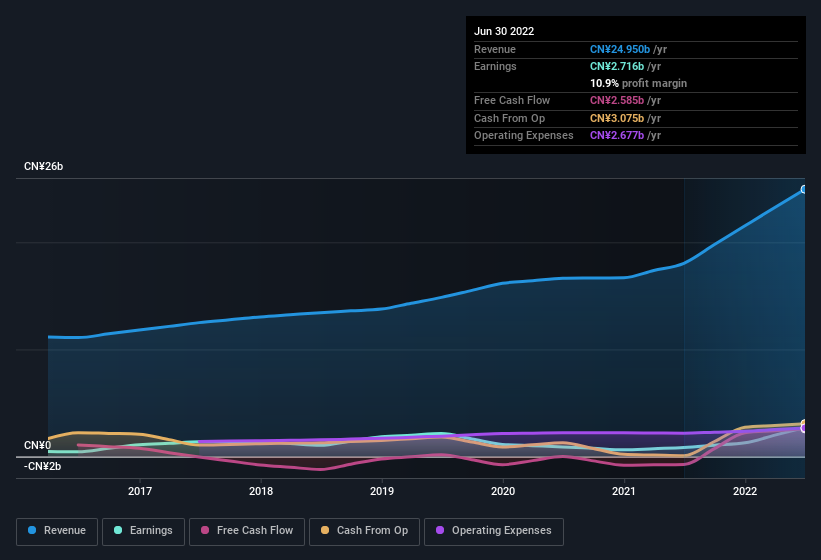

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Fufeng Group shareholders can take confidence from the fact that EBIT margins are up from 6.4% to 13%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Fufeng Group's future EPS 100% free.

Are Fufeng Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Fufeng Group is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Principal Founder & Executive Chairman Xuechun Li paid HK$3.5m, for stock at HK$3.47 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

On top of the insider buying, we can also see that Fufeng Group insiders own a large chunk of the company. Owning 41% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling CN¥5.2b. That level of investment from insiders is nothing to sneeze at.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Deheng Li, is paid less than the median for similar sized companies. For companies with market capitalisations between CN¥6.9b and CN¥22b, like Fufeng Group, the median CEO pay is around CN¥4.2m.

The CEO of Fufeng Group only received CN¥1.7m in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Fufeng Group Worth Keeping An Eye On?

One positive for Fufeng Group is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that Fufeng Group is showing 1 warning sign in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Fufeng Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additives, and biochemical and starch-based products in the People’s Republic of China and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion