High Insider Ownership Growth Stocks In Asian Markets March 2025

Reviewed by Simply Wall St

As global markets face challenges such as regulatory uncertainties and trade tensions, Asian markets are navigating these complexities with resilience. Amidst this backdrop, growth companies in Asia with high insider ownership can offer unique insights into potential stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.2% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| Gudeng Precision Industrial (TPEX:3680) | 30.8% | 33% |

| M31 Technology (TPEX:6643) | 27.2% | 71% |

| WinWay Technology (TWSE:6515) | 22.6% | 32.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| BIWIN Storage Technology (SHSE:688525) | 18.9% | 88.8% |

| giftee (TSE:4449) | 34.3% | 69.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Below we spotlight a couple of our favorites from our exclusive screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. operates in the research, development, production, and marketing of edible bird’s nest products in China with a market cap of HK$3.31 billion.

Operations: The company's revenue is derived from sales to online distributors (CN¥21.07 million), offline distributors (CN¥508.94 million), direct sales to online customers (CN¥907.52 million), direct sales to offline customers (CN¥344.32 million), and direct sales to e-commerce platforms (CN¥290.51 million).

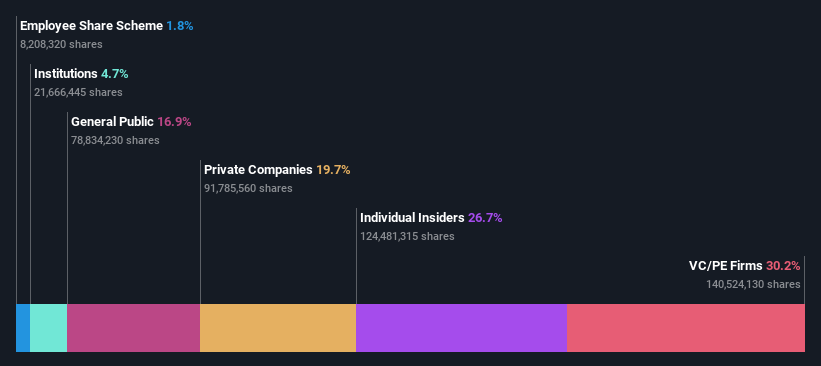

Insider Ownership: 26.7%

Xiamen Yan Palace Bird's Nest Industry is experiencing a strategic shift with high insider ownership, focusing on brand enhancement and supply chain expansion. Despite a forecasted annual revenue growth of 13.1%, recent guidance indicates a net profit decline due to increased branding costs and new factory expenses. However, earnings are expected to grow at 15.87% annually, surpassing the Hong Kong market average. The company maintains a high Return on Equity forecast of 24.2%, indicating strong future performance potential despite current challenges.

- Get an in-depth perspective on Xiamen Yan Palace Bird's Nest Industry's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Xiamen Yan Palace Bird's Nest Industry is trading beyond its estimated value.

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

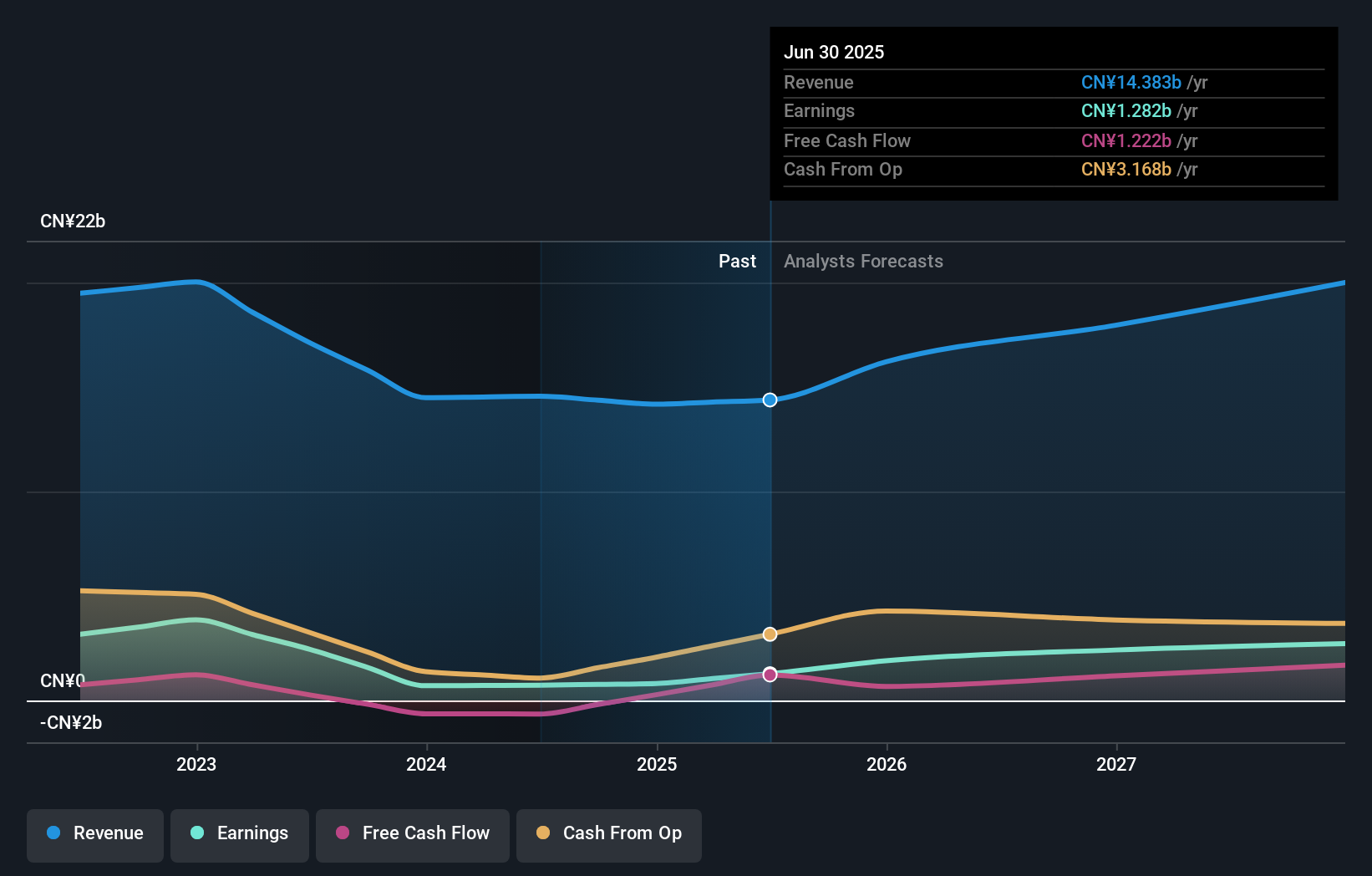

Overview: Dongyue Group Limited is an investment holding company that operates in the manufacturing, distribution, and sale of polymers, organic silicone, refrigerants, dichloromethane, PVC, liquid alkali, and other products both in China and internationally with a market cap of approximately HK$14.68 billion.

Operations: The company's revenue segments include CN¥4.31 billion from polymers, CN¥5.53 billion from refrigerants, CN¥5.12 billion from organic silicon, and CN¥1.12 billion from dichloromethane PVC and liquid alkali.

Insider Ownership: 15.4%

Dongyue Group's high insider ownership aligns with its robust growth trajectory, as earnings are projected to grow significantly at 41% annually, outpacing the Hong Kong market. While revenue is expected to increase by 8.8% per year, slightly above the market average, profit margins have declined from last year. Despite a low Return on Equity forecast of 11.7%, the company's strong earnings growth potential positions it well for future expansion within Asia's competitive landscape.

- Click to explore a detailed breakdown of our findings in Dongyue Group's earnings growth report.

- According our valuation report, there's an indication that Dongyue Group's share price might be on the expensive side.

Tongqinglou Catering (SHSE:605108)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China with a market cap of CN¥5.58 billion.

Operations: Tongqinglou Catering Co., Ltd. generates its revenue primarily from providing catering services in China.

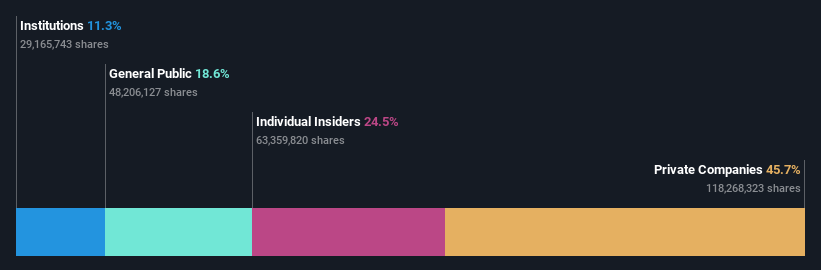

Insider Ownership: 24.5%

Tongqinglou Catering's strong insider ownership supports its growth potential, with earnings projected to grow significantly at 44.9% annually, surpassing the China market average. Despite a low future Return on Equity of 13.9%, the company trades at a substantial discount to estimated fair value and is considered good relative value compared to peers. Revenue growth of 19.6% per year is expected, though it remains below the high-growth threshold but above market averages.

- Take a closer look at Tongqinglou Catering's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Tongqinglou Catering's current price could be quite moderate.

Where To Now?

- Embark on your investment journey to our 648 Fast Growing Asian Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Dongyue Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:189

Dongyue Group

An investment holding company, manufactures, distributes, and sells polymers, organic silicone, refrigerants, dichloromethane, polyvinyl chloride (PVC), liquid alkali, and other products in the People's Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.