As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, Asian markets continue to capture investor attention, offering a unique blend of opportunities and challenges. For investors interested in exploring smaller or newer companies, penny stocks remain an intriguing option despite their somewhat outdated name. These stocks often represent companies with strong financials that could provide both affordability and growth potential amidst current market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.42 | HK$878.3M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.59 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$3.15B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.80 | THB9.7B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 957 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market cap of approximately HK$26.58 billion.

Operations: The company's revenue is primarily derived from petroleum products at CN¥58.97 billion, followed by chemical products at CN¥18.77 billion and petrochemical products trade at CN¥8.10 billion.

Market Cap: HK$26.58B

Sinopec Shanghai Petrochemical, with a market cap of HK$26.58 billion, faces challenges as it remains unprofitable despite significant revenue streams from petroleum (CN¥58.97 billion) and chemical products (CN¥18.77 billion). The company has been reducing its debt-to-equity ratio from 11.2% to 1.6% over five years and maintains more cash than total debt, indicating financial prudence amidst losses that have increased annually by 33.3%. Recent share buybacks totaling HKD 152.8 million reflect efforts to stabilize stock value following a net loss of CN¥462.13 million for H1 2025, contrasting with last year's profit.

- Take a closer look at Sinopec Shanghai Petrochemical's potential here in our financial health report.

- Evaluate Sinopec Shanghai Petrochemical's prospects by accessing our earnings growth report.

Wing Tai Properties (SEHK:369)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wing Tai Properties Limited is an investment holding company involved in property investment, development, and management across Hong Kong, the United Kingdom, China, Singapore, and internationally with a market cap of HK$2.36 billion.

Operations: The company's revenue is primarily derived from Property Investment and Management at HK$553.1 million, followed by Property Development at HK$199.6 million, and Hospitality Investment and Management contributing HK$125.6 million.

Market Cap: HK$2.36B

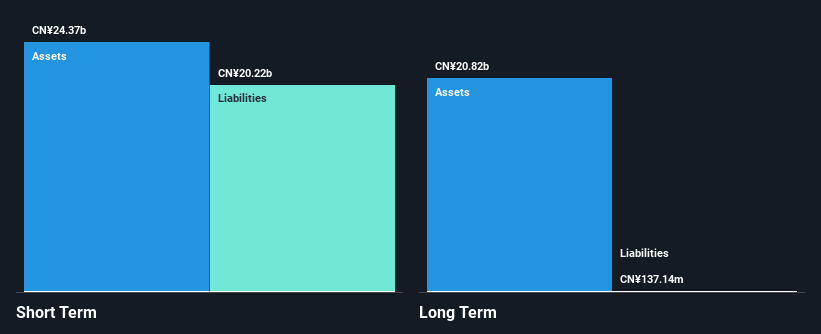

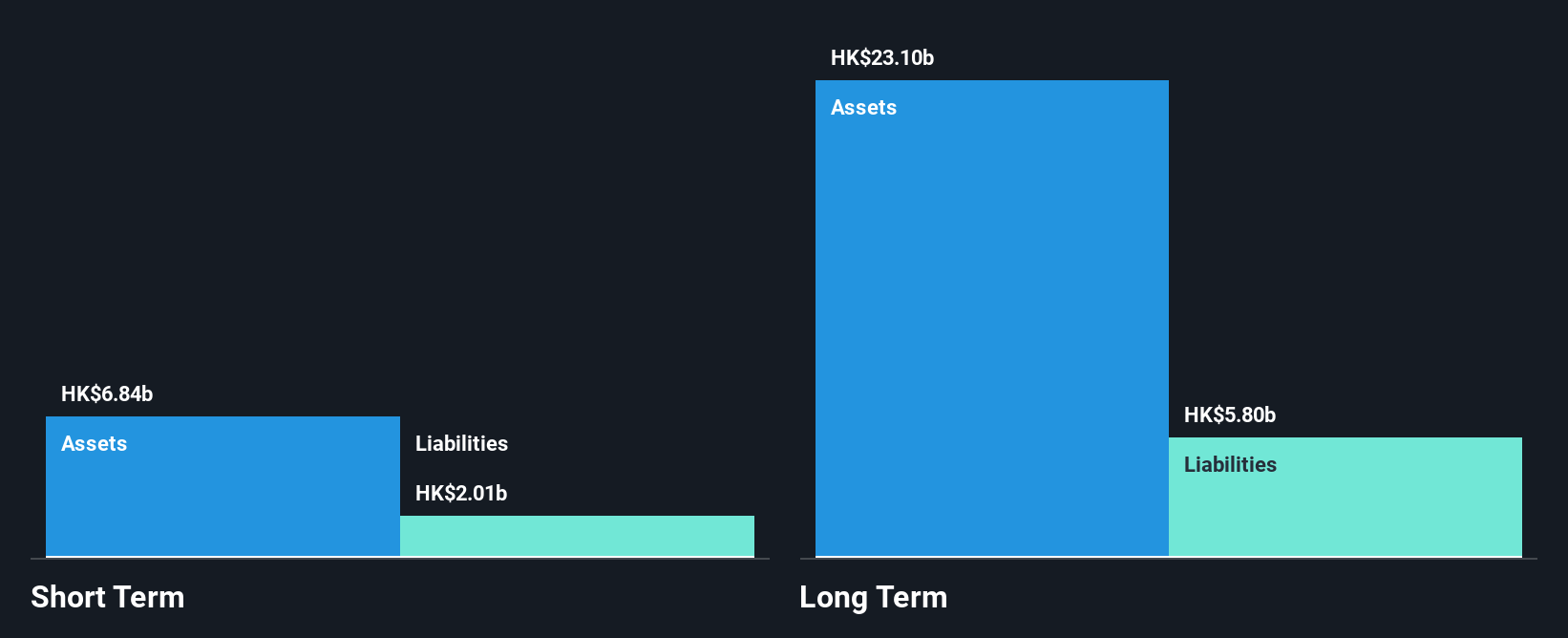

Wing Tai Properties, with a market cap of HK$2.36 billion, is currently unprofitable, reporting a net loss of HK$1,154.4 million for H1 2025 despite generating revenue primarily from property investment and management (HK$553.1 million). The company declared an interim dividend of HKD 0.03 per share but faces challenges as its dividend is not well covered by earnings or free cash flows. While the seasoned management team and board provide stability, increasing debt levels pose concerns; however, short-term assets exceed both short- and long-term liabilities. Earnings are forecast to grow significantly at 160.35% annually according to consensus estimates.

- Dive into the specifics of Wing Tai Properties here with our thorough balance sheet health report.

- Explore Wing Tai Properties' analyst forecasts in our growth report.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market cap of approximately HK$43.94 billion.

Operations: The company's revenue is primarily derived from its Property and Casualty Insurance segment, generating CN¥51.36 billion through Sunshine P&C and CN¥111 million via Sunshine Surety, along with CN¥24.46 billion from Life Insurance.

Market Cap: HK$43.94B

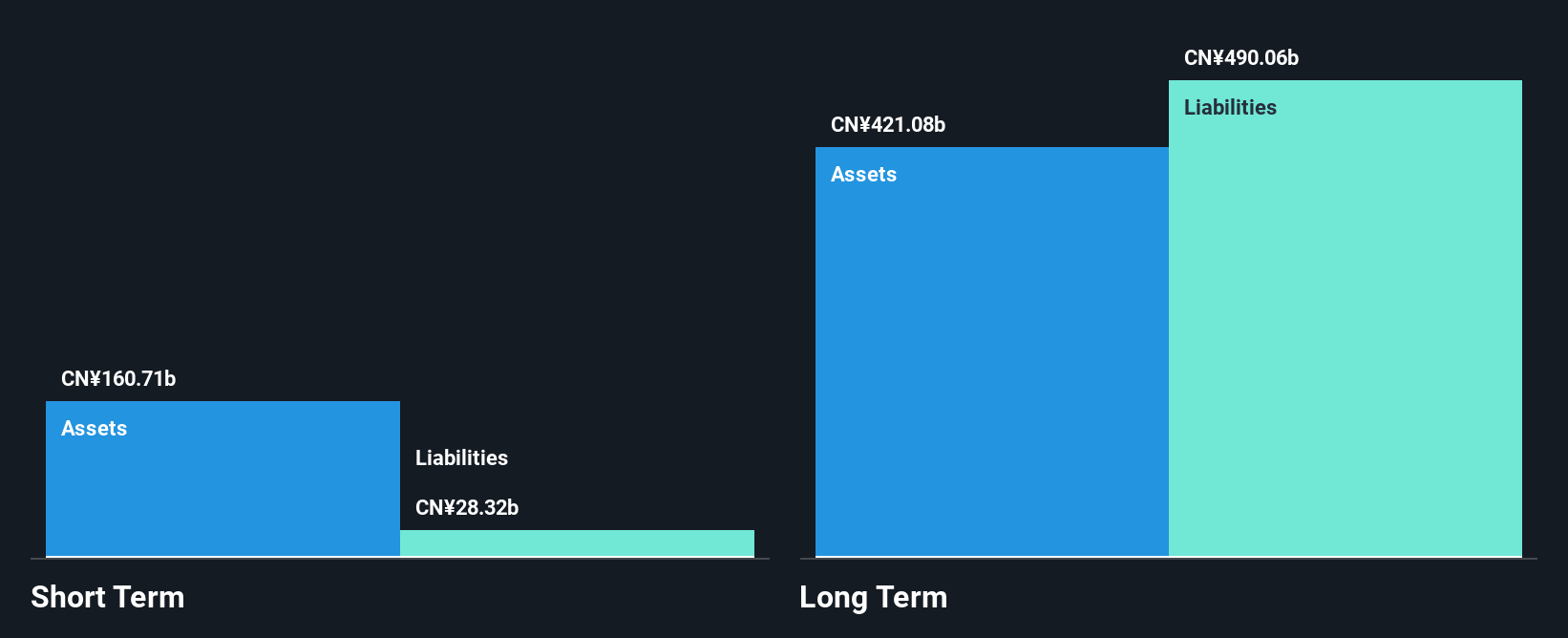

Sunshine Insurance Group, with a market cap of HK$43.94 billion, demonstrates financial stability through well-covered debt by operating cash flow and interest payments secured by EBIT. Recent earnings growth of 42.9% surpasses its five-year average decline, indicating a positive shift in profitability. The company is trading at good value compared to peers and industry standards, with short-term assets exceeding liabilities but long-term liabilities remain uncovered. Recent board changes include the election of new directors enhancing governance structures. Sunshine's addition to the FTSE All-World Index underscores its growing recognition in global markets despite challenges like low return on equity.

- Click here and access our complete financial health analysis report to understand the dynamics of Sunshine Insurance Group.

- Examine Sunshine Insurance Group's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 954 more companies for you to explore.Click here to unveil our expertly curated list of 957 Asian Penny Stocks.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives