- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2314

Many Still Looking Away From Lee & Man Paper Manufacturing Limited (HKG:2314)

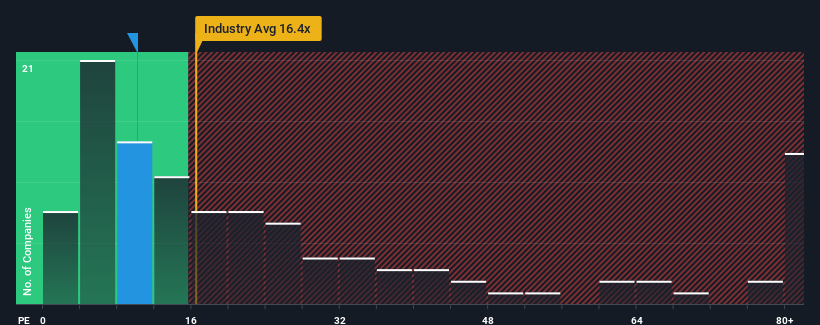

It's not a stretch to say that Lee & Man Paper Manufacturing Limited's (HKG:2314) price-to-earnings (or "P/E") ratio of 10.1x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Lee & Man Paper Manufacturing's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Lee & Man Paper Manufacturing

Is There Some Growth For Lee & Man Paper Manufacturing?

There's an inherent assumption that a company should be matching the market for P/E ratios like Lee & Man Paper Manufacturing's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. As a result, earnings from three years ago have also fallen 70% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14% per year, which is noticeably less attractive.

With this information, we find it interesting that Lee & Man Paper Manufacturing is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Lee & Man Paper Manufacturing's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Lee & Man Paper Manufacturing's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lee & Man Paper Manufacturing (at least 1 which is significant), and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2314

Lee & Man Paper Manufacturing

Engages in the manufacture and trading of packaging papers, pulps, and tissue papers in the People’s Republic of China, Vietnam, Malaysia, Macau, and Hong Kong.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives