- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2899

Shareholders May Not Be So Generous With Zijin Mining Group Company Limited's (HKG:2899) CEO Compensation And Here's Why

Key Insights

- Zijin Mining Group's Annual General Meeting to take place on 17th of May

- CEO Laichang Zou's total compensation includes salary of CN¥3.00m

- Total compensation is 150% above industry average

- Zijin Mining Group's EPS grew by 40% over the past three years while total shareholder return over the past three years was 65%

Performance at Zijin Mining Group Company Limited (HKG:2899) has been reasonably good and CEO Laichang Zou has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 17th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Zijin Mining Group

How Does Total Compensation For Laichang Zou Compare With Other Companies In The Industry?

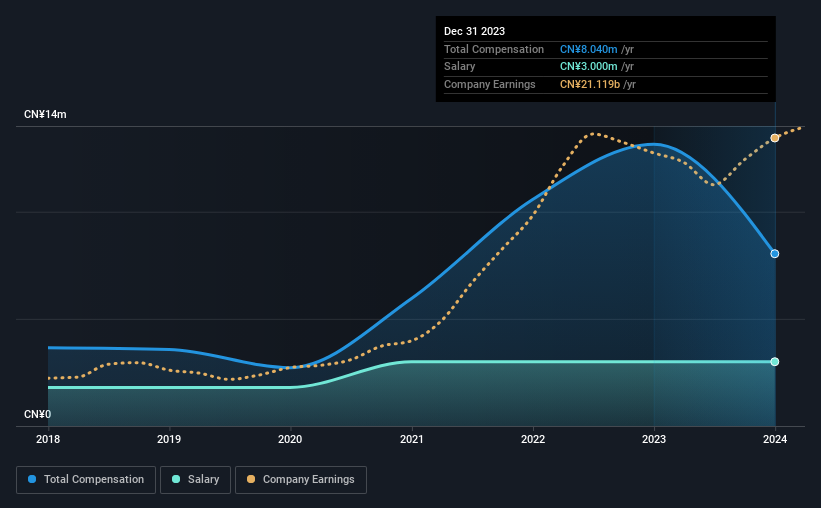

At the time of writing, our data shows that Zijin Mining Group Company Limited has a market capitalization of HK$510b, and reported total annual CEO compensation of CN¥8.0m for the year to December 2023. We note that's a decrease of 39% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥3.0m.

For comparison, other companies in the Hong Kong Metals and Mining industry with market capitalizations above HK$63b, reported a median total CEO compensation of CN¥3.2m. Hence, we can conclude that Laichang Zou is remunerated higher than the industry median. What's more, Laichang Zou holds HK$53m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥3.0m | CN¥3.0m | 37% |

| Other | CN¥5.0m | CN¥10m | 63% |

| Total Compensation | CN¥8.0m | CN¥13m | 100% |

On an industry level, around 88% of total compensation represents salary and 12% is other remuneration. In Zijin Mining Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Zijin Mining Group Company Limited's Growth Numbers

Zijin Mining Group Company Limited has seen its earnings per share (EPS) increase by 40% a year over the past three years. Its revenue is up 4.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Zijin Mining Group Company Limited Been A Good Investment?

We think that the total shareholder return of 65%, over three years, would leave most Zijin Mining Group Company Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Zijin Mining Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zijin Mining Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2899

Zijin Mining Group

Engages in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources in Mainland China and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)