- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1266

Xiwang Special Steel Company Limited's (HKG:1266) CEO Compensation Looks Acceptable To Us And Here's Why

Shareholders may be wondering what CEO Jian Zhang plans to do to improve the less than great performance at Xiwang Special Steel Company Limited (HKG:1266) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 21 May 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Xiwang Special Steel

How Does Total Compensation For Jian Zhang Compare With Other Companies In The Industry?

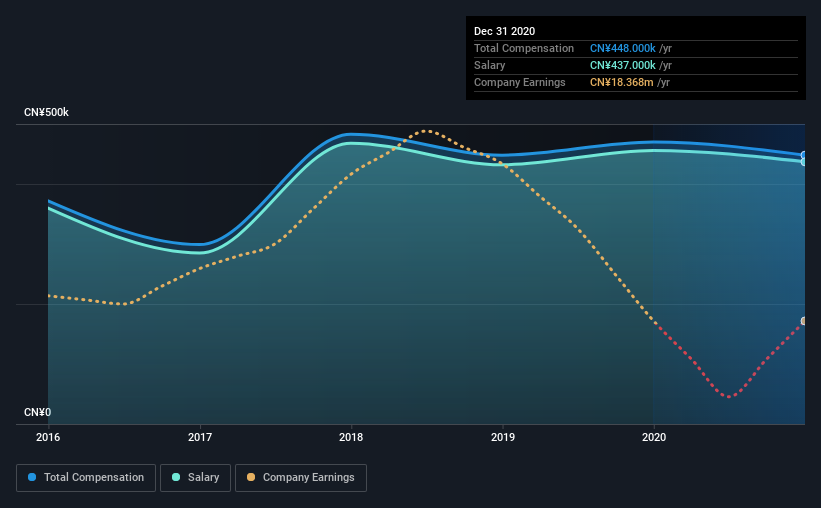

Our data indicates that Xiwang Special Steel Company Limited has a market capitalization of HK$995m, and total annual CEO compensation was reported as CN¥448k for the year to December 2020. We note that's a small decrease of 4.7% on last year. We note that the salary portion, which stands at CN¥437.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥786k. Accordingly, Xiwang Special Steel pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥437k | CN¥456k | 98% |

| Other | CN¥11k | CN¥14k | 2% |

| Total Compensation | CN¥448k | CN¥470k | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Xiwang Special Steel is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Xiwang Special Steel Company Limited's Growth Numbers

Xiwang Special Steel Company Limited has reduced its earnings per share by 74% a year over the last three years. In the last year, its revenue is up 37%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Xiwang Special Steel Company Limited Been A Good Investment?

Few Xiwang Special Steel Company Limited shareholders would feel satisfied with the return of -71% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Xiwang Special Steel pays its CEO a majority of compensation through a salary. The fact that shareholders are sitting on a loss is certainly disheartening. The fact that earnings growth has gone backwards could be a factor for the downward trend in the share price. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Xiwang Special Steel you should be aware of, and 2 of them can't be ignored.

Important note: Xiwang Special Steel is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1266

Xiwang Special Steel

Xiwang Special Steel Company Limited, together with its subsidiaries, engages in the manufacture and sale of electric arc furnace-based special steel products in China.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives