- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3833

Is Now The Time To Put Xinjiang Xinxin Mining Industry (HKG:3833) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Xinjiang Xinxin Mining Industry (HKG:3833). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Xinjiang Xinxin Mining Industry

Xinjiang Xinxin Mining Industry's Improving Profits

In the last three years Xinjiang Xinxin Mining Industry's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Xinjiang Xinxin Mining Industry's EPS catapulted from CN¥0.20 to CN¥0.40, over the last year. It's not often a company can achieve year-on-year growth of 101%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Xinjiang Xinxin Mining Industry's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Xinjiang Xinxin Mining Industry shareholders can take confidence from the fact that EBIT margins are up from 23% to 33%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

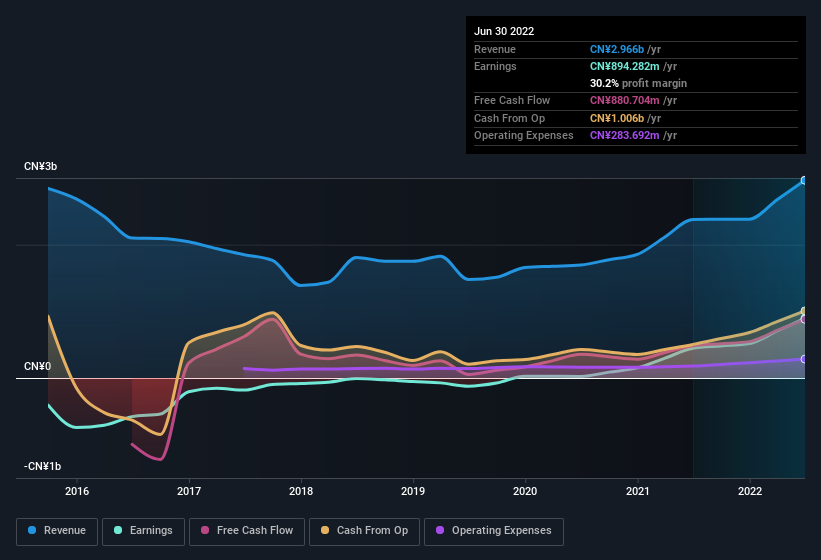

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Xinjiang Xinxin Mining Industry isn't a huge company, given its market capitalisation of HK$2.2b. That makes it extra important to check on its balance sheet strength.

Are Xinjiang Xinxin Mining Industry Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Xinjiang Xinxin Mining Industry followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CN¥280m. This considerable investment should help drive long-term value in the business. Those holdings account for over 13% of the company; visible skin in the game.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Xinjiang Xinxin Mining Industry, with market caps between CN¥718m and CN¥2.9b, is around CN¥2.2m.

The CEO of Xinjiang Xinxin Mining Industry only received CN¥630k in total compensation for the year ending December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Xinjiang Xinxin Mining Industry Deserve A Spot On Your Watchlist?

Xinjiang Xinxin Mining Industry's earnings per share have been soaring, with growth rates sky high. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Xinjiang Xinxin Mining Industry is worth considering carefully. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Xinjiang Xinxin Mining Industry's ROE with industry peers (and the market at large).

Although Xinjiang Xinxin Mining Industry certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3833

Xinjiang Xinxin Mining Industry

Engages in mining, ore processing, smelting, refining, and selling of nickel, copper, and other nonferrous metals.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026