- Hong Kong

- /

- Basic Materials

- /

- SEHK:1313

China Resources Cement (SEHK:1313) One-Off CN¥257.5m Loss Challenges Earnings Recovery Narrative

Reviewed by Simply Wall St

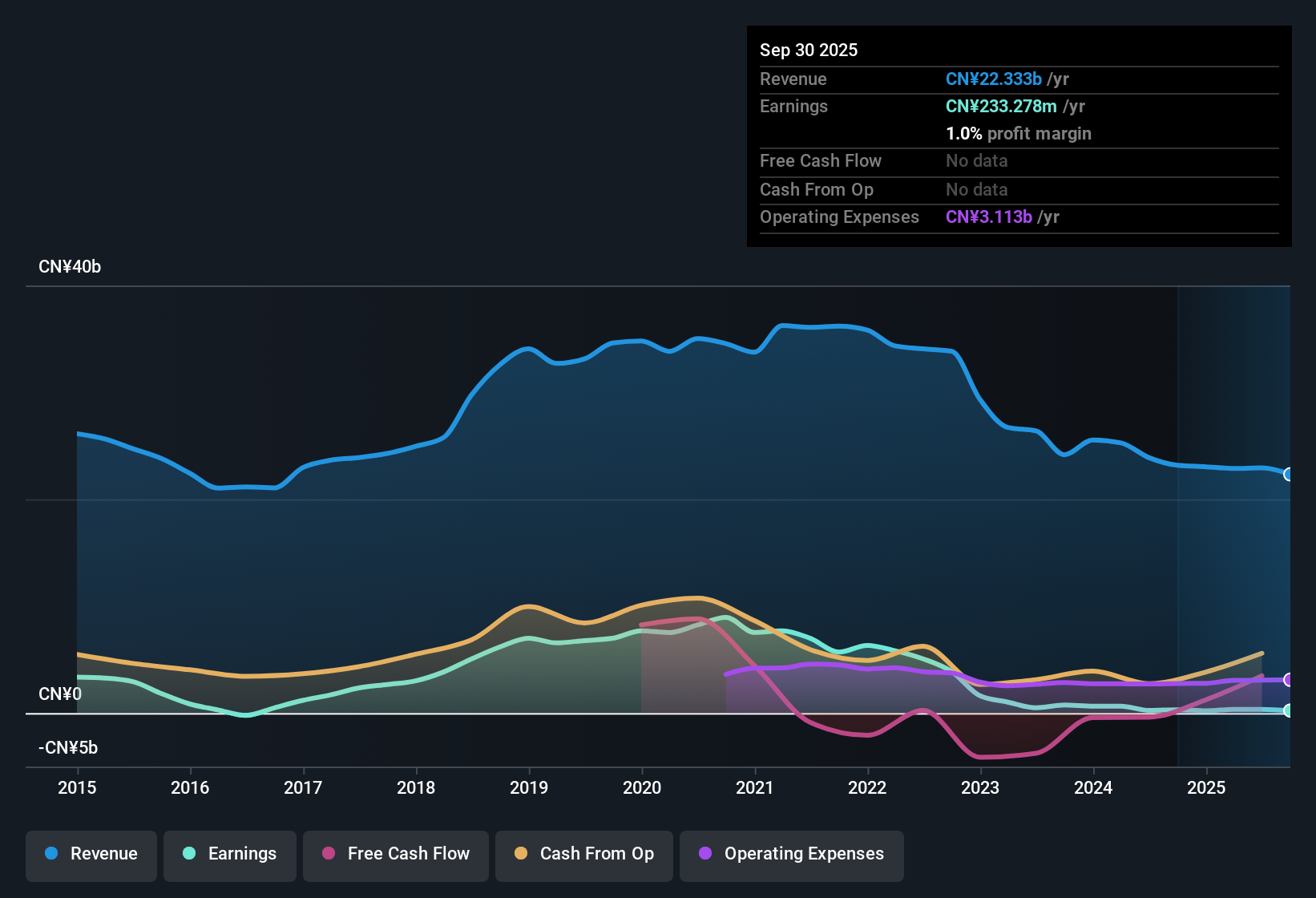

China Resources Building Materials Technology Holdings (SEHK:1313) reported a one-off loss of CN¥257.5 million over the twelve months to 30th September 2025, which dragged its net profit margin down to 1%, compared to 1.4% last year. Over the last five years, earnings have declined at an average rate of 60.9% per year, with earnings growth turning negative in the latest period. This has pushed recent performance far below its longer-term trends. Despite these setbacks, analyst forecasts point toward annual earnings growth of 41.8% over the next three years, offering some optimism for investors focused on future rebound potential.

See our full analysis for China Resources Building Materials Technology Holdings.Next, we will see how these earnings results stack up against the most widely discussed market narratives, giving a clearer picture of where consensus might be right or due for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slips to 1% After One-Off Loss

- The company’s net profit margin dropped to 1%, below last year’s 1.4%, following a one-off CN¥257.5 million loss that weighed on operational profitability even further.

- Forecasts expect profit to rebound sharply. Analysts see annual earnings rising 41.8% over the next three years, which challenges the narrative that one-off costs and margin compression truly define the future. Instead, forecasts point to

- Faster expected profit growth than the Hong Kong market, with company forecasts at 41.8% per year versus 12.3% per year for the broader market.

- These optimistic projections create a high bar for the anticipated turnaround, especially since profit margins are starting from such a low baseline.

Revenue Growth Lags Behind Sector Trends

- Annual revenue is expected to increase by just 3.9% per year, an underperformance when compared to the broader market’s average growth of 8.6% per year in Hong Kong.

- Anticipated profit growth depends heavily on cost control, given that top-line sales are not keeping pace. This raises two critical discussion points:

- The slow revenue trajectory means that margin expansion and cost management must drive future earnings gains rather than robust sales growth alone.

- This gap creates tension with sector narratives around recovery, implying the company may benefit less from demand rebounds than peers whose top-line growth is stronger.

Shares Priced at a Steep Premium

- With a price-to-earnings ratio of 48.8x, the stock trades more than three times the average for Asian Basic Materials companies (15.4x) and well above peers (14.7x). This suggests a premium that may reflect growth expectations rather than recent performance.

- These elevated valuation levels heighten risk for investors if promised earnings growth fails to materialize. The current share price of HK$1.78 is also above the DCF fair value of HK$1.46 and below the analyst price target of HK$2.17, making the following considerations important:

- Any shortfall in the projected turnaround could sharply challenge market optimism, making the gap between price, underlying fundamentals, and sector multiples even more critical to watch.

- Valuation risks stand out more given ongoing concerns about structural sector weakness, including continued headwinds in construction demand and legacy losses still flowing through financial results.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Resources Building Materials Technology Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

China Resources Building Materials faces sluggish revenue growth, thin profit margins, and premium valuation risks. These factors leave little margin for error if the turnaround falters.

If you want steadier performance, focus on stable growth stocks screener (2095 results) to find companies with a track record of consistent growth and reliable fundamentals through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1313

China Resources Building Materials Technology Holdings

An investment holding company, manufactures and sells cement, concrete, aggregates, and related products and services in Mainland China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion