- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1116

Here's Why I Think Mayer Holdings (HKG:1116) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Mayer Holdings (HKG:1116). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Mayer Holdings

Mayer Holdings's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Mayer Holdings's EPS went from CN¥0.0011 to CN¥0.006 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

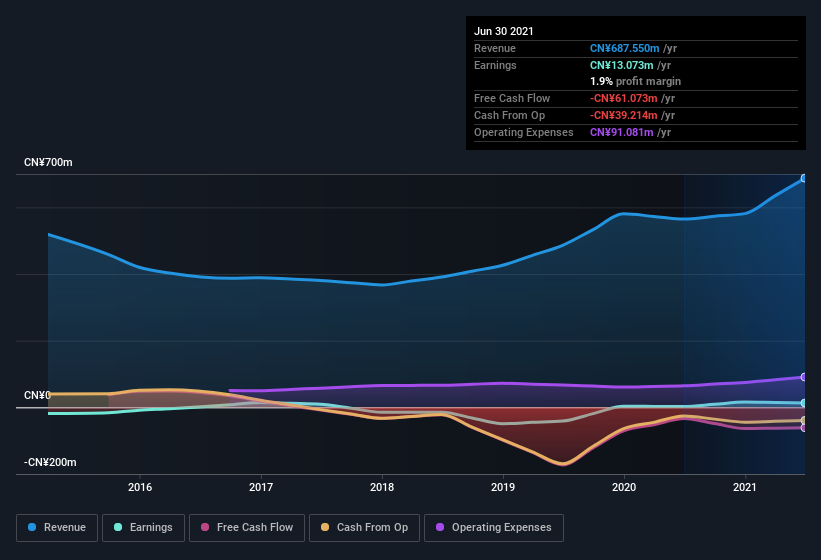

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Mayer Holdings is growing revenues, and EBIT margins improved by 4.5 percentage points to 7.8%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Mayer Holdings is no giant, with a market capitalization of HK$434m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mayer Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While Mayer Holdings insiders did net -CN¥69m selling stock over the last year, they invested CN¥74m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Ngan Cheung for HK$69m worth of shares, at about HK$0.15 per share.

On top of the insider buying, we can also see that Mayer Holdings insiders own a large chunk of the company. Indeed, with a collective holding of 71%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about CN¥310m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Mayer Holdings To Your Watchlist?

Mayer Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Mayer Holdings belongs on the top of your watchlist. Even so, be aware that Mayer Holdings is showing 2 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Mayer Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Huiyuan Cowins Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1116

Huiyuan Cowins Technology Group

An investment holding company, processes, manufactures, trades in, and sells steel sheets and pipes, and other steel products in the People’s Republic of China.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives