China Reinsurance (SEHK:1508) Rises 7.6% After First-Half Profitability Improves—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

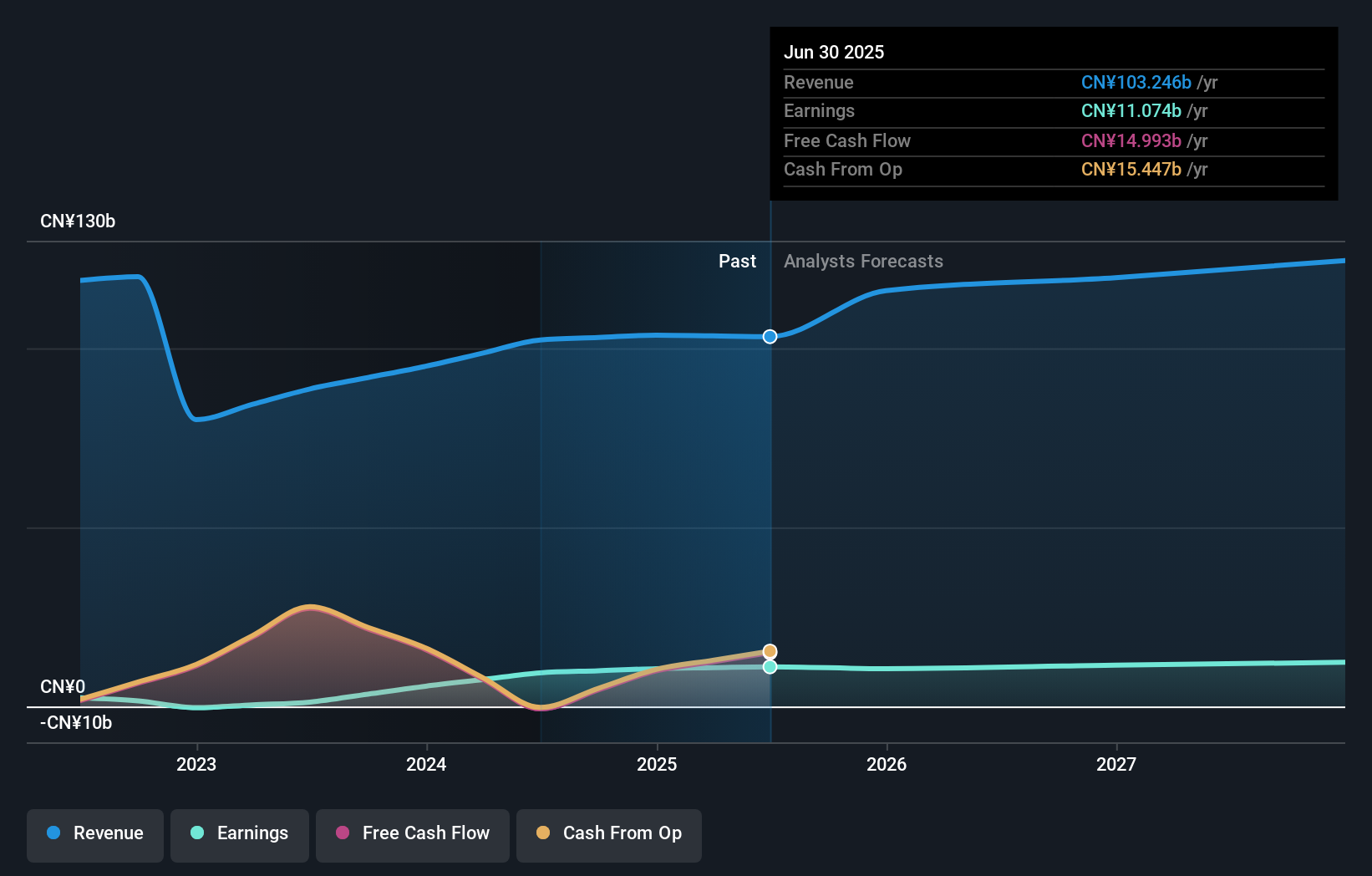

- China Reinsurance (Group) Corporation recently announced its earnings for the half year ended June 30, 2025, reporting net income of CNY 6.24 billion, an increase from CNY 5.73 billion a year earlier, with basic and diluted earnings per share rising to CNY 0.15 from CNY 0.13.

- This uplift in net income and earnings per share suggests improved profitability and stronger operational performance for the first half of the year compared to the previous period.

- To assess whether this earnings growth changes the company's outlook, we'll explore what the improved first-half profitability means for the overall investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

China Reinsurance (Group) Investment Narrative Recap

To be a shareholder in China Reinsurance (Group), you need to have confidence in the company's ability to leverage its scale and expertise to capture growth across China's evolving insurance market and select international opportunities, even as the reinsurance industry faces margin pressure. The latest half-year results show stronger earnings and slight margin improvement, but do not materially shift the main short-term catalyst, China Re’s push for innovation and digital risk management, or address the persistent risk from declining domestic interest rates eroding investment income. Among this year’s announcements, the firm's decision to raise its final ordinary dividend to RMB 0.05 per share stands out alongside the earnings news. While higher dividends could appeal to income-seeking investors and reflect management’s confidence, the sustainability of these payouts still ties back to maintaining profitability in the face of tight net margins and fluctuating investment returns. Yet, even as profitability ticks up, investors should be aware that falling domestic interest rates remain a risk for future earnings and...

Read the full narrative on China Reinsurance (Group) (it's free!)

China Reinsurance (Group)'s narrative projects CN¥114.7 billion revenue and CN¥11.8 billion earnings by 2028. This requires 3.4% yearly revenue growth and a CN¥1.2 billion earnings increase from the current CN¥10.6 billion.

Uncover how China Reinsurance (Group)'s forecasts yield a HK$1.69 fair value, a 9% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s consensus for fair value stands uniformly at HK$1.69 across all estimates. While views are consistent here, concerns over China’s lower interest rate environment could challenge returns, reminding you to explore other viewpoints within the community.

Explore another fair value estimate on China Reinsurance (Group) - why the stock might be worth just HK$1.69!

Build Your Own China Reinsurance (Group) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Reinsurance (Group) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Reinsurance (Group) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Reinsurance (Group)'s overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives