Key Takeaways

- Proprietary technology, digital transformation, and advanced analytics are expected to accelerate efficiency gains, boosting profitability and market share beyond current forecasts.

- Strategic international expansion, strong government partnerships, and leadership in catastrophe products position the firm for premium growth surpassing industry expectations.

- Climate-related disaster losses, demographic shifts, stiff competition, subdued investment income, and digitalization risks all threaten future profitability and sustained earnings growth.

Catalysts

About China Reinsurance (Group)- Operates as a reinsurance company in the People's Republic of China and internationally.

- While analyst consensus expects technology-driven operational efficiency to moderately boost margins, the company's aggressive rollout of proprietary AI risk platforms, broad application of precision analytics to product design and claims, and industry-first digital transformation initiatives could compress combined ratios substantially faster-enabling sustainable double-digit ROE growth and sharply higher profitability.

- Analysts broadly agree that international expansion could raise revenue, but management's ambitious vision to become a global top 5 reinsurer-supported by proven M&A integration (Chaucer doubling profit and asset scale in 6 years), deep governmental ties for Belt & Road projects, and a 25% overseas asset base-could unlock exponential premium growth and substantial market share gains, far outpacing consensus revenue assumptions.

- Surging insurance penetration driven by China's continued urbanization and rapid middle-class growth is likely to accelerate, with China Reinsurance strategically positioned as the preferred partner to state-backed insurers; this may lead to outsized premium growth and a durable uplift to top-line revenue beyond what the current market is pricing.

- The intensification of catastrophic and climate-related events globally, combined with China Reinsurance's first-mover advantage in proprietary catastrophe modeling, self-developed natural disaster products, and national policy leadership, could trigger a structural re-rating of premium pricing and market share, boosting both revenue and mid-term earnings volatility in the company's favor.

- Regulatory liberalization and convergence of commercial and social health coverage in China are poised to unleash significant latent demand for high-margin, innovative medical and specialty insurance products, with the firm's scale, data partnerships, and platform/ecosystem integrations enabling outperformance in earnings and net margin expansion relative to peers.

China Reinsurance (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on China Reinsurance (Group) compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming China Reinsurance (Group)'s revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.2% today to 10.9% in 3 years time.

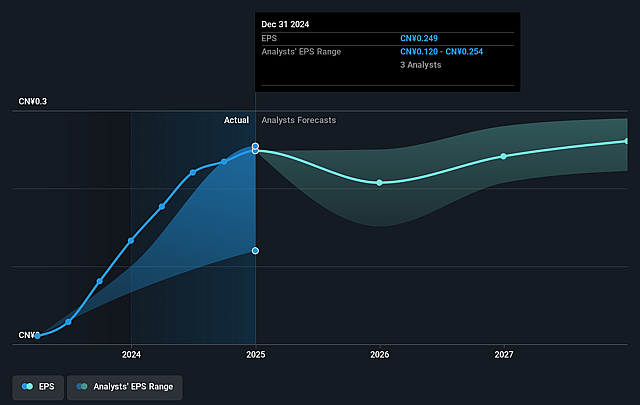

- The bullish analysts expect earnings to reach CN¥13.1 billion (and earnings per share of CN¥0.31) by about September 2028, up from CN¥10.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.0x on those 2028 earnings, up from 5.8x today. This future PE is lower than the current PE for the HK Insurance industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.64%, as per the Simply Wall St company report.

China Reinsurance (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing frequency and severity of natural disasters due to climate change pose a significant long-term risk, as China Reinsurance (Group) admits to recurring large-scale catastrophe losses that could lead to persistently elevated payout ratios, ultimately eroding future net margins and reducing profitability.

- Demographic shifts in China, such as an aging population and declining birthrates, threaten to shrink the insurable risk pool, which may slow premium growth over time, negatively impacting top-line revenue expansion.

- Heightened competition from both domestic and global reinsurers as well as alternative capital sources is making the Chinese reinsurance market highly competitive, with the company itself noting it controls a lower global share than its GDP weighting would suggest, putting long-term pressure on both revenue growth and net margins.

- Sustained low interest rates in China, acknowledged by management as a long-term trend, reduce investment income, which China Reinsurance (Group) heavily relies on for overall profit, thus threatening future earnings if investment returns remain subdued or volatile.

- While the company is emphasizing digital transformation and technology upgrades, it still faces the risk of lagging behind global peers in digitalization, which could result in continued operational inefficiencies, increased expense ratios, and ultimately diminished earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for China Reinsurance (Group) is HK$2.11, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of China Reinsurance (Group)'s future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$2.11, and the most bearish reporting a price target of just HK$1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥119.4 billion, earnings will come to CN¥13.1 billion, and it would be trading on a PE ratio of 8.0x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$1.59, the bullish analyst price target of HK$2.11 is 24.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.