ZhongAn Online P & C Insurance (SEHK:6060) Reports Strong Premiums Despite Earnings Decline

Reviewed by Simply Wall St

Key Assets Propelling ZhongAn Online P & C Insurance Forward

Recent financial results highlight ZhongAn's revenue growth, with a 15% increase year-over-year, as noted by CEO Jiang Xing. This growth underscores strong market demand and effective market share capture. The company also achieved a 200 basis point expansion in gross margin, reflecting efficient cost management and operational improvements, as mentioned by CFO Wang Min. Furthermore, the company's profitability over the past year has been bolstered by a favorable Price-To-Earnings ratio of 5.4x, which is below the industry average, suggesting efficient earnings generation.

Critical Issues Affecting the Performance of ZhongAn Online P & C Insurance and Areas for Growth

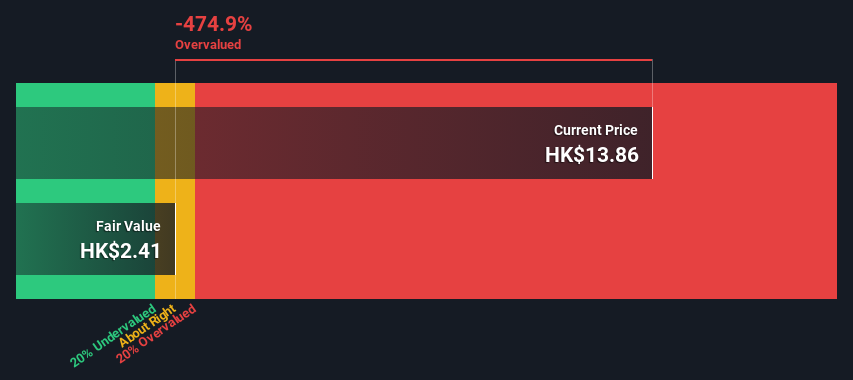

ZhongAn faces challenges such as operational inefficiencies, with supply chain delays impacting demand fulfillment, as acknowledged by Jiang Xing. Competitive pressures are also mounting, necessitating strategic responses to maintain market position. Additionally, the company's Return on Equity remains low at 19.1%, and earnings are projected to decline by 53.5% annually over the next three years, indicating potential profitability concerns. The share price trading above estimated fair value further complicates the financial outlook, despite favorable earnings ratios.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound for ZhongAn, particularly in market expansion and digital transformation. The company is actively exploring emerging markets with significant growth potential, as highlighted by Wang Min. Investments in digital initiatives aim to enhance customer experience and operational efficiency, positioning ZhongAn favorably in a tech-driven market. The company also holds a strong cash position relative to its debt, providing a solid foundation for pursuing these growth avenues.

Market Volatility Affecting ZhongAn Online P & C Insurance's Position

External threats include economic headwinds and supply chain vulnerabilities, with management closely monitoring global indicators for potential impacts. Regulatory changes present both opportunities and risks, requiring vigilance to maintain compliance and capitalize on favorable shifts. The company's share price volatility over the past three months further highlights market instability, which could affect investor confidence and future growth prospects.

To learn about how ZhongAn Online P & C Insurance's valuation metrics are shaping its market position, check out our detailed analysis of ZhongAn Online P & C Insurance's Valuation. Explore the current health of ZhongAn Online P & C Insurance and how it reflects on its financial stability and growth potential.Conclusion

ZhongAn Online P & C Insurance has demonstrated strong revenue growth and improved gross margins, driven by effective market strategies and cost management. However, the company faces significant challenges, including operational inefficiencies and competitive pressures, which could impact its profitability as indicated by the projected decline in earnings and low Return on Equity. While ZhongAn's exploration of emerging markets and digital transformation initiatives present promising growth avenues, the current share price trading above the estimated fair value suggests that investor expectations may already be high, potentially limiting future upside. As such, the company must navigate market volatility and regulatory changes carefully to sustain its growth trajectory and maintain investor confidence.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if ZhongAn Online P & C Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:6060

ZhongAn Online P & C Insurance

An Internet-based Insurtech company, engages in the provision of internet insurance and insurance information technology services in the People’s Republic of China.

Mediocre balance sheet low.