In recent weeks, Asian markets have shown resilience amid easing U.S.-China trade tensions and favorable economic data from Japan, leading to a positive outlook for investors seeking stable returns. As the region's markets navigate these developments, dividend stocks emerge as attractive options for those looking to capitalize on consistent income streams while potentially benefiting from market stability.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.15% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.68% | ★★★★★★ |

| NCD (TSE:4783) | 4.71% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Daicel (TSE:4202) | 4.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

Click here to see the full list of 1078 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

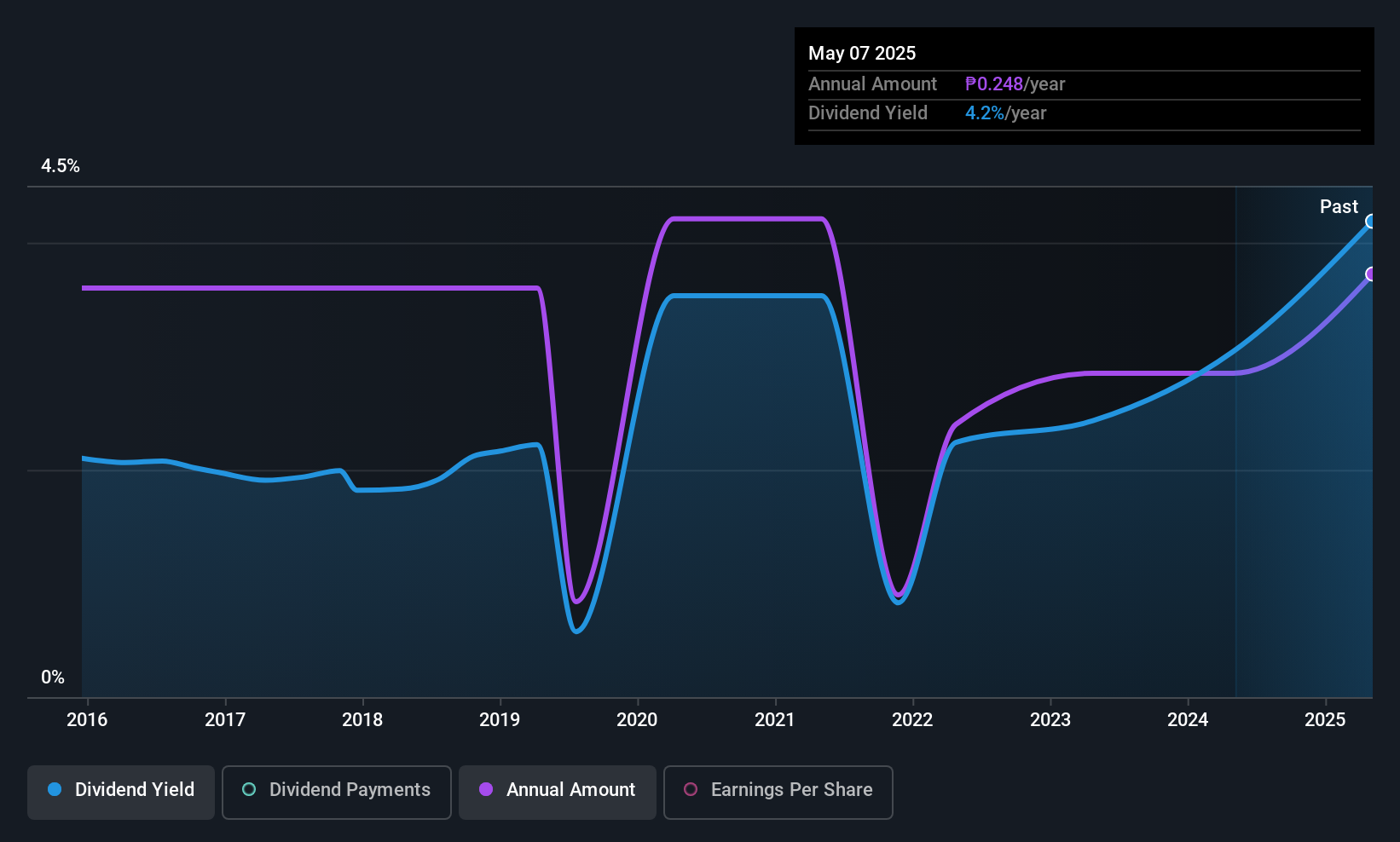

iPeople (PSE:IPO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: iPeople, Inc., along with its subsidiaries, operates in the education sector in the Philippines and has a market capitalization of ₱6.60 billion.

Operations: iPeople, inc. generates revenue primarily from its education segment, amounting to ₱5.57 billion.

Dividend Yield: 3.9%

iPeople's dividend payments have increased over the past decade, yet they remain unreliable and volatile, with significant annual drops. Despite this, the dividends are well-covered by earnings and cash flows, boasting a payout ratio of 30.5% and a cash payout ratio of 21.4%. Recent earnings showed modest growth for the first half of 2025. However, its dividend yield is relatively low at 3.93%, compared to top-tier Philippine market payers at 6.02%.

- Delve into the full analysis dividend report here for a deeper understanding of iPeople.

- Upon reviewing our latest valuation report, iPeople's share price might be too pessimistic.

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited is an investment holding company involved in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt in Zambia and the Democratic Republic of Congo with a market cap of HK$33.95 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue from leaching ($1.09 billion) and smelting ($2.77 billion).

Dividend Yield: 3.9%

China Nonferrous Mining's dividends have shown volatility over the past decade, yet recent increases reflect a positive trend. The company declared a final dividend of HK$0.34 per share for 2024, paid in July 2025. Despite a lower yield of 3.86% compared to top Hong Kong payers, dividends are well-covered by earnings and cash flows with payout ratios of 41.5% and 29.7%, respectively, supported by strong profit growth driven by higher copper prices and production volume.

- Navigate through the intricacies of China Nonferrous Mining with our comprehensive dividend report here.

- Our valuation report unveils the possibility China Nonferrous Mining's shares may be trading at a discount.

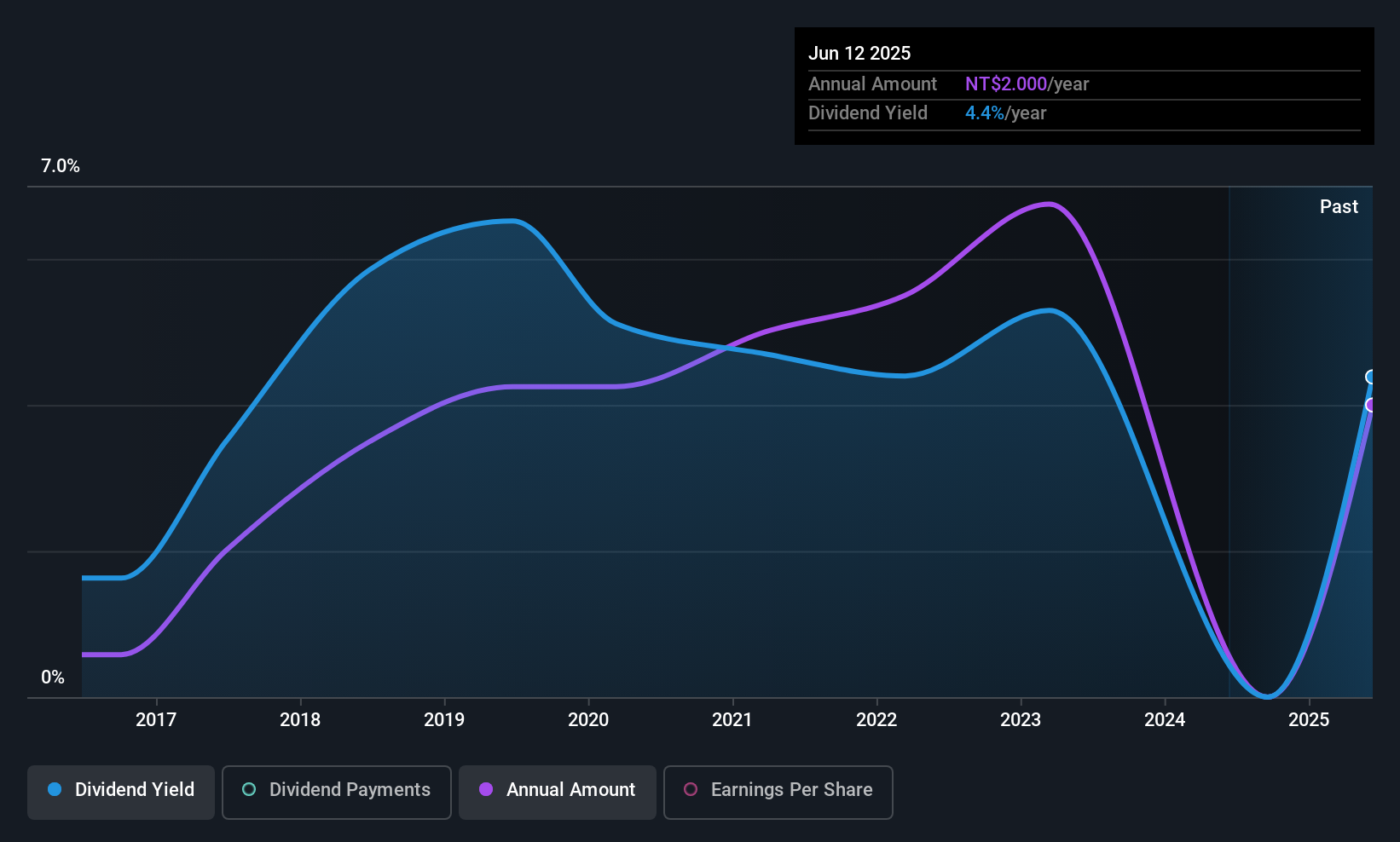

Highlight Tech (TPEX:6208)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Highlight Tech Corp. operates in Taiwan and China, focusing on the design, manufacture, sale, retail, wholesale, repair, and maintenance of electronic components with a market cap of NT$5.30 billion.

Operations: Highlight Tech Corp.'s revenue segments are not provided in the available text.

Dividend Yield: 3.6%

Highlight Tech's dividend yield of 3.57% trails behind top Taiwan payers, and its dividend history over the past decade has been unreliable with volatility. However, dividends are covered by earnings and cash flows with payout ratios of 66.4% and 88%, respectively. Despite a recent dip in sales to NT$898.83 million for Q2 2025 from NT$969.83 million a year ago, basic earnings per share remained steady at NT$0.77, indicating stable earnings support for future payouts.

- Dive into the specifics of Highlight Tech here with our thorough dividend report.

- The valuation report we've compiled suggests that Highlight Tech's current price could be inflated.

Seize The Opportunity

- Delve into our full catalog of 1078 Top Asian Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highlight Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6208

Highlight Tech

Designs, manufactures, sells, retails, wholesales, repairs, and maintains electronic components in Taiwan and China.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives