Last Update 23 Sep 25

Fair value Increased 10%Digital Transformation And EV Insurance Will Open New Markets

The notable upward revision in China Reinsurance (Group)’s revenue growth forecasts has driven higher consensus expectations, resulting in an increased fair value estimate, as reflected in the analyst price target rising from HK$1.54 to HK$1.69.

What's in the News

- Mr. Zhuang Qianzhi will no longer serve as president; he will act as provisional person-in-charge until a new president is appointed.

- The board is scheduled to consider and approve interim results for the six months ended 30 June 2025, along with other business matters.

- Announced a final ordinary dividend of RMB 0.05 per share for the year ended 31 December 2024.

Valuation Changes

Summary of Valuation Changes for China Reinsurance (Group)

- The Consensus Analyst Price Target has significantly risen from HK$1.54 to HK$1.69.

- The Consensus Revenue Growth forecasts for China Reinsurance (Group) has significantly risen from 3.4% per annum to 6.3% per annum.

- The Future P/E for China Reinsurance (Group) has significantly risen from 6.48x to 7.51x.

Key Takeaways

- Innovative products in climate change and EV insurance could enhance revenue by addressing unmet demand and emerging risks.

- Focus on digital transformation and global expansion may improve operational efficiency and boost revenue growth in strategic regions.

- Competitive global market, domestic interest rate drops, and climate risks threaten growth, market share, and profitability despite optimism about long-term trends.

Catalysts

About China Reinsurance (Group)- Operates as a reinsurance company in the People's Republic of China and internationally.

- China Reinsurance is focusing on new product innovations in areas such as climate change and EV insurance, which could enhance future revenue streams by tapping into unmet market demand and mitigating emerging risks.

- The company's efforts in leveraging technology for digital transformation and precise risk management are likely to improve operational efficiency and could lead to higher net margins through cost management and better pricing accuracy.

- The firm is actively pursuing global expansion, aiming to grow its international presence and increase its market share from 4% of the global reinsurance market, which may boost overall revenue growth as international operations expand in strategic regions.

- China Reinsurance is committed to long-term, value-based investments, with a focus on stable, high-dividend-yield sectors like technology and AI, potentially increasing total investment returns and overall earnings, even in a low domestic interest rate environment.

- The company anticipates growth in its primary and reinsurance segments, particularly life and health insurance driven by domestic demand and regulatory changes, which could bolster consolidated revenue and improve profit margins.

China Reinsurance (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming China Reinsurance (Group)'s revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 10.3% in 3 years time.

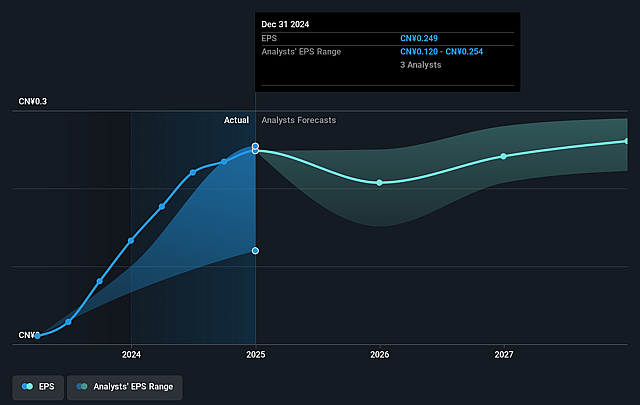

- Analysts expect earnings to reach CN¥11.8 billion (and earnings per share of CN¥0.27) by about September 2028, up from CN¥10.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥10.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, up from 5.9x today. This future PE is lower than the current PE for the HK Insurance industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

China Reinsurance (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The domestic interest rate in China has been dropping, which creates pressure on achieving attractive investment returns and could negatively impact net margins and earnings.

- The global reinsurance market is highly competitive, with major international players having a significant presence in China, which may limit the company's ability to increase its market share and revenue.

- Climate change poses significant risks, as natural disasters could result in high claims and impact net margins if not properly mitigated with effective risk management strategies.

- The company faces challenges related to innovation and diversification in the global market, with a relatively small share of the international reinsurance market, potentially impacting long-term revenue growth.

- While the company is optimistic about long-term economic trends, uncertainties in both domestic and international markets remain, which could affect future revenue and profitability projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$1.538 for China Reinsurance (Group) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$2.11, and the most bearish reporting a price target of just HK$1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥114.7 billion, earnings will come to CN¥11.8 billion, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of HK$1.61, the analyst price target of HK$1.54 is 4.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.