Earnings Release: Here's Why Analysts Cut Their Fufeng Group Limited (HKG:546) Price Target To HK$6.16

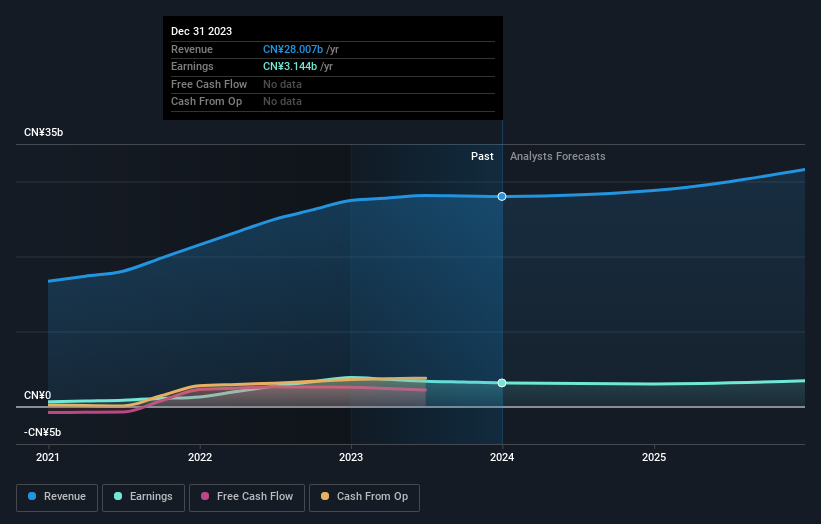

It's been a good week for Fufeng Group Limited (HKG:546) shareholders, because the company has just released its latest annual results, and the shares gained 2.0% to HK$5.07. Results were roughly in line with estimates, with revenues of CN¥28b and statutory earnings per share of CN¥1.24. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Fufeng Group

Taking into account the latest results, the most recent consensus for Fufeng Group from dual analysts is for revenues of CN¥28.8b in 2024. If met, it would imply a reasonable 2.8% increase on its revenue over the past 12 months. Statutory earnings per share are forecast to shrink 4.6% to CN¥1.19 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥29.1b and earnings per share (EPS) of CN¥1.48 in 2024. So there's definitely been a decline in sentiment after the latest results, noting the real cut to new EPS forecasts.

The average price target fell 6.9% to HK$6.16, with reduced earnings forecasts clearly tied to a lower valuation estimate.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Fufeng Group's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 2.8% growth on an annualised basis. This is compared to a historical growth rate of 16% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 8.6% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Fufeng Group.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Fufeng Group. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Fufeng Group's revenue is expected to perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Fufeng Group. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Fufeng Group going out as far as 2025, and you can see them free on our platform here.

It is also worth noting that we have found 1 warning sign for Fufeng Group that you need to take into consideration.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additives, and biochemical and starch-based products in the People’s Republic of China and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026