- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1208

Assessing MMG (SEHK:1208) Valuation After Sweeping Leadership Changes and Strategic Management Reshuffle

Reviewed by Simply Wall St

MMG (SEHK:1208) just rolled out a sweeping leadership reshuffle, with CAO Liang taking over as chairman and new presidents appointed for Las Bambas and Africa. For investors, this is really about future strategy and execution.

See our latest analysis for MMG.

The shake up comes after a powerful run in the shares, with MMG’s 1 month share price return of 19.10% and 3 month share price return of 45.70% adding to an already substantial year to date share price return of 237.85%. The 1 year total shareholder return of 216.42% highlights how strongly sentiment and execution have shifted in the market’s eyes.

If you are weighing what could come next for MMG, it may be worth widening the lens and discovering fast growing stocks with high insider ownership as other potential high momentum ideas.

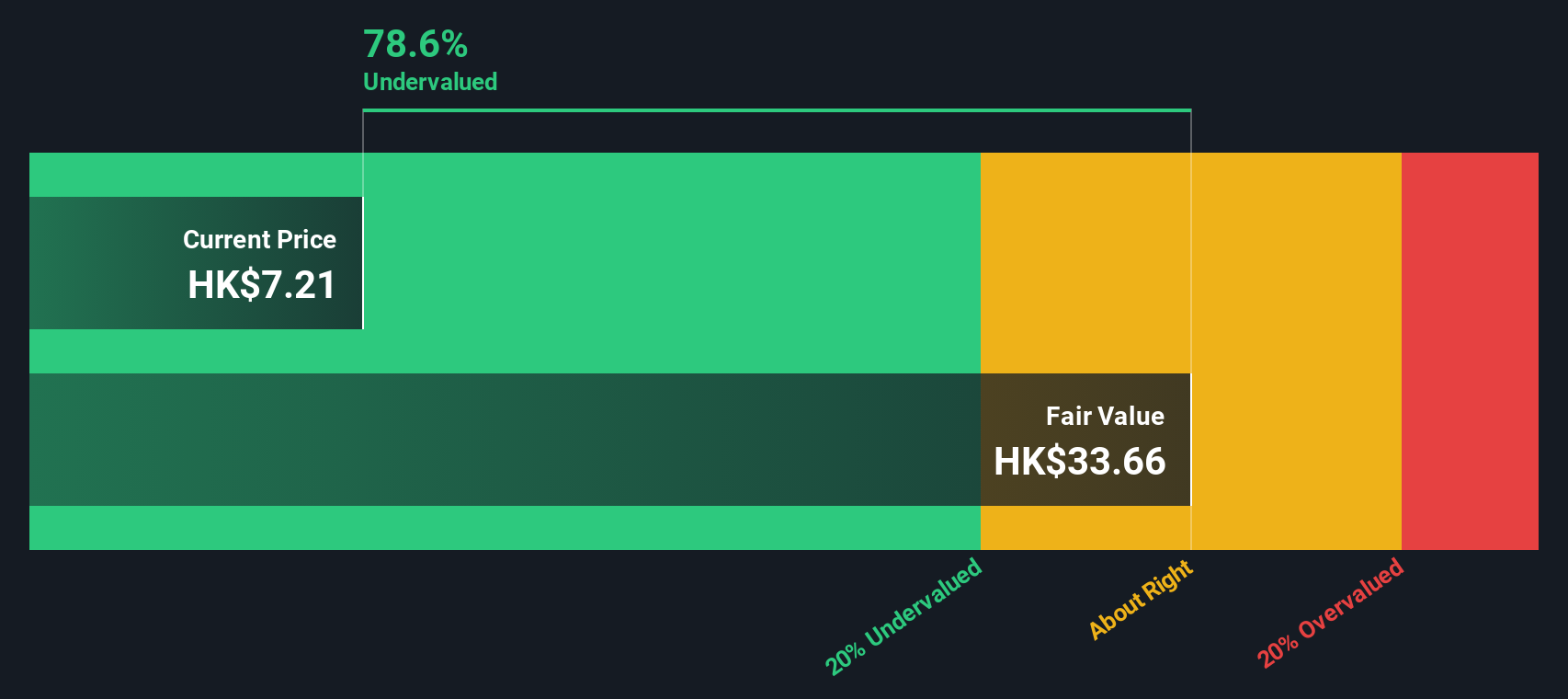

Yet despite stellar gains and rapid earnings growth, MMG still trades at a hefty discount to some intrinsic value estimates, while sitting above consensus targets. This raises the question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 33.5% Overvalued

With MMG closing at HK$8.48 against a narrative fair value of about HK$6.35, the current price embeds a rich future earnings story.

Ongoing production expansions including Las Bambas optimization, the ramp up at Kinsevere, and the multi year capacity expansion at Khoemacau (targeting 130kt by 2028) should drive meaningful volume growth and operating leverage, contributing to sustained top line gains and improved margins.

Curious how much growth and margin expansion this narrative bakes in, and what profit multiple it assumes several years from now? The most widely followed view quietly leans on ambitious revenue compounding, rising profitability and a discounted cash flow built on a sub double digit rate. The tension between those projections and today’s price is where the real story starts.

Result: Fair Value of $6.35 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Las Bambas community disruptions and execution risk on major expansion projects could quickly challenge these upbeat growth and margin assumptions.

Find out about the key risks to this MMG narrative.

Another View: Deep Value Signal From Our DCF Model

While the narrative fair value suggests MMG is 33.5% overvalued, our DCF model points the other way entirely. It indicates shares trade around 80% below an intrinsic value near HK$42. This kind of gap can flag either a rare opportunity or a serious market doubt, which do you think it is?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MMG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MMG Narrative

If you see MMG’s story differently or want to stress test these assumptions with your own work, you can build a fresh view in just minutes: Do it your way.

A great starting point for your MMG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart investing move?

Serious investors never stop upgrading their opportunity set, and you should not either. Broaden your watchlist now so you are not chasing the next rally late.

- Capture potential multibaggers early by reviewing these 3606 penny stocks with strong financials with improving fundamentals before the broader market catches on.

- Position your portfolio at the front of the AI wave by targeting these 30 healthcare AI stocks shaping the future of medicine and diagnostics.

- Secure stronger income streams by focusing on these 13 dividend stocks with yields > 3% that may boost cash returns while markets stay volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1208

MMG

An investment holding company, engages in the exploration, development, and mining of mineral properties.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)