- Hong Kong

- /

- Basic Materials

- /

- SEHK:1313

China Resources Building Materials Technology Holdings Limited (HKG:1313) Stocks Shoot Up 32% But Its P/E Still Looks Reasonable

China Resources Building Materials Technology Holdings Limited (HKG:1313) shares have continued their recent momentum with a 32% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

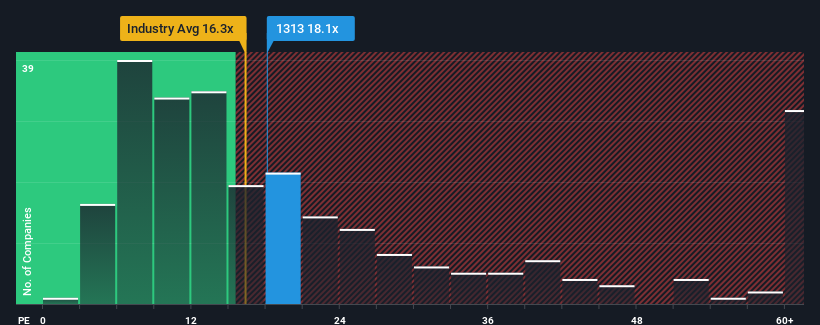

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider China Resources Building Materials Technology Holdings as a stock to avoid entirely with its 18.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

China Resources Building Materials Technology Holdings could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for China Resources Building Materials Technology Holdings

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like China Resources Building Materials Technology Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. The last three years don't look nice either as the company has shrunk EPS by 92% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 25% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 16% per year, which is noticeably less attractive.

In light of this, it's understandable that China Resources Building Materials Technology Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From China Resources Building Materials Technology Holdings' P/E?

China Resources Building Materials Technology Holdings' P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China Resources Building Materials Technology Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with China Resources Building Materials Technology Holdings.

Of course, you might also be able to find a better stock than China Resources Building Materials Technology Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1313

China Resources Building Materials Technology Holdings

An investment holding company, manufactures and sells cement, concrete, aggregates, and related products and services in Mainland China.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026