Key Takeaways

- Rising climate risks and regulatory changes are increasing underwriting challenges, claims volatility, and compliance costs, straining profitability and operational resilience.

- Overexposure to China's economy and traditional investment assets limits diversification, while insurtech and alternative capital sources threaten long-term revenue growth.

- Strategic focus on technology, international expansion, and sectoral growth positions the company for stronger profitability, market share gains, and resilience against industry challenges.

Catalysts

About China Reinsurance (Group)- Operates as a reinsurance company in the People's Republic of China and internationally.

- The accelerating impact of climate change, with increasingly frequent and severe natural catastrophes such as typhoons and floods in China and globally, is likely to drive up loss volatility and reinsurance claims, resulting in higher liabilities and ongoing pressure on underwriting margins and combined ratios.

- China Reinsurance's continued heavy reliance on the Chinese market, despite international expansions, leaves it exposed to systemic risks from persistent demographic aging, declining birth rates, and domestic macroeconomic slowdowns, which could erode long-term premium growth and shrink the pool of insurable assets.

- Investments remain heavily allocated to Chinese financial and property-related assets, which are vulnerable to ongoing credit risk and asset quality deterioration; as such, returns on the investment portfolio and net investment income are at heightened risk from further economic stress within China.

- The rapid evolution of insurtech, direct risk transfer tools like catastrophe bonds, and alternative capital providers threaten to disintermediate traditional reinsurers, putting sustained downward pressure on revenue growth and cost efficiency for China Reinsurance as new entrants and capital compete aggressively for the same risks.

- Regulatory tightening and shifts towards risk-based capital regimes are expected to require higher reserves and capital buffers, raising compliance costs and compressing returns on equity and future earnings, especially if loss experiences worsen or competitive pressures lead to further price competition.

China Reinsurance (Group) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on China Reinsurance (Group) compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming China Reinsurance (Group)'s revenue will grow by 3.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.2% today to 9.3% in 3 years time.

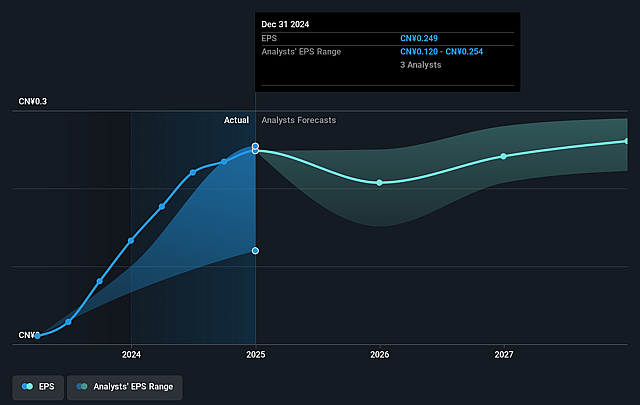

- The bearish analysts expect earnings to reach CN¥10.7 billion (and earnings per share of CN¥0.24) by about September 2028, up from CN¥10.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.7x on those 2028 earnings, down from 5.8x today. This future PE is lower than the current PE for the HK Insurance industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.64%, as per the Simply Wall St company report.

China Reinsurance (Group) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth initiatives in technology, digital transformation, and risk management-including the development of proprietary models for climate and catastrophe risks as well as AI-driven platforms for underwriting and product innovation-may lead to improved expense ratios, enhanced underwriting profitability, and stronger net margins over time.

- Rapid expansion in international markets, particularly through successful integration and strong performance of the Chaucer acquisition and entry into Belt and Road countries, could result in increased premium income, geographic diversification, and greater earnings resilience, supporting revenue growth and risk-adjusted returns.

- Structural growth opportunities in health, agriculture, and EV insurance, coupled with regulatory trends encouraging commercial insurance participation in China's healthcare system, position the company to capture incremental premiums from high-potential segments, supporting sustained long-term revenue and profit growth.

- Secular demand drivers such as China's urbanization, infrastructure development, and rising middle class-combined with regulatory reforms and the company's position as the most international Chinese reinsurer-are likely to fuel expanding market share, greater gross written premiums, and robust earnings growth.

- Continued commitment to long-term value-based investment strategies, prudent asset allocation, and proactive responses to the low interest rate environment have driven record investment income and yields, which, if sustained, may further boost investment returns and support positive earnings momentum in the coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for China Reinsurance (Group) is HK$1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of China Reinsurance (Group)'s future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$2.11, and the most bearish reporting a price target of just HK$1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥114.8 billion, earnings will come to CN¥10.7 billion, and it would be trading on a PE ratio of 4.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$1.59, the bearish analyst price target of HK$1.0 is 58.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.