- Hong Kong

- /

- Basic Materials

- /

- SEHK:2212

Revenues Tell The Story For Future Bright Mining Holdings Limited (HKG:2212) As Its Stock Soars 26%

Future Bright Mining Holdings Limited (HKG:2212) shares have continued their recent momentum with a 26% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

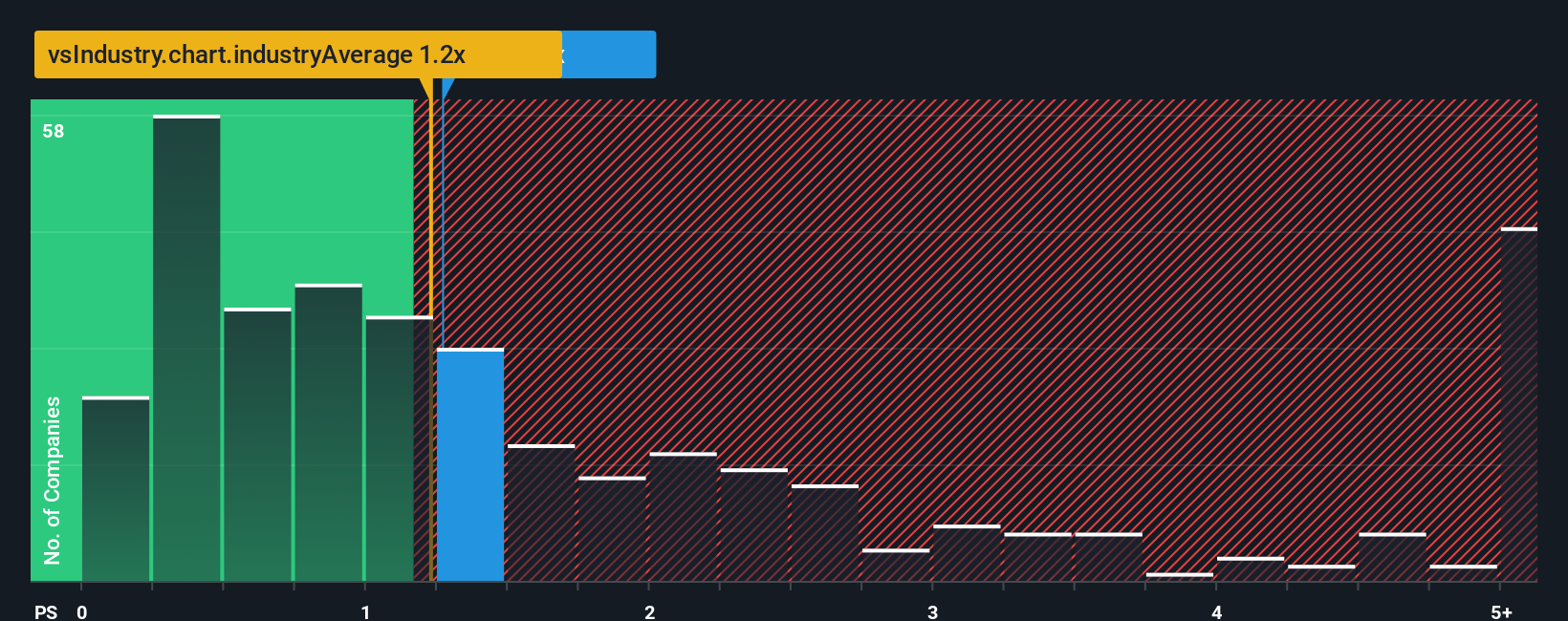

Following the firm bounce in price, when almost half of the companies in Hong Kong's Basic Materials industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Future Bright Mining Holdings as a stock probably not worth researching with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Future Bright Mining Holdings

What Does Future Bright Mining Holdings' Recent Performance Look Like?

Future Bright Mining Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Future Bright Mining Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Future Bright Mining Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an excellent 291% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 4.0%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Future Bright Mining Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Future Bright Mining Holdings' P/S?

Future Bright Mining Holdings' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Future Bright Mining Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Future Bright Mining Holdings you should be aware of, and 2 of them are potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2212

Future Bright Mining Holdings

An investment holding company, engages in the excavation and sale of marble blocks in Mainland China.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives