Earnings Miss: Huabao International Holdings Limited Missed EPS By 36% And Analysts Are Revising Their Forecasts

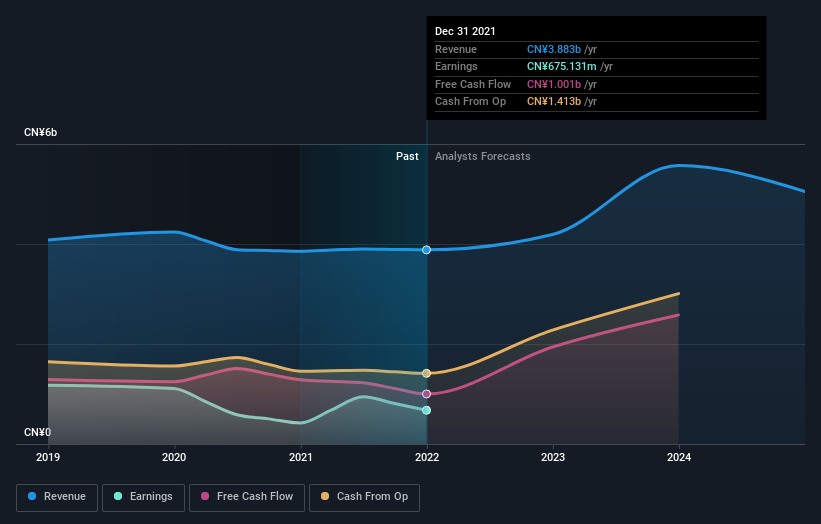

Huabao International Holdings Limited (HKG:336) missed earnings with its latest annual results, disappointing overly-optimistic forecasters. It looks like quite a negative result overall, with both revenues and earnings falling well short of analyst predictions. Revenues of CN¥3.9b missed by 12%, and statutory earnings per share of CN¥0.22 fell short of forecasts by 36%. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Huabao International Holdings

Taking into account the latest results, the current consensus from Huabao International Holdings' twin analysts is for revenues of CN¥4.19b in 2022, which would reflect a reasonable 7.9% increase on its sales over the past 12 months. Statutory earnings per share are predicted to rise 3.8% to CN¥0.22. Before this earnings report, the analysts had been forecasting revenues of CN¥5.33b and earnings per share (EPS) of CN¥0.46 in 2022. It looks like sentiment has declined substantially in the aftermath of these results, with a large cut to revenue estimates and a large cut to earnings per share numbers as well.

The average price target climbed 21% to HK$6.50despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Huabao International Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 7.9% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 2.8% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 3.2% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Huabao International Holdings is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. They also downgraded their revenue estimates, although industry data suggests that Huabao International Holdings' revenues are expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Huabao International Holdings going out as far as 2024, and you can see them free on our platform here.

Before you take the next step you should know about the 3 warning signs for Huabao International Holdings (1 is potentially serious!) that we have uncovered.

Valuation is complex, but we're here to simplify it.

Discover if Huabao International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:336

Huabao International Holdings

An investment holding company, researches, develops, produces, distributes, and sells flavours, fragrances, food ingredients, tobacco and aroma raw materials, and condiment products primarily in the People’s Republic of China.

Flawless balance sheet low.

Market Insights

Community Narratives