- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2689

Nine Dragons Paper (SEHK:2689) Valuation in Focus After Board Appointment of Governance Expert Sun Po Yuen

Reviewed by Simply Wall St

Nine Dragons Paper (Holdings) (SEHK:2689) announced the appointment of Mr. Sun Po Yuen as an independent non-executive director, effective October 16, 2025. His extensive governance and accounting background could attract fresh attention from investors focusing on board strength and oversight.

See our latest analysis for Nine Dragons Paper (Holdings).

After an impressive year-to-date share price return of 78.46%, Nine Dragons Paper (Holdings) has shown strong momentum, further bolstered by recent board-level changes. While the 1-year total return stands at 60.87%, results over the past five years highlight how important renewed confidence and strategic direction can be for shareholders.

If improved governance is on your radar, it may be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership.

With so much positive momentum and new governance expertise added to the board, investors may ask whether Nine Dragons Paper is still trading at a discount or if the market is already factoring in anticipated future gains.

Price-to-Earnings of 13.5x: Is it justified?

At the last close price of HK$5.55, Nine Dragons Paper (Holdings) trades on a price-to-earnings (P/E) ratio of 13.5x, putting it well under the industry average and close to its statistically-calculated fair value multiple. This suggests the market may not be fully recognizing the company’s improved profit performance.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For Nine Dragons, a P/E of 13.5x means investors pay HK$13.50 for every HK$1 of annual net income. This metric is especially relevant for established manufacturing businesses where consistent earnings drive valuation.

Relative to the Asian Forestry industry’s average P/E of 18.8x, Nine Dragons appears cheaper on this key metric. This could signal a discount or potential underappreciation for its rapid earnings rebound and more favorable profit margins. Compared to its estimated fair P/E of 14.4x, the current multiple is also attractive, reflecting room for sentiment to improve further.

Explore the SWS fair ratio for Nine Dragons Paper (Holdings)

Result: Price-to-Earnings of 13.5x (UNDERVALUED)

However, slowing revenue growth and unpredictable sector headwinds could still dampen the outlook. This underscores the need for careful monitoring ahead.

Find out about the key risks to this Nine Dragons Paper (Holdings) narrative.

Another View: What Does Our DCF Model Say?

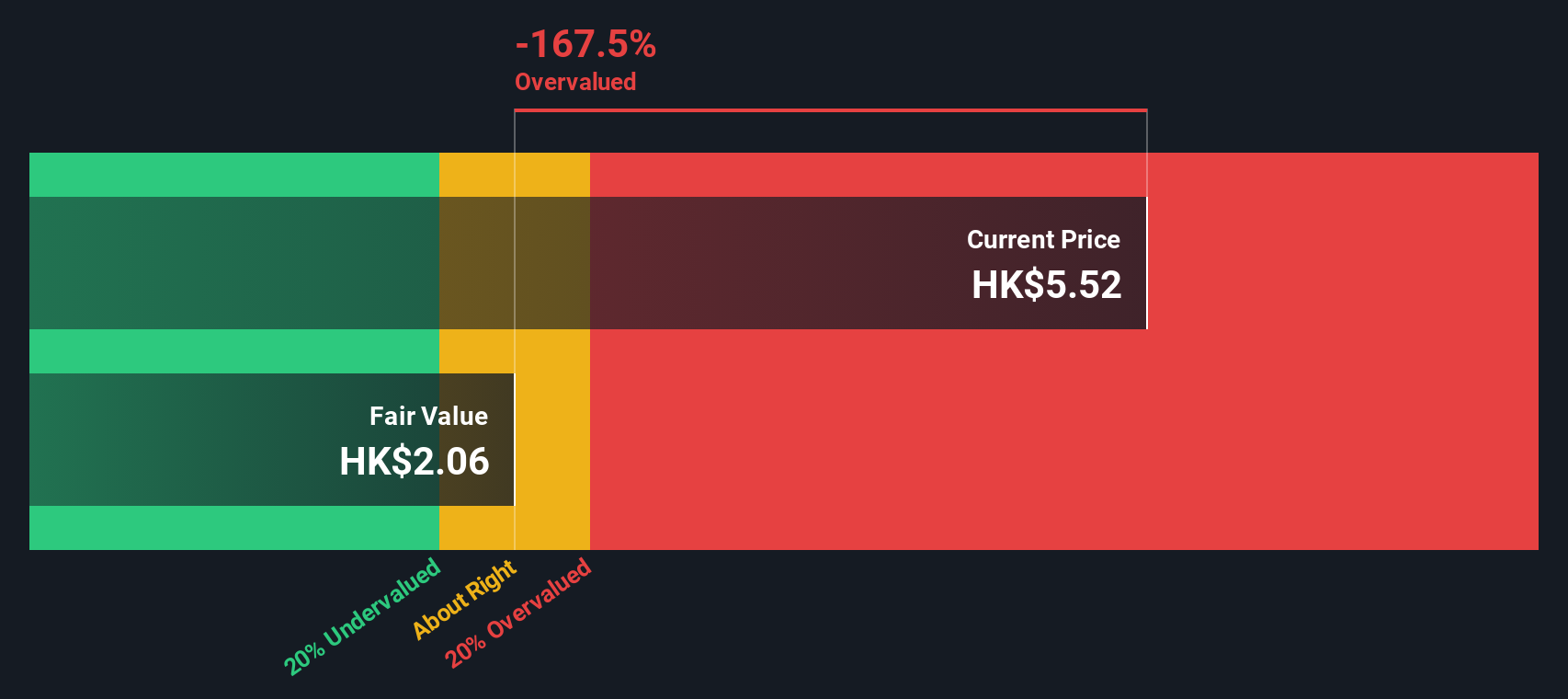

While the price-to-earnings multiple makes Nine Dragons Paper look attractively valued, our SWS DCF model tells a more cautious story. At HK$5.55, the share price is actually trading above our estimate of fair value. This suggests the market could be a bit too optimistic right now. Does this mean the current rally has outpaced the company's underlying long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nine Dragons Paper (Holdings) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nine Dragons Paper (Holdings) Narrative

If you have a different perspective or would rather dive into the numbers yourself, you can craft your own view quickly and easily. Do it your way.

A great starting point for your Nine Dragons Paper (Holdings) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Expand your edge and seize compelling growth opportunities before the crowd does by using the Simply Wall Street Screener today. You owe it to your portfolio not to miss these hot ideas.

- Catch the momentum with these 876 undervalued stocks based on cash flows, which are priced well below their worth and offer a potential entry point for value investing.

- Tap into the income potential of these 17 dividend stocks with yields > 3%, featuring companies rewarding shareholders with steady dividends above 3%.

- Get ahead of the next tech wave with these 27 quantum computing stocks as these companies make early moves in quantum computing and shape tomorrow’s breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nine Dragons Paper (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2689

Nine Dragons Paper (Holdings)

Manufactures and sells packaging paper, printing and writing paper, and specialty paper products and pulp in the People’s Republic of China.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives